Cryptocurrency Tax Calculator

Is this tool helpful?

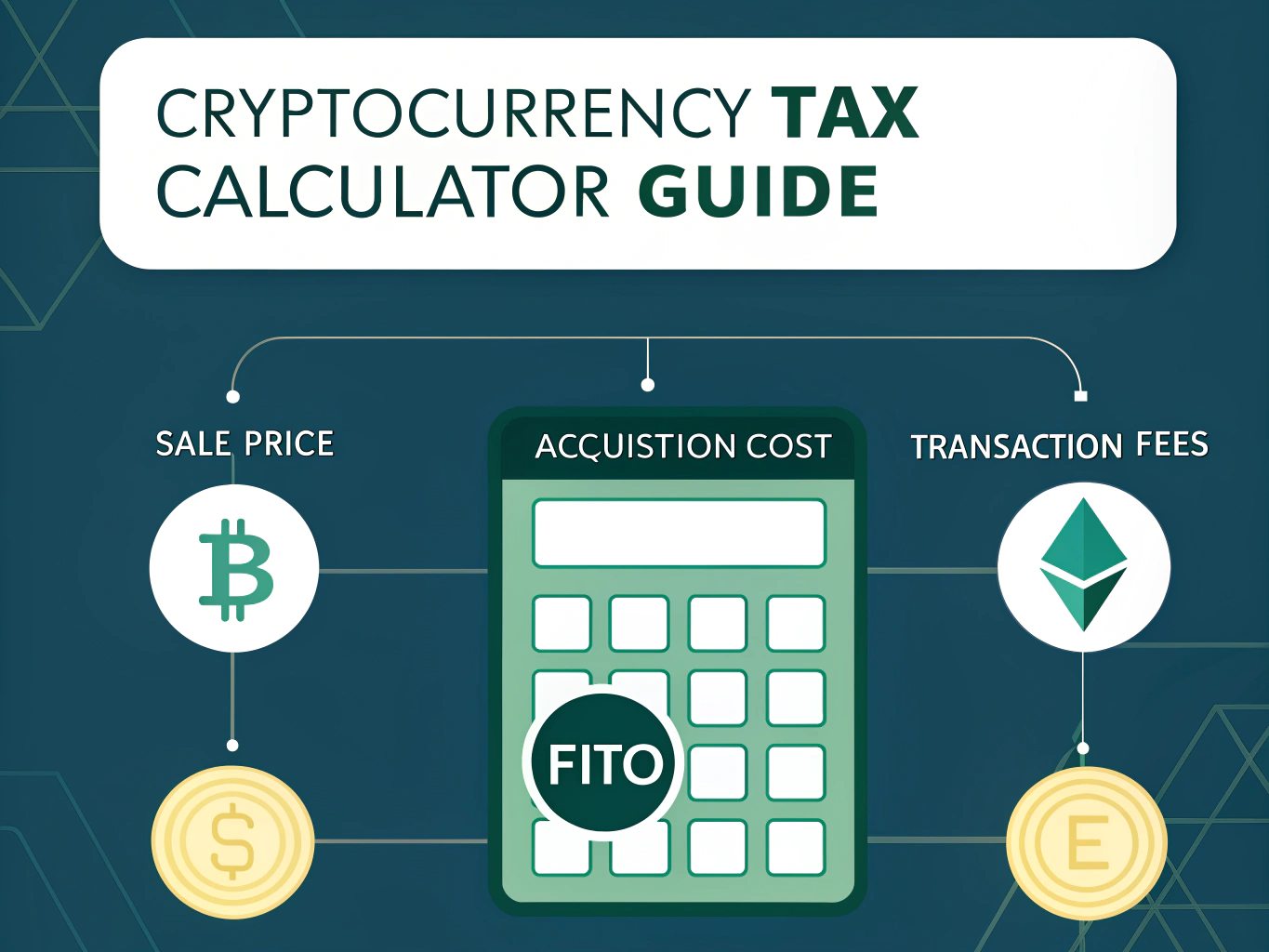

How to Use the Cryptocurrency Tax Calculator Effectively

Use this calculator to quickly determine your cryptocurrency tax liability based on FIFO (First-In-First-Out) capital gains and losses. Follow these steps:

- Enter Sale Price (USD): Type the total amount you received from selling your cryptocurrency. For example, if you sold 3 LTC at $180 each, enter 540.00.

- Input Acquisition Cost (USD): Enter the original purchase price of the cryptocurrency sold. For instance, if you bought 3 LTC at $150 each, enter 450.00.

- Add Transaction Fees (USD): Include all related selling expenses, like exchange fees or network charges. If your fees totaled $20, enter 20.00.

The calculator instantly shows your net gain or loss and labels it as a capital gain or capital loss, helping you understand your tax position clearly.

Introduction to the Cryptocurrency Tax Liability Calculator

This cryptocurrency tax calculator helps you compute the taxable gain or loss from your digital asset transactions using the FIFO accounting method. It simplifies the process of determining how much tax you owe or the losses you can claim, saving time and reducing errors. Tracking your crypto gains and losses accurately ensures compliance with tax regulations and supports better portfolio management.

Key benefits of using this cryptocurrency tax calculator:

- Accurate Capital Gains Reporting: Calculates gains and losses according to IRS guidelines.

- Quick and Easy: Automates calculations to avoid manual errors.

- Tax Compliance: Supports proper documentation to fulfill tax reporting obligations.

- Record Keeping: Helps maintain detailed transaction records for tax purposes.

- Informed Tax Planning: Assists in making strategic decisions regarding cryptocurrency trades.

How This FIFO-Based Cryptocurrency Tax Calculator Works

This tool uses the FIFO method to calculate gains or losses, assuming your first purchased cryptocurrencies are the first ones sold. This method is recognized by tax authorities and ensures consistency in your tax reporting.

The core calculation follows this formula:

$$\text{Net Gain/Loss} = \text{Sale Price} – \text{Acquisition Cost} – \text{Transaction Fees}$$

Why FIFO Matters in Cryptocurrency Taxes

Using FIFO means you match the earliest purchased units of cryptocurrency against the units you sell. This approach keeps your cost basis and gains/losses clear and consistent, which helps you avoid errors in tax filings.

Example Cryptocurrency Tax Calculations

Example 1: Calculating a Capital Gain

- Sold 5 ADA for $1,250 total

- Original purchase cost was $1,000

- Paid $75 in transaction fees

Using the formula:

$$\text{Net Gain} = 1250 – 1000 – 75 = 175$$

You realize a capital gain of $175, which you must report for tax purposes.

Example 2: Calculating a Capital Loss

- Sold 10 XRP for $900 overall

- Original purchase cost was $1,000

- Transaction fees totaled $50

Applying the formula:

$$\text{Net Loss} = 900 – 1000 – 50 = -150$$

This results in a capital loss of $150, which you may use to offset gains in other transactions.

Common Cryptocurrency Tax Scenarios and Use Cases

- Year-end Tax Preparation: Calculate total crypto capital gains and losses before filing your taxes.

- Portfolio Tracking: Monitor your crypto investment performance by calculating gains or losses per transaction.

- Tax Loss Harvesting: Identify potential losses to offset taxable gains and reduce overall tax liability.

- Investment Tax Planning: Assess tax impact before making trades or selling assets.

Frequently Asked Questions About Cryptocurrency Taxes

What is the FIFO calculation method?

FIFO (First-In-First-Out) assumes that the earliest units of cryptocurrency you purchased are sold first. This method standardizes how you calculate your cost basis and gains or losses for taxes.

Are cryptocurrency transactions taxable?

Yes. The IRS treats cryptocurrency as property, so selling, trading, or exchanging your crypto triggers capital gains or losses that must be reported.

What transaction fees can I include?

Include all fees directly related to buying or selling your cryptocurrency, such as exchange fees, network fees, and broker commissions.

How do I report cryptocurrency gains and losses?

Report them on IRS Form 8949 and Schedule D. Use this calculator to find the gain or loss amounts for each transaction.

Can this calculator handle multiple cryptocurrencies?

Yes. Enter values in USD for any cryptocurrency transactions to calculate your tax liability efficiently.

What’s the difference between capital gains and losses?

A capital gain occurs when your sale price minus acquisition cost and fees results in a positive number. A capital loss happens when this amount is negative.

Do I need to calculate taxes for each transaction?

Yes. Every sale or exchange event must be calculated separately to report accurate gains or losses. This calculator supports that process.

Tax Planning Strategies Using the Cryptocurrency Tax Calculator

Use Tax Loss Harvesting to Reduce Your Tax Bill

Identify losses on your investments with this calculator to offset gains elsewhere in your portfolio. This strategy helps you minimize your overall tax liability while maintaining your investments.

Track Your Cost Basis for Each Cryptocurrency Purchase

Consistently update and monitor your acquisition costs and fees. Accurate cost basis tracking simplifies your tax reporting and prevents mistakes during tax season.

Optimize Portfolio Moves with Tax Insights

Knowing your taxable gains and losses gives you an edge in deciding when to buy or sell crypto assets. Use this calculator regularly to make informed investment choices.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.