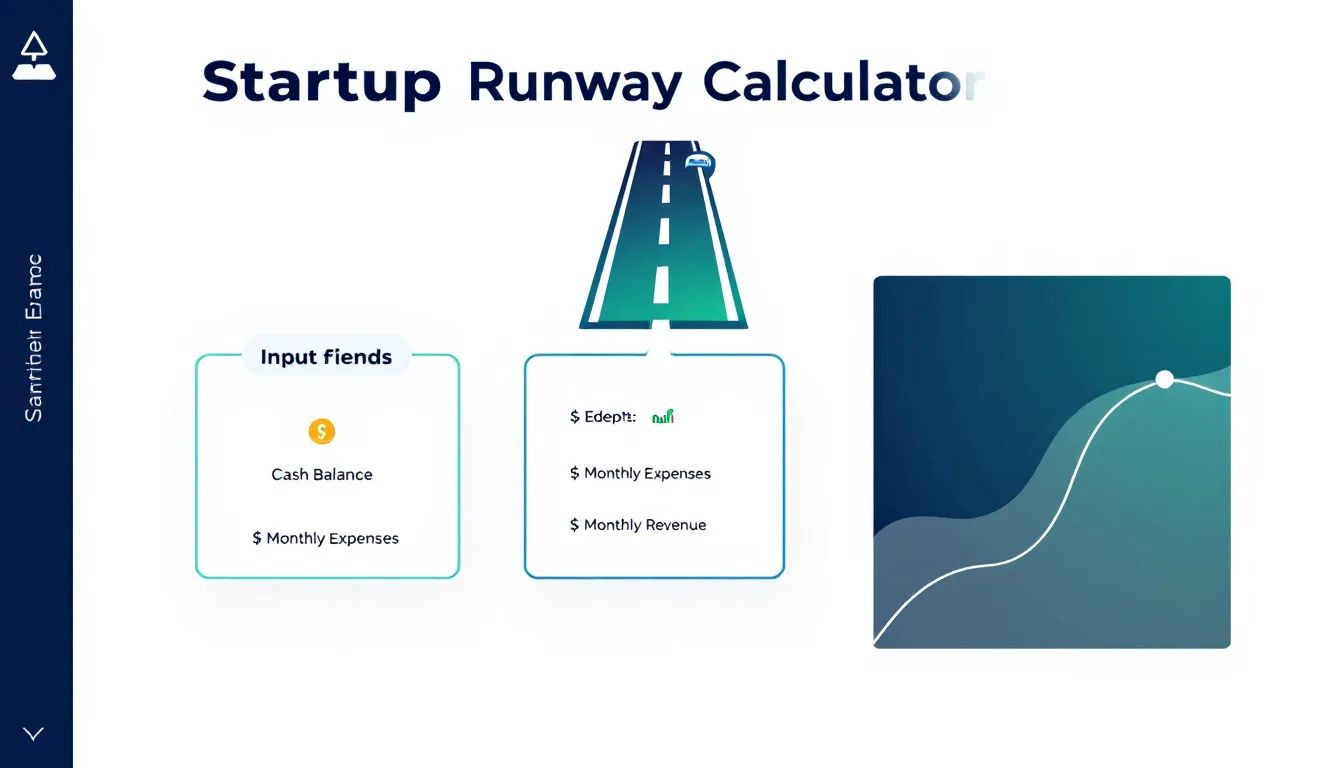

Startup Runway Calculator

Is this tool helpful?

How to Use the Startup Runway Calculator Effectively

Step-by-Step Guide to Calculate Your Startup’s Financial Runway

Use this calculator to estimate how long your startup can operate before running out of cash. Follow these steps to enter your data accurately and get meaningful results:

- Enter your Cash Balance: Input the total available cash and liquid assets. For example, if you have $250,000 in bank accounts and $40,000 in short-term investments, enter 290000. Another example could be $120,000 in cash reserves and $30,000 in marketable securities; enter 150000.

- Fill in Monthly Expenses: Include all recurring costs like salaries, rent, utilities, and subscriptions. For instance, if monthly expenses total $45,000, input 45000. Or if your fixed costs are $30,000 and variable costs $20,000, enter 50000.

- Add Monthly Revenues (optional): Enter average monthly income if your startup generates revenue. For example, input 28000 for steady sales or 35000 for subscription income.

- Include One-Time Expenses (optional): Add any planned large costs like new equipment or software licenses. For example, anticipate a $60,000 product launch and enter 60000. Another example: $25,000 office renovation, enter 25000.

- Set Revenue Growth Rate (%) (optional): Enter the anticipated monthly revenue growth as a percentage. If you expect a 4% monthly increase, enter 4; if you forecast a 6% growth, enter 6.

- Set Expense Growth Rate (%) (optional): Enter your expected monthly increase in expenses. For example, enter 1.5 if expenses grow by 1.5% monthly, or 3 for a more aggressive cost rise.

- Click “Calculate Runway”: Submit your inputs to view the monthly burn rate, runway duration, adjusted runway, and a detailed cash balance chart.

Understanding Your Results

The output explains key financial metrics to help you plan better:

- Monthly Burn Rate: Your net cash spent each month, calculated as Monthly Expenses minus Monthly Revenues.

- Runway: Number of months your current cash lasts at the current burn rate.

- Adjusted Runway: Shows your runway considering one-time expenses and changing revenue and expense growth rates.

- Cash Balance Chart: Visualizes your cash flow over time, helping you spot when cash may run low and enabling proactive decisions.

Startup Runway Calculator: Definition, Purpose, and Benefits

What Is a Startup Runway?

Your startup’s runway is the amount of time you can keep operating before running out of cash. It assumes no new funding arrives. This metric helps you assess your startup’s financial health and plan your next moves.

Purpose of the Startup Runway Calculator

This calculator helps you:

- Plan your finances: Understand how long your funds will last.

- Make decisions: Budget expenses, hire staff, or initiate fundraising.

- Assess risks: Identify potential cash flow shortages early.

- Communicate with investors: Share clear, data-backed financial projections.

- Set goals: Adjust growth or cost-saving targets to extend your runway.

Benefits of Using This Startup Runway Financial Tool

- Precise financial forecasting: See how long your resources last using current and projected data.

- Better cash management: Know when to tighten expenses or boost income.

- Strategic scenario planning: Model the impact of growth rates and unexpected costs.

- Fundraising readiness: Time your capital raises to avoid cash crunches.

- Effective resource allocation: Prioritize spending that extends runway or accelerates revenue.

- Risk mitigation: Spot cash flow gaps before they become urgent.

- Investor confidence: Show your grasp of financial health with solid projections.

- Align your team: Rally everyone around clear financial goals.

- Visualize financial trends: Use the cash balance chart to track your fiscal trajectory.

- Adaptability: Update inputs anytime as your business evolves.

Example Calculations Demonstrating Startup Runway and Burn Rate

Basic Runway and Burn Rate Calculation

Suppose your startup has the following financials:

- Cash Balance: $400,000

- Monthly Expenses: $70,000

- Monthly Revenues: $25,000

The monthly burn rate $$B$$ is the difference between expenses and revenues:

$$ B = \text{Monthly Expenses} – \text{Monthly Revenues} $$$$ B = 70,000 – 25,000 = 45,000 $$The runway in months $$R$$ calculates as:

$$ R = \frac{\text{Cash Balance}}{B} $$$$ R = \frac{400,000}{45,000} \approx 8.89 \text{ months} $$This means your startup can run for about 8.9 months before cash runs out at this burn rate.

Adjusted Runway with Growth Rates and One-Time Expenses

Considering growth rates and one-time costs:

- Revenue Growth Rate: 4% per month

- Expense Growth Rate: 2.5% per month

- One-Time Expenses: $50,000

First, account for one-time expenses by reducing cash balance:

$$ \text{Adjusted Cash} = 400,000 – 50,000 = 350,000 $$Next, project revenue and expenses month-over-month assuming growth rates compound. After three months:

$$ \text{Projected Revenue} = 25,000 \times (1 + 0.04)^3 \approx 28,124 $$$$ \text{Projected Expenses} = 70,000 \times (1 + 0.025)^3 \approx 75,450 $$The new burn rate at month three becomes:

$$ \text{Burn Rate} = 75,450 – 28,124 = 47,326 $$This adjusted burn rate, combined with the depleted cash from one-time expenses, shortens the runway. The calculator estimates the exact adjusted runway by simulating these monthly changes until cash runs out.

Practical Applications of the Startup Runway Calculator for Founders and Financial Managers

1. Fundraising Strategy

Calculate your runway to time fundraising rounds. For example, if your runway is 12 months and raising funds takes 6 months, start fundraising no later than 6 months before you need capital.

2. Hiring and Growth Decisions

Evaluate how new hires or expansion plans affect your runway. If adding staff decreases runway significantly, adjust hiring timelines or seek additional funds.

3. Pivot and Business Model Evaluation

Check how shifts in market strategy or product focus impact cash flow. Use updated inputs to see how new expenses or revenues change your runway.

4. Investor Discussions

Share your runway projections to demonstrate financial awareness and planning. It helps investors understand your current situation and future needs clearly.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.