Sustainable Growth Rate Calculator

Is this tool helpful?

How to Use the Sustainable Growth Rate Calculator Effectively

This calculator helps you estimate your company’s maximum organic growth rate without needing external funding. To get accurate results, enter the following financial metrics carefully:

- Return on Equity (ROE) (%): Enter your company’s ROE as a percentage. For example, if your net income is $1.5 million and shareholders’ equity is $8 million, your ROE is 18.75%. Another example: if your company’s net income is $3 million against $15 million in equity, input 20%.

- Dividend Payout Ratio (%): Enter the percentage of earnings paid out as dividends. For example, if your company distributes $400,000 in dividends from $2 million in earnings, enter 20%. Another example would be 10% if dividends paid are $100,000 on $1 million earnings.

Introduction: Understanding the Sustainable Growth Rate Calculator

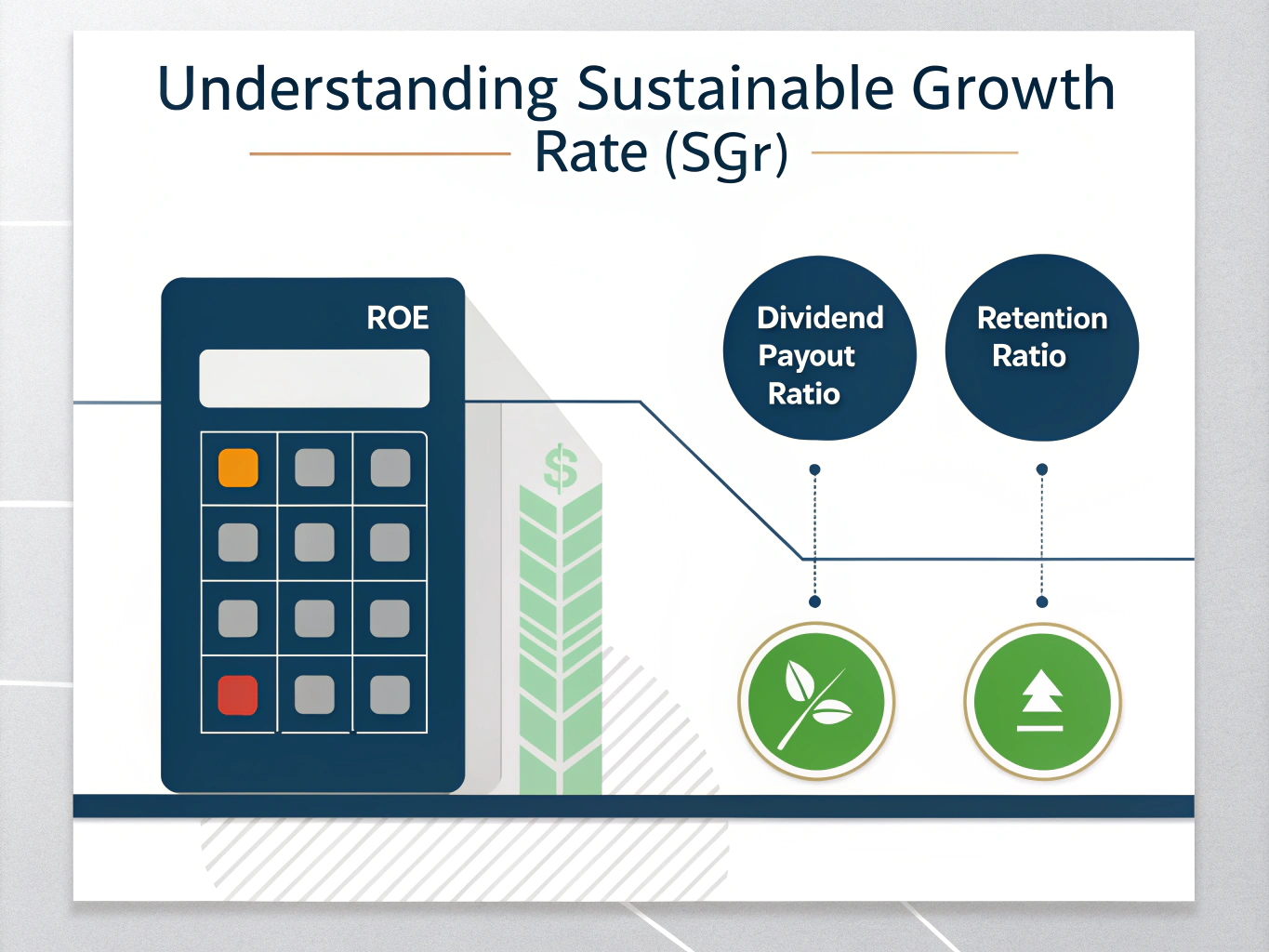

The Sustainable Growth Rate (SGR) Calculator measures how fast your company can grow organically by relying solely on reinvested earnings. It shows the maximum growth achievable without seeking external financing, helping you maintain financial stability and plan realistic expansion. Using your company’s Return on Equity and Dividend Payout Ratio, this tool calculates the rate at which your equity base can grow sustainably, supporting strategic decision-making, budget planning, and risk management.

How the Sustainable Growth Rate is Calculated

The formula for Sustainable Growth Rate is:

$$ \text{SGR} = \text{ROE} \times (1 – \text{Dividend Payout Ratio}) $$

Key Components Explained

- Return on Equity (ROE): Indicates how effectively the company uses shareholders’ equity to generate profit.

- Dividend Payout Ratio: Represents the share of earnings distributed to shareholders as dividends.

- Retention Ratio: Calculated as 1 minus Dividend Payout Ratio, this reflects the proportion of earnings retained and reinvested into the business.

Example Calculations Using the Sustainable Growth Rate Calculator

Suppose your company has:

- ROE: 12%

- Dividend Payout Ratio: 25%

The sustainable growth rate would be:

$$ \text{SGR} = 0.12 \times (1 – 0.25) = 0.09 = 9\% $$

Your company can grow at 9% annually without seeking outside financing.

Another example:

- ROE: 22%

- Dividend Payout Ratio: 10%

The sustainable growth rate is:

$$ \text{SGR} = 0.22 \times (1 – 0.10) = 0.198 = 19.8\% $$

This shows the company can sustain nearly 20% growth using internal funds.

Benefits of Using the Sustainable Growth Rate Calculator for Business Planning

- Set Realistic Growth Targets: Avoid overestimating growth potential by understanding internal financing limits.

- Maintain Financial Stability: Prevent excessive borrowing or dilution by aligning growth with sustainable rates.

- Optimize Dividend Policies: Balance shareholder returns with reinvestment needs.

- Identify Funding Gaps: Spot financing shortfalls early to plan for external capital when necessary.

- Communicate Clearly with Investors: Present growth expectations grounded in financial data.

Practical Applications and Industry-Specific Insights

Applying SGR in Different Business Contexts

You can tailor strategic planning using SGR estimates to your industry’s typical financial patterns and growth profiles.

Retail Industry

- Often shows lower ROE due to competitive margins.

- Dividends tend to be higher to attract investors.

- Working capital demands can limit growth velocity.

Technology Industry

- Higher ROE driven by intangible assets and innovation.

- Often reinvests earnings fully, reflecting low dividend payout ratios.

- Lower capital expenditures enable faster growth rates.

Strategic Integration of Sustainable Growth Rate in Financial Planning

Growth Management Tactics

- Enhance operational efficiency to improve ROE.

- Review dividend policies to increase retained earnings.

- Optimize working capital to support expansion.

- Build sustainable competitive advantages to boost profitability.

Incorporating SGR into Financial Forecasting

- Use SGR as a key input in annual budgeting processes.

- Align long-term strategic goals with sustainable growth capacities.

- Monitor actual growth rates against SGR regularly to adjust plans.

- Evaluate financing needs considering your sustainable growth limits.

Frequently Asked Questions About Sustainable Growth Rate

What is a good sustainable growth rate for my business?

Ideal growth rates vary by industry and company stage. Generally, 8% to 15% growth rates are healthy for established firms. High-growth sectors like technology may sustain higher rates, often above 20%.

Can the sustainable growth rate be negative?

Yes. A negative sustainable growth rate occurs if ROE is negative, indicating your company is shrinking and not generating sufficient returns to grow organically.

How often should I calculate the sustainable growth rate?

Calculate SGR at least quarterly or annually, especially when updating dividend policies or experiencing significant changes in profitability.

Is the sustainable growth rate model relevant for startups?

Startups often rely on external funding, so SGR has limited application early on. However, as they mature, tracking SGR helps plan transitions to self-sustained growth.

How does sustainable growth rate relate to competitive advantage?

Companies with strong competitive advantages retain higher ROE, enabling faster growth without external financing. Maintaining these advantages supports sustainable expansion.

Can SGR assist decisions in mergers and acquisitions?

Yes. SGR helps evaluate whether acquisitions can be financed internally and how they align with your company’s sustainable growth objectives.

Best Practices for Implementing Sustainable Growth Rate Analysis

Consistent Monitoring

- Track actual growth against calculated sustainable growth rates.

- Adjust operational and financial strategies when growth deviates.

- Regularly update inputs like ROE and payout ratios each quarter.

Informed Strategic Decisions

- Use SGR as a benchmark for evaluating growth initiatives.

- Consider SGR limits when exploring expansion or investment opportunities.

- Align dividend payment policies to support your sustainable growth targets.

Industry Benchmarking

- Compare your sustainable growth rate with competitors and peers.

- Analyze variations in ROE and payout ratios across your industry.

- Identify areas to improve profitability and retention for enhanced growth.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.