Personal Loan Calculator

Is this tool helpful?

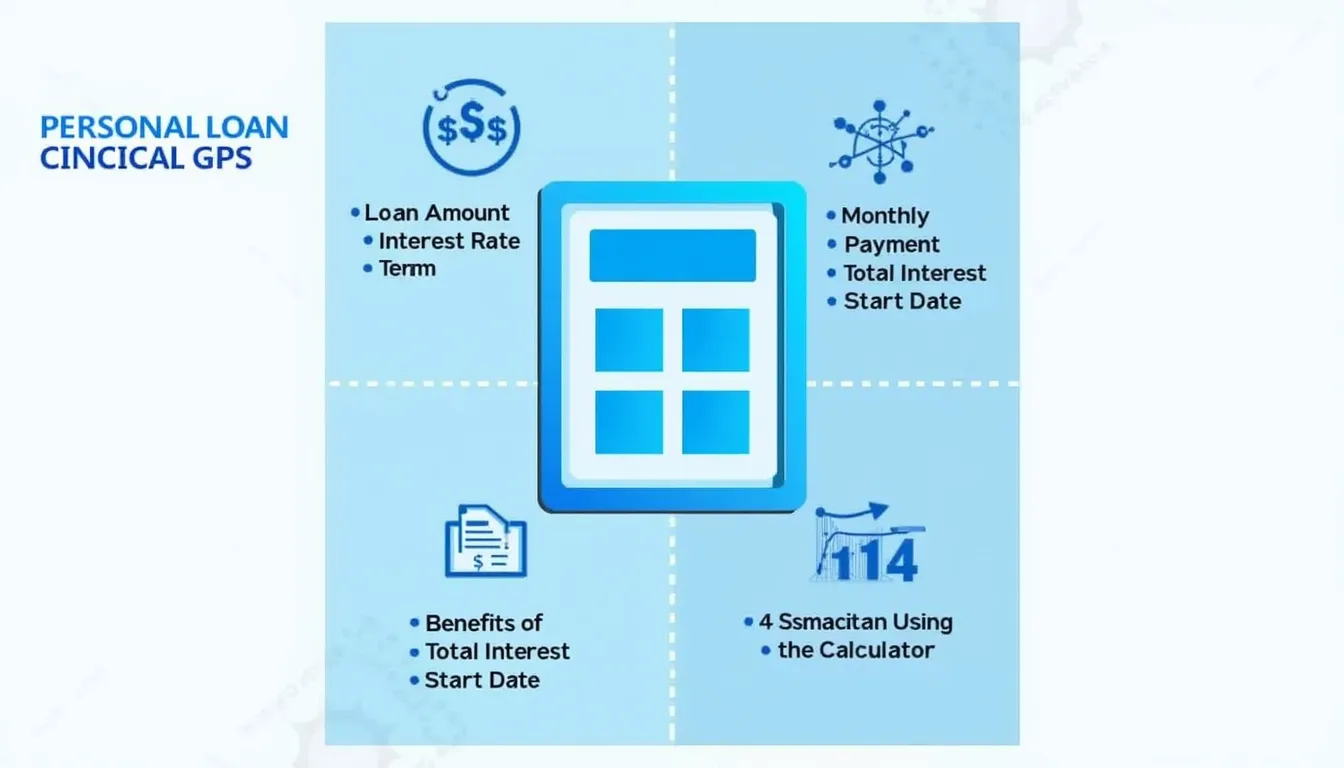

How to Use the Personal Loan Calculator Effectively

Our Personal Loan Calculator helps you plan your borrowing with accuracy and confidence. Follow these simple steps to get the most out of this financial tool:

- Enter the Loan Amount: Input the total sum you plan to borrow in USD. For example, try $15,000 or $50,000.

- Specify the Interest Rate: Provide the annual interest rate as a percentage. Examples: 4.75% or 9.25%.

- Set the Loan Term: Choose the duration for repayment in years. Try entering 3 years or 7 years.

- Select the Loan Start Date: Pick the month and year when the loan will begin.

- Click “Calculate”: The calculator will generate your monthly payment, total interest, total cost, and a detailed payment schedule.

Once you submit these inputs, the calculator provides a full breakdown of your loan payments, helping you understand your financial commitment clearly.

What Is a Personal Loan? Definition, Purpose, and Key Benefits

A personal loan is an unsecured borrowing option that provides individuals with a lump sum of money, generally without collateral. Borrowers commonly use personal loans for various financial needs such as consolidating debt, funding home renovations, financing major purchases, or covering emergencies.

Unlike secured loans like auto loans or mortgages, personal loans usually have fixed interest rates and set repayment terms, giving borrowers predictable monthly payments that help with budgeting.

Key Advantages of Personal Loans:

- Flexible use of funds for a variety of purposes

- Fixed interest rates and stable repayment timelines

- Often lower interest compared to credit card rates

- No collateral required for unsecured loans

- Chance to improve your credit score through consistent payments

Explore the Power of Our Personal Loan Calculator

Our calculator is designed to offer precise insights into your loan’s financial impact by using advanced financial algorithms. It estimates monthly payments, total interest paid, and overall loan costs, empowering you to make informed borrowing decisions.

Mathematical Formula Behind the Calculator

The calculator relies on the amortization formula to compute monthly payments:

$$ M = P \frac{r(1+r)^n}{(1+r)^n – 1} $$- M = Monthly payment amount

- P = Principal loan amount

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of monthly payments (loan term in months)

Benefits of Using This Personal Loan Calculator

- Accurate Financial Planning: Receive precise calculations of monthly payments, total interest, and overall loan cost.

- Quick Scenario Comparison: Easily test different loan amounts, interest rates, and terms to find the best fit.

- Informed Borrowing Decisions: Visualize long-term payment impacts to budget wisely.

- Budget Management: Plan your monthly expenses by knowing your exact loan obligations.

- Transparency: Understand month-by-month principal and interest payments clearly.

Example Loan Calculations to Illustrate the Tool’s Practical Use

Example 1: Small Business Expansion Loan

Jessica is planning to borrow $18,000 for a 4-year personal loan at a 7.2% interest rate. The calculator estimates:

- Monthly Payment: Approximately $437.09

- Total Interest Paid: About $2,997.28

- Total Cost of Loan: Around $20,997.28

Jessica uses these results to confirm that the loan fits within her monthly budget and aligns with her business goals.

Example 2: Medical Expenses Financing

Michael needs $12,000 to cover medical bills and considers a 3-year loan at 5.8% interest. The calculator shows:

- Monthly Payment: Approximately $363.66

- Total Interest Paid: Roughly $959.68

- Total Cost of Loan: Approximately $12,959.68

This information helps Michael understand the total financial impact while planning repayment effectively.

Example 3: Vacation Financing Comparison

Samantha is comparing two loan options for a $10,000 vacation:

- 2-year loan at 6.0% interest

- 3-year loan at 4.5% interest

The calculator results:

Option 1 (2 years):

- Monthly Payment: $443.21

- Total Interest Paid: $637.04

- Total Loan Cost: $10,637.04

Option 2 (3 years):

- Monthly Payment: $295.15

- Total Interest Paid: $628.93

- Total Loan Cost: $10,628.93

Samantha uses these insights to balance lower monthly payments against total loan cost for her financial priorities.

Why Use a Personal Loan Calculator? Addressing Common Borrower Concerns

Assessing Loan Affordability

By understanding your monthly payment obligations, you can evaluate if a loan fits your budget and avoid financial overextension.

Comparing Multiple Loan Offers

Quickly test different interest rates, loan amounts, and terms to find the best deal from lenders.

Understanding the True Cost of Your Loan

See the full financial impact of interest charges beyond the principal amount.

Long-Term Financial Planning

Plan ahead with a detailed payment schedule that tracks how principal and interest change over time.

Conclusion: Empower Your Financial Choices with Confidence

Using this Personal Loan Calculator puts powerful financial planning in your hands. It provides:

- Reliable, precise projections of loan payments

- Easy comparison of varied loan scenarios

- Transparency on total borrowing costs

- Support in budgeting and managing long-term financial commitments

- Confidence to select loan terms that best suit your needs

Remember: Personal loans are significant financial commitments. Analyze all your options carefully and use thoughtful planning tools like this calculator to ensure your borrowing aligns with your overall financial well-being.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.