QBI Deduction Calculator

Is this tool helpful?

How to Use the QBI Deduction Calculator Effectively

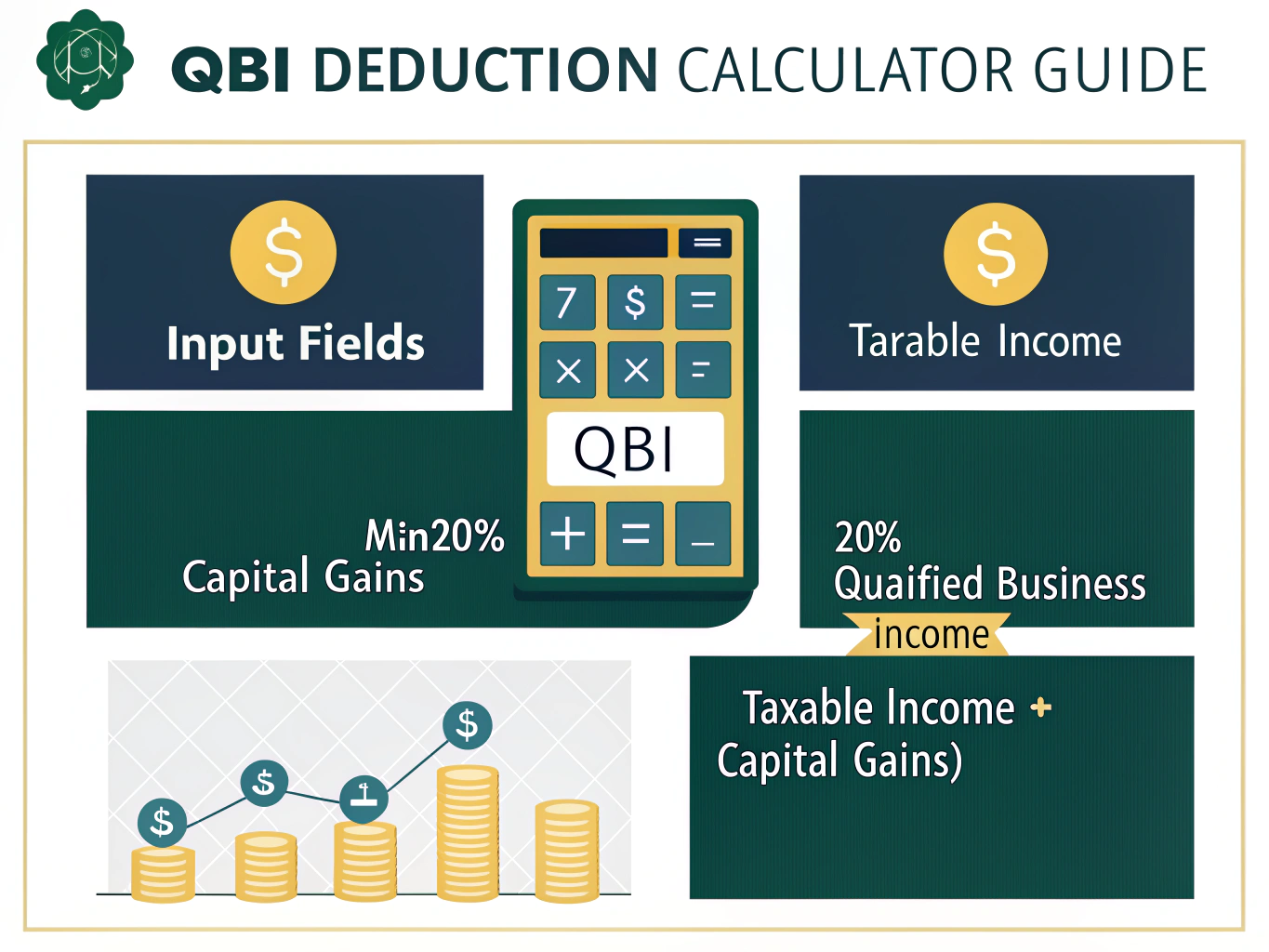

Use this calculator to estimate your Qualified Business Income (QBI) tax deduction accurately by following these steps:

- Enter Your Taxable Income: Provide your total taxable income for the year. For example, if you earned $180,000, enter “180000”. Another example could be $220,000.

- Input Your Capital Gains: Enter the total capital gains you realized during the tax year. For instance, if you had $12,500 in capital gains, input “12500”. Alternatively, enter $5,000 if that applies to you.

- Enter Qualified Business Income: Provide the amount of your qualified business income. For example, if your business earned $100,000, enter “100000”. Another example is $60,000.

- Calculate Your QBI Deduction: Click the calculate button to see your estimated deduction based on the data entered.

Understanding the QBI Deduction Calculator

The Qualified Business Income Deduction Calculator helps you quickly determine the allowable deduction under Section 199A of the Tax Cuts and Jobs Act. This tax deduction allows eligible business owners to reduce their taxable income by up to 20% of their QBI.

This calculator automates the complex formula, making it easier to estimate your maximum deduction without manual calculations or confusion.

The calculator applies this formula:

Key Benefits of Using This QBI Deduction Calculator

- Fast and Accurate: Quickly calculates your QBI deduction with reliable precision.

- Phase-out Notifications: Alerts you if your taxable income falls within the $170,000 to $220,000 phase-out range, indicating possible limitations.

- Easy to Use: Simple input fields with clear instructions guide you through the process.

- Time Saver: Eliminates the need for manual math, reducing errors and saving time.

- Helps in Tax Planning: Lets you make informed decisions to optimize your tax position throughout the year.

Example Calculations Using the QBI Deduction Calculator

Example 1: Freelancer with Moderate Income

- Qualified Business Income: $90,000

- Taxable Income: $130,000

- Capital Gains: $20,000

Calculation steps:

- 20% of QBI = 0.20 × $90,000 = $18,000

- 20% of (Taxable Income – Capital Gains) = 0.20 × ($130,000 – $20,000) = 0.20 × $110,000 = $22,000

- QBI Deduction: The smaller of the two, which is $18,000

Example 2: Small Business Owner with High Capital Gains

- Qualified Business Income: $70,000

- Taxable Income: $115,000

- Capital Gains: $35,000

Calculation details:

- 20% of QBI = 0.20 × $70,000 = $14,000

- 20% of (Taxable Income – Capital Gains) = 0.20 × ($115,000 – $35,000) = 0.20 × $80,000 = $16,000

- QBI Deduction: Minimum value is $14,000

Real-World Applications for This Qualified Business Income Deduction Calculator

Annual and Quarterly Tax Planning

Use the calculator to estimate your QBI deduction during quarterly tax filings and annual tax planning. It helps you anticipate tax liabilities and manage cash flow effectively.

Optimizing Business Structure and Transactions

Evaluate how different business structures and income sources impact your QBI deduction. This calculator aids in assessing potential tax benefits when making business decisions.

Investment and Income Timing Strategies

Understand how capital gains and income recognition affect your deductible amount. Plan your investments and income timing for the greatest tax advantage.

Frequently Asked Questions About the QBI Deduction Calculator

What qualifies as Qualified Business Income?

Qualified Business Income includes the net amount of income, gains, deductions, and losses from any qualified trade or business. It excludes capital gains and losses, interest, and dividends.

How does the QBI deduction reduce my taxes?

It allows you to deduct up to 20% of your QBI, lowering your taxable income and reducing your overall tax bill.

When should I use this calculator?

Use it during tax planning, quarterly filings, or any time your business income or capital gains change. Regular updates ensure accurate tax projections.

Can I combine income from multiple businesses?

Yes, add all eligible qualified business income from your businesses for a total QBI amount to input into the calculator.

How do capital gains impact the QBI deduction?

Capital gains reduce the taxable income limit, which may lower your maximum deductible QBI amount. The calculator accounts for this adjustment automatically.

Are all businesses eligible for the QBI deduction?

Sole proprietorships, partnerships, S corporations, trusts, and estates are eligible. C corporations do not qualify for this deduction.

How often should I recalculate my QBI deduction?

Review and recalculate quarterly or whenever your income, capital gains, or business structure changes to stay aligned with tax rules and maximize your deduction.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.