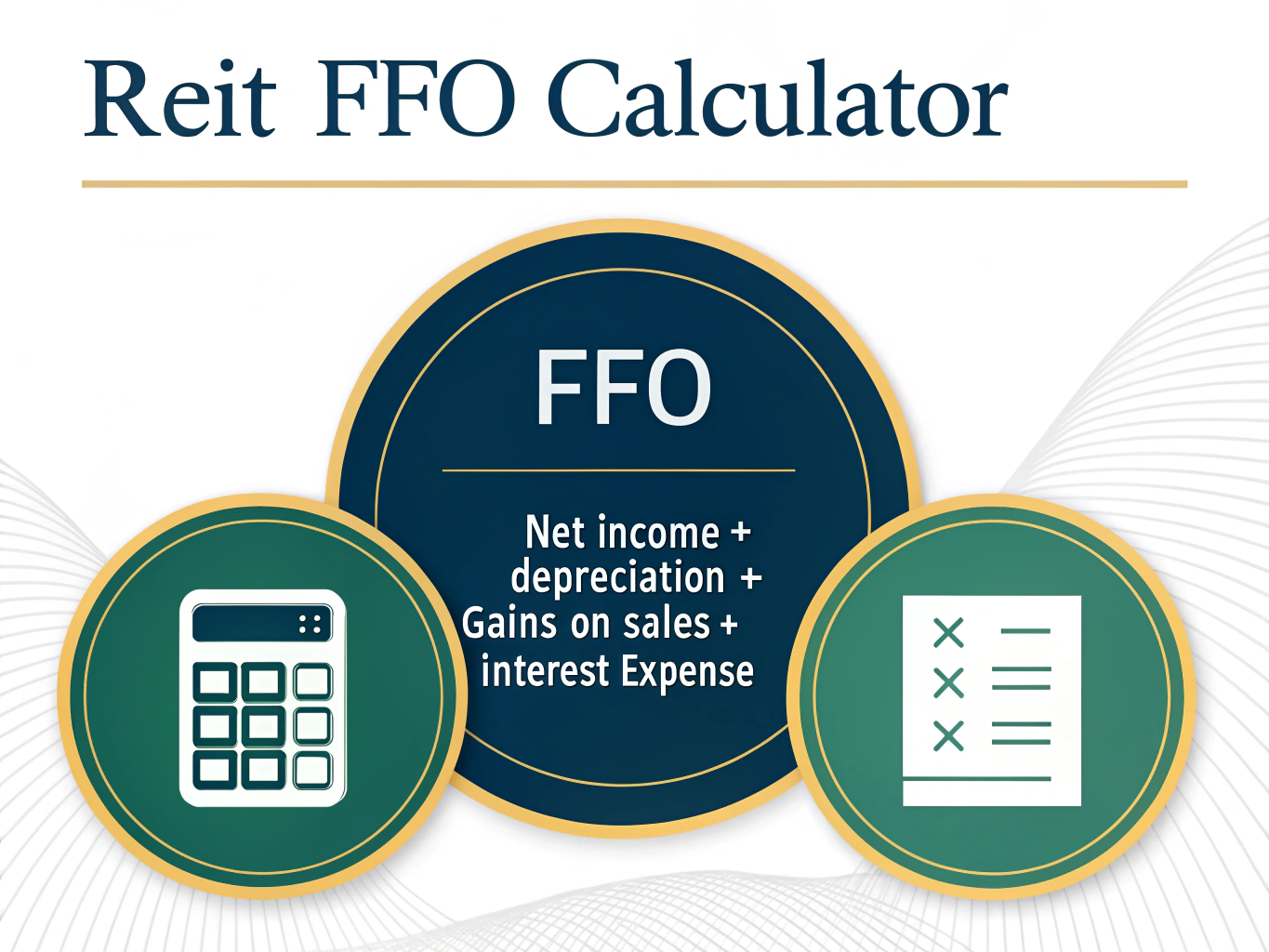

REIT FFO Calculator

Is this tool helpful?

How to Use the REIT FFO Calculator Effectively

To accurately calculate the Funds From Operations (FFO) for your Real Estate Investment Trust, enter the relevant financial data below. Here’s how to use each field:

- Net Income: Enter the total net income generated by your REIT for the reporting period. For example, input 4,150,000 or 6,800,000 depending on your financial statement.

- Depreciation: Input the total depreciation expense for the period. This could be 1,250,000 or 2,000,000 to reflect wear and tear on properties.

- Gains on Sales: Enter the gains realized from property sales within the period. Typical entries could be 500,000 or 1,100,000, representing profits from such transactions.

- Interest Expense: Input your total interest expense on loans and financing. You might enter values like 650,000 or 900,000 depending on your debt costs.

After entering these values, submit the form to calculate the FFO instantly. The tool validates your inputs to ensure they are positive numbers, prompting corrections if needed.

Introduction to the REIT FFO Calculator: Definition, Purpose, and Benefits

The REIT FFO Calculator is a practical financial tool designed to help investors and analysts evaluate Real Estate Investment Trust performance using Funds From Operations (FFO). FFO serves as a better indicator of a REIT’s operational success by adjusting net income for non-cash items and one-time gains.

Unlike simple net income figures, which can be distorted by depreciation or gains from property sales, FFO offers a clearer view of the cash-generating ability of your real estate assets. This clarity helps you make informed investment decisions and assess the sustainability of dividend payments.

Key benefits of using this FFO calculator include:

- Ensures industry-standard calculations aligned with NAREIT guidelines

- Provides fast and accurate results without requiring complex spreadsheets

- Supports comparison of multiple REITs by delivering consistent metrics

- Helps you track operational performance and investment potential over time

Example FFO Calculation Using the REIT Calculator

Imagine a REIT with the following financial data for a quarter:

- Net Income: $6,200,000

- Depreciation: $1,900,000

- Gains on Sales: $700,000

- Interest Expense: $1,100,000

Using the REIT FFO Calculator, the formula applied is:

$$ \mathrm{FFO} = \mathrm{Net\ Income} + \mathrm{Depreciation} – \mathrm{Gains\ on\ Sales} + \mathrm{Interest\ Expense} $$Calculating with the numbers:

$$ 6,200,000 + 1,900,000 – 700,000 + 1,100,000 = 8,500,000 $$Funds From Operations: $8,500,000

This FFO number reflects the REIT’s operational inflows more accurately than net income alone, aiding better financial analysis.

Practical Uses and Applications of the FFO Calculator

1. Investment Analysis

- Compare the profitability of different REITs based on standardized cash flow metrics

- Evaluate whether a REIT’s dividend payments are supported by underlying operations

- Assess the potential risks and returns in varied real estate sectors using FFO

2. Portfolio Management

- Monitor ongoing performance trends within your real estate assets

- Make rebalancing decisions based on operational cash flow rather than accounting profits

- Adapt investment strategies quickly when financial conditions change

3. Financial Planning for Real Estate Professionals

- Conduct accurate business valuation using cash flow adjusted earnings

- Set strategic goals based on reliable operational metrics

- Benchmark performance against industry averages and peers

Frequently Asked Questions About REIT FFO Calculation

What is Funds From Operations (FFO) in REIT analysis?

FFO is a financial measure that adjusts net income by adding depreciation and interest expense while subtracting gains from property sales. It provides a clearer picture of a REIT’s cash earnings from core real estate activities.

Why should I use FFO instead of net income to evaluate REITs?

Net income includes non-cash and one-time items that distort the true operational performance. FFO removes these effects to give you a better understanding of the ongoing profitability and cash flow sustainability.

How often should FFO be calculated?

Calculate FFO at least quarterly and annually, aligning with financial reporting periods to track performance trends and make timely investment decisions.

Can FFO be negative, and what does it mean?

Yes, FFO can be negative if a REIT’s operating losses and adjustments exceed its income. This may indicate operational difficulties or large non-cash expenses impacting earnings.

How does FFO affect dividend decisions?

Many REITs base dividend sustainability on FFO, targeting payout ratios that ensure dividends are supported by actual operational cash flow, avoiding overpayment based on accounting profits.

Are there other FFO measures besides the standard calculation?

Yes. Some REITs report Adjusted FFO (AFFO) or normalized FFO, which further adjust for maintenance costs and other items. This calculator uses the standard NAREIT FFO definition.

How can investors use FFO metrics effectively?

Use FFO to compare different REITs, analyze dividend safety, and measure pure operational performance, aiding better investment choices and portfolio management.

Additional Factors to Consider When Analyzing REIT FFO

Market and Economic Context

- Consider current real estate market trends and sector-specific dynamics

- Analyze the influence of interest rates on financing costs and property values

- Account for regional economic conditions that may affect property performance

Comparative and Trend Analysis

- Compare FFO values with industry peers to assess relative performance

- Monitor FFO growth or decline over time to identify underlying trends

- Evaluate FFO on a per share basis for more precise valuation insights

- Analyze FFO payout ratios to judge dividend sustainability

Integrating FFO with Other Financial Metrics

- Use Price to FFO ratios to evaluate REIT valuation compared to earnings

- Incorporate Debt to FFO ratios for assessing financial leverage and risk

- Combine with operating margin and occupancy rates for a full performance picture

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.