Is this tool helpful?

How to Use the Forex Margin Calculator Effectively

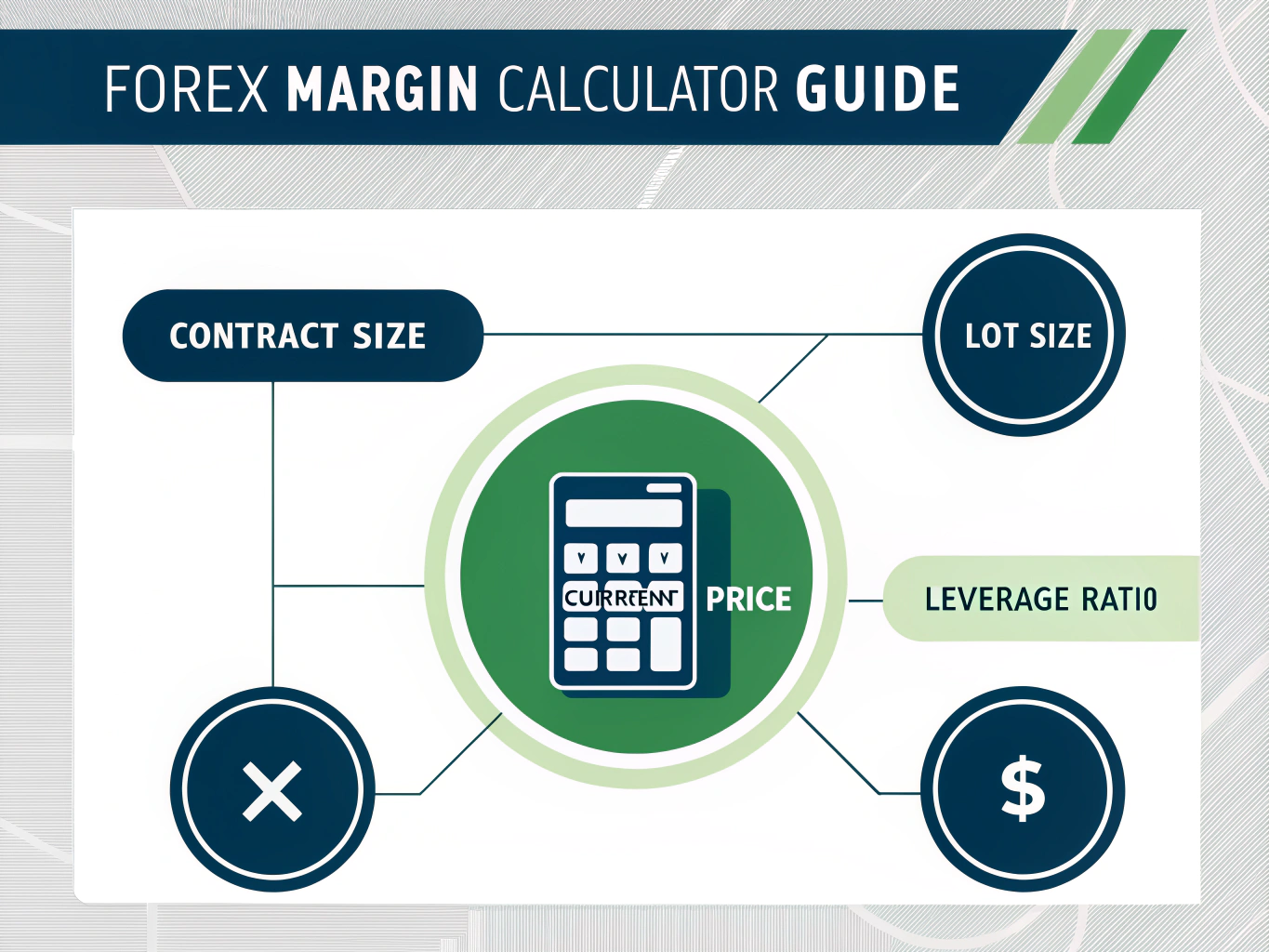

This forex margin calculator helps you quickly find the margin required to open a trading position based on your inputs. Here’s a clear explanation of each field with sample inputs different from those in the calculator form:

Input Fields Guide

- Contract Size: Enter the standard contract size for your currency pair. For example, use 80,000 for a smaller contract like AUD/USD or 50,000 for an intermediate contract in USD/CAD.

- Lot Size: Specify your trading volume in lots. Examples include 0.75 for three-quarter lots or 1.5 for one and a half standard lots.

- Current Price (USD): Input the current exchange rate of your chosen currency pair. You might enter 0.9850 for USD/CHF or 108.50 for USD/JPY.

- Leverage Ratio: Select the leverage offered by your broker from the dropdown. Choose values such as 100:1 or 400:1, depending on your trading account.

What Is the Forex Margin Calculator and Why You Should Use It

The forex margin calculator is a simple yet essential tool traders use to determine the required margin for opening a forex trading position. It factors in your position size, current exchange rate, and leverage ratio to provide a precise margin amount.

Using this calculator helps you manage your account balance wisely, control risk exposure, and avoid unexpected margin calls. It also ensures you maintain correctly sized positions aligned with your trading strategy and risk tolerance.

Key Benefits of the Forex Margin Calculator

- Calculate Required Capital: Know exactly how much money you need for each trade before opening positions.

- Manage Risk Effectively: Avoid over-leveraging and keep your positions within a safe margin threshold.

- Optimize Account Balances: Allocate funds efficiently for multiple open positions.

- Improve Trading Discipline: Use precise calculations to stick to your trading plan and reduce impulsive decisions.

Example Calculations with the Forex Margin Calculator

This JavaScript-powered calculator instantly computes your required margin after you enter values. Here are two clear examples based on the formula:

$$ \text{Margin Requirement} = \frac{\text{Contract Size} \times \text{Lot Size} \times \text{Current Price}}{\text{Leverage Ratio}} $$Example 1: Trading AUD/USD

- Contract Size: 80,000

- Lot Size: 0.75

- Current Price: 0.9850

- Leverage: 200:1

Required Margin Calculation:

$$ \frac{80,000 \times 0.75 \times 0.9850}{200} = \frac{59,100}{200} = 295.50 $$

You need approximately $295.50 as margin to open this position.

Example 2: Trading USD/CHF

- Contract Size: 50,000

- Lot Size: 1.5

- Current Price: 0.9125

- Leverage: 100:1

Required Margin Calculation:

$$ \frac{50,000 \times 1.5 \times 0.9125}{100} = \frac{68,437.5}{100} = 684.38 $$

You will need about $684.38 in margin for this trade.

Understanding Forex Margin Requirements and Leverage

Margin is the amount of money you must put forward to open a leveraged position, while leverage amplifies your market exposure using a fraction of the total trade size as margin.

As leverage increases, the required margin decreases, allowing you to hold larger positions with less capital. But keep in mind, higher leverage also increases risk.

Why Precise Margin Calculation Matters

- Proper Position Sizing: Avoid entering positions too large for your account.

- Risk Control: Reduce chances of margin calls and account liquidation.

- Balance Optimization: Maximize capital deployment across trades.

- Informed Strategy Development: Build trading plans based on accurate margin data.

Tips for Managing Margin When Trading Forex

- Always calculate margin before opening positions.

- Maintain sufficient free margin to handle market volatility.

- Adjust position sizes according to changes in currency pair prices.

- Use leverage prudently—don’t just aim for maximum leverage.

- Monitor margin levels actively during market hours.

Using the Forex Margin Calculator in Different Trading Strategies

Scalping and Day Trading

Quick trades require frequent margin calculations to track small gains and losses precisely. Use the calculator to size positions rapidly and avoid exhausting margin.

Swing and Position Trading

Longer holding periods and larger positions make accurate margin calculation essential to managing risk over time and preventing forced liquidations.

Frequently Asked Questions About Forex Margin

What is forex margin?

Margin is the collateral required to open and keep a leveraged trading position, usually a percentage of the full position size set by your broker.

How does leverage affect margin?

Leverage increases your market exposure with less capital. Higher leverage lowers your margin requirement but also raises potential risk.

How do I avoid margin calls?

By using this calculator to keep your margin requirements within your account equity and maintaining appropriate free margin, you reduce the chance of margin calls.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.