Dividend Payout Ratio Calculator

Is this tool helpful?

How to use the tool

- Fill “Dividend Per Share” – e.g., 2.15 USD or 0.90 USD.

- Fill “Earnings Per Share” – e.g., 4.70 USD or 6.80 USD.

- Press “Calculate” to display the dividend payout ratio instantly.

- Compare results with industry norms to judge dividend sustainability.

- Refine inputs whenever new DPS or EPS data appear in quarterly reports.

Formula

The tool applies:

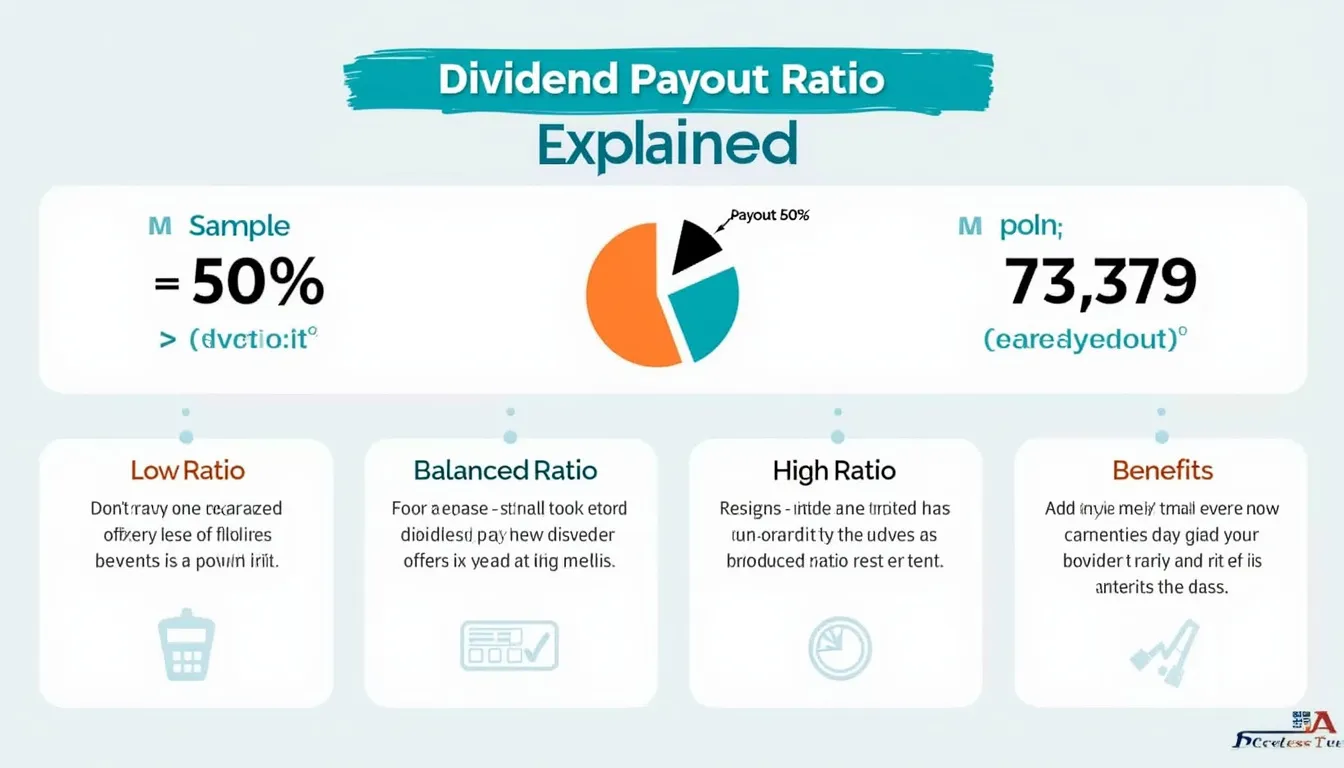

$$ \text{Dividend Payout Ratio (\%)} = rac{\text{Dividend Per Share}}{\text{Earnings Per Share}} \times 100 $$Example calculations

- DPS 2.15, EPS 4.70 → $$ rac{2.15}{4.70}\times100 = 45.74\%$$

- DPS 0.90, EPS 6.80 → $$ rac{0.90}{6.80}\times100 = 13.24\%$$

Quick-Facts

- Typical payout range for mature firms: 40 – 60 % (Investopedia, 2023).

- S&P 500 average payout ratio: 34 % in 2022 (FactSet, 2023).

- Utility sector average: 60 % (S&P Global, 2022).

- Tech sector average: 20 % (Morningstar, 2023).

FAQ

What is the dividend payout ratio?

The dividend payout ratio is the percentage of net earnings distributed to shareholders as cash dividends (Investopedia, 2023).

Why does a high ratio signal risk?

A ratio near or above 100 % shows dividends exceed earnings, raising cut risk when profits dip (Morningstar, 2023).

What is a “safe” payout ratio?

Analysts regard 40 – 60 % as sustainable for established firms, allowing reinvestment and dividend growth (FactSet, 2023).

How often should you recalculate?

Update the ratio each quarter when companies publish new EPS and DPS figures (SEC Form 10-Q, sec.gov).

Can growth companies have low ratios?

Yes; tech giants retain earnings for R&D, posting ratios near 20 % or lower (Morningstar, 2023).

Does the tool work for ADRs?

Yes—enter DPS and EPS converted to the same currency for accurate results (Nasdaq ADR Guide, 2022).

How do share buybacks affect the ratio?

Buybacks reduce share count, lifting EPS and thus lowering the payout ratio if DPS stays flat (Harvard Business Review, 2020).

What other metrics complement this ratio?

Combine payout ratio with free-cash-flow payout and dividend-coverage ratios for a fuller view of dividend safety (CFA Institute, 2021).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.