Forex Profit/Loss Calculator

Is this tool helpful?

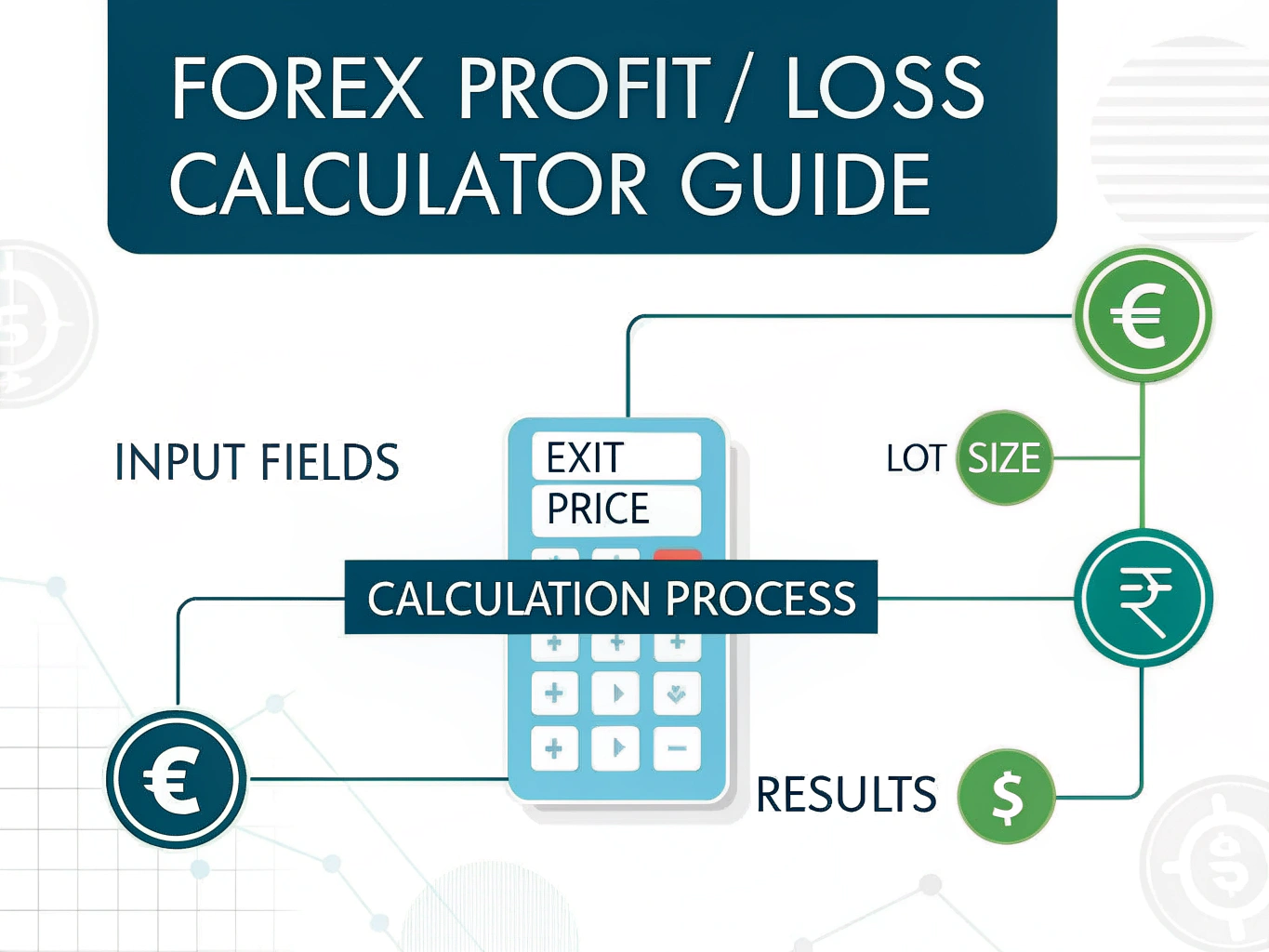

How to Use the Forex Profit/Loss Calculator Effectively

Follow these straightforward steps to calculate your forex trading profit or loss accurately:

- Entry Price: Enter the price where you opened your trading position. For example, use 1.15775 or 1.13420.

- Exit Price: Input the price where you closed your position. Examples include 1.16050 or 1.12800.

- Lot Size: Specify how many lots you traded. Use values like 0.75 or 2.25 to represent your trading volume.

After inputting these values, click “Calculate” to instantly see your profit or loss along with the total pip movement.

Forex Profit/Loss Calculator: Definition, Purpose, and Benefits

The Forex Profit/Loss Calculator is a practical tool that helps you determine how much money you gain or lose on your currency trades, especially for the popular EUR/USD pair. It streamlines your calculations by accurately estimating your earnings or losses before you finalize any trade. This tool supports effective trading by letting you:

- Plan precise position sizes to manage your risk

- Quickly assess potential trade outcomes

- Make confident decisions using calculated risk and reward

- Improve your money management strategies

- Avoid overleveraging and unexpected losses

How the Forex Profit/Loss Calculator Works

This calculator uses a simple formula to determine your profit or loss based on the price change, lot size, and pip value:

The formula is:

Understanding Each Component

- Price Movement: The difference between your exit and entry price, converted into pips by multiplying the decimal change by 10,000.

- Lot Size: The number of lots you trade. A standard lot equals 100,000 currency units. Mini and micro lots represent smaller sizes (0.1 and 0.01 respectively).

- Pip Value: For EUR/USD, each pip movement is worth $10 per standard lot.

Example Calculations for EUR/USD Trades

Example 1: Calculating Profit in a Long Position

Assume you enter a long position with:

- Entry Price: 1.17500

- Exit Price: 1.18000

- Lot Size: 1.2

The profit calculation is:

Example 2: Calculating Loss in a Short Position

Assume you enter a short position with:

- Entry Price: 1.20500

- Exit Price: 1.21050

- Lot Size: 0.5

The loss calculation is:

Advanced Strategies Using the Forex Profit/Loss Calculator

Assessing Your Risk-Reward Ratio

You can use this calculator to tailor your lot size and trade targets according to your risk tolerance. Follow these steps:

- Define your maximum risk per trade, like 1.5% of your trading account balance.

- Input your entry price and intended stop-loss price.

- Calculate the lot size that matches your acceptable loss.

- Estimate your potential profit based on your target exit price.

Position Scaling and Trade Management

The calculator can help you optimize multiple entries and exits:

- Determine partial profit-taking points to lock in gains

- Calculate additional position sizes for averaging in or out

- Analyze overall effects of scaling on your profit or loss

Using the Calculator Across Different Trading Styles

Day Trading

- Quickly size multiple trades within a single day

- Evaluate short-term profit targets

- Adjust positions rapidly based on ongoing market changes

Swing Trading

- Project weekly profit or loss levels

- Fine-tune your position sizes for longer-term holds

- Support analysis across several timeframes

FAQs About Forex Profit/Loss Calculation

What is a pip in forex trading?

A pip is the smallest measurable price change in currency trading, usually the fourth decimal place (0.0001) for most pairs. For EUR/USD, one pip equals $10 per standard lot.

How does lot size affect profit and loss?

Your lot size multiplies your gain or loss. Larger lots increase both potential returns and risk. Standard lots equal 100,000 units, mini lots 10,000, and micro lots 1,000 units.

Can I use this calculator for other currency pairs?

This tool is tailored for EUR/USD with a fixed pip value of $10 per standard lot. Pip values vary with other currency pairs depending on exchange rates and base currencies, so calculations may change.

Why calculate profit/loss before trading?

Pre-trade calculations help you:

- Choose appropriate position sizes

- Set realistic profit targets

- Manage risk effectively

- Maintain good trading discipline and account health

How do I use this tool for risk management?

To manage risk effectively:

- Set your maximum tolerable loss per trade

- Enter your entry price and planned stop-loss price

- Adjust your lot size to keep losses within your limits

- Determine profit targets based on risk-reward criteria

What’s the difference between profit calculations for long vs. short positions?

The formula stays the same. Profit depends on:

- Long trades: profitable when exit price is higher than entry price

- Short trades: profitable when exit price is lower than entry price

- The calculator automatically accounts for these differences

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.