30-Year Mortgage Calculator

Is this tool helpful?

How to Use the 30-Year Mortgage Calculator Effectively

Our 30-year mortgage calculator is designed to help you understand the financial implications of your home loan. Here’s a step-by-step guide on how to use it effectively:

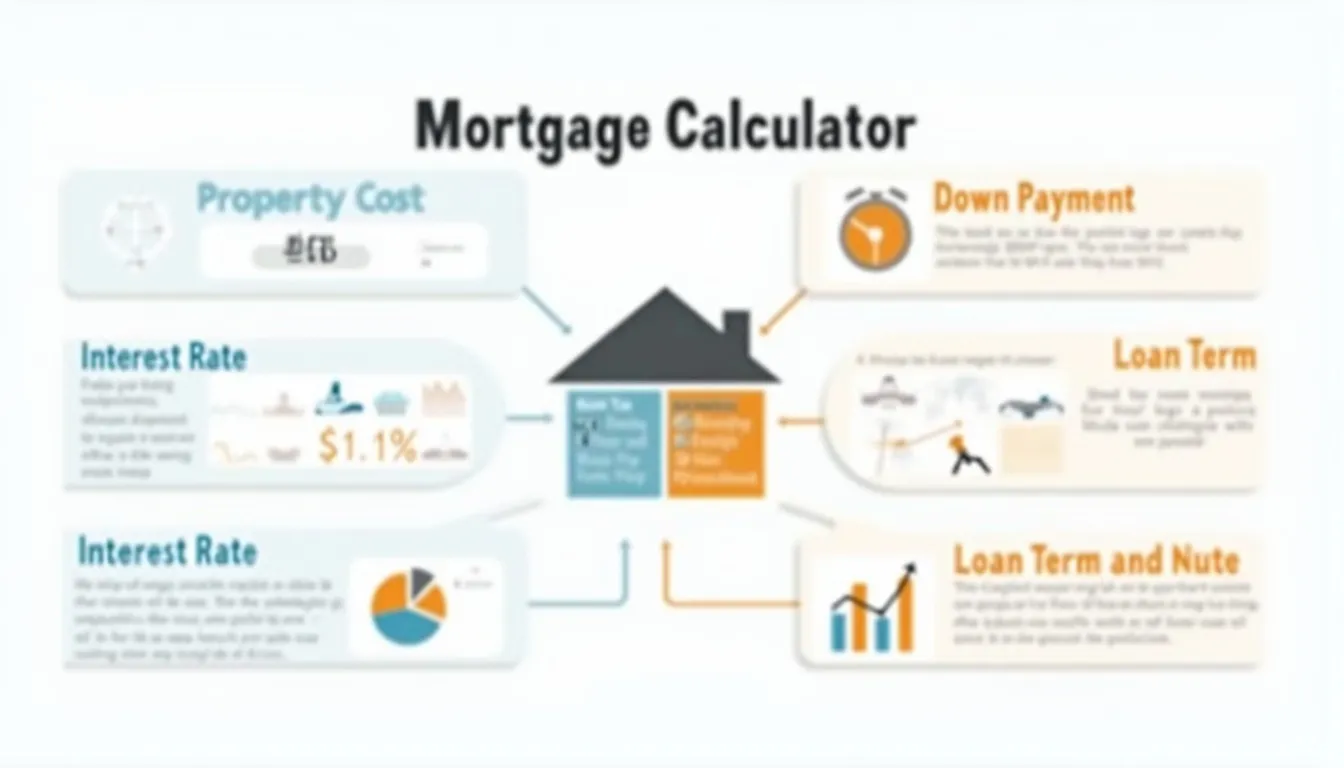

1. Enter the Loan Amount

Start by inputting the total amount you plan to borrow. This is typically the home’s purchase price minus your down payment. For example, if you’re buying a $400,000 home with a 20% down payment, you’d enter $320,000 as your loan amount.

2. Input the Annual Interest Rate

Enter the annual interest rate offered by your lender. This should be expressed as a percentage. For instance, if your lender offers a 3.5% interest rate, you’d enter 3.5 into this field.

3. Specify the Loan Term

While this calculator is designed for 30-year mortgages, you can adjust the term if needed. The default is set to 30 years, but you can change it if you’re considering a different loan duration.

4. Optional: Set the Start Date

If you know when your mortgage payments will begin, you can enter this date. This helps in calculating the exact payoff date and creating a more accurate amortization schedule.

5. Optional: Add Extra Monthly Payments

If you plan to make additional payments each month to pay off your mortgage faster, enter this amount. For example, if you want to pay an extra $100 per month, input 100 in this field.

6. Calculate and Review Results

After entering all the required information, click the “Calculate” button. The calculator will display your monthly payment, total amount paid over the life of the loan, total interest paid, and the loan payoff date.

7. Analyze Additional Payment Impact

If you entered an additional monthly payment, the calculator will show how this affects your mortgage. You’ll see the new payoff date, time saved, and interest savings.

8. Examine the Amortization Chart

The calculator provides a visual representation of how your loan balance decreases over time. This chart helps you understand the relationship between principal and interest payments throughout the loan term.

Understanding Your 30-Year Mortgage: A Comprehensive Guide

A 30-year fixed-rate mortgage is one of the most popular home loan options in the United States. It offers predictable monthly payments over a long term, making homeownership more accessible for many buyers. Our calculator is designed to help you navigate the complexities of this financial commitment.

The Basics of a 30-Year Mortgage

A 30-year mortgage spreads your loan repayment over 360 monthly payments. The “fixed-rate” aspect means your interest rate remains constant throughout the loan term, ensuring your principal and interest payment stays the same each month (although your total payment may change due to fluctuations in property taxes and insurance).

Key Components of Your Mortgage Payment

- Principal: The amount you borrowed and need to repay.

- Interest: The cost of borrowing money, calculated as a percentage of your loan balance.

- Property Taxes: Annual taxes assessed by your local government based on your property’s value.

- Homeowners Insurance: Protection for your property against various risks.

- Private Mortgage Insurance (PMI): Required if your down payment is less than 20% of the home’s value.

Our calculator focuses on the principal and interest portions of your payment, as these are consistent and directly related to your loan terms.

Benefits of Using the 30-Year Mortgage Calculator

1. Financial Planning and Budgeting

By providing an accurate estimate of your monthly mortgage payment, this calculator helps you determine how much house you can afford. It allows you to experiment with different loan amounts and interest rates to find a monthly payment that fits comfortably within your budget.

2. Understanding the True Cost of Your Loan

The calculator shows you the total amount you’ll pay over the life of the loan, including both principal and interest. This information can be eye-opening, as it reveals the significant impact of interest over a 30-year period.

3. Evaluating the Impact of Additional Payments

One of the most powerful features of this calculator is its ability to show how extra payments can affect your mortgage. By inputting an additional monthly payment, you can see how much time and interest you could save over the life of your loan.

4. Visualizing Your Loan Amortization

The amortization chart provides a clear visual representation of how your loan balance decreases over time. This can be particularly motivating, as it shows how each payment contributes to building your home equity.

5. Comparing Different Loan Scenarios

By allowing you to easily adjust inputs, the calculator enables you to compare various loan scenarios. This can be invaluable when deciding between different loan offers or considering refinancing options.

How the 30-Year Mortgage Calculator Addresses User Needs

Demystifying Complex Financial Concepts

Mortgages involve complex financial calculations that can be daunting for many homebuyers. Our calculator simplifies these concepts, making them accessible to everyone. It takes the guesswork out of understanding how different factors affect your mortgage payments and overall loan cost.

Empowering Informed Decision-Making

By providing clear, detailed information about your potential mortgage, this calculator empowers you to make informed decisions. Whether you’re a first-time homebuyer or considering refinancing, having accurate figures at your fingertips can significantly impact your financial choices.

Illustrating the Power of Extra Payments

Many borrowers are unaware of how impactful even small additional payments can be over the life of a 30-year mortgage. Our calculator vividly demonstrates this, potentially motivating users to adopt strategies that can save them thousands in interest and shave years off their mortgage.

Facilitating Long-Term Financial Planning

A 30-year mortgage is a long-term commitment, and our calculator helps users plan for the future. By showing the full amortization schedule, it allows borrowers to understand how their financial situation will evolve over time, aiding in long-term financial planning.

Practical Applications and Examples

Example 1: First-Time Homebuyer

Let’s consider Sarah, a first-time homebuyer looking at a $300,000 house with a 20% down payment.

- Loan Amount: $240,000

- Interest Rate: 3.5%

- Loan Term: 30 years

Using our calculator, Sarah finds:

- Monthly Payment: $1,077.71

- Total Paid Over 30 Years: $387,975.60

- Total Interest Paid: $147,975.60

Sarah decides to add an extra $100 to her monthly payment. The calculator shows this would:

- Save her $27,401.92 in interest

- Help her pay off the mortgage 4 years and 3 months earlier

Example 2: Refinancing Consideration

John has been paying on his 30-year mortgage for 5 years. He’s considering refinancing to take advantage of lower interest rates. His current situation:

- Remaining Balance: $225,000

- Current Interest Rate: 4.5%

- Remaining Term: 25 years

He’s offered a refinance option:

- New Loan Amount: $225,000

- New Interest Rate: 3.25%

- New Term: 30 years

Using our calculator for both scenarios, John discovers:

- Current Monthly Payment: $1,266.71

- New Monthly Payment: $979.21

- Monthly Savings: $287.50

- Total Interest Saved (even with extended term): $23,453.20

This information helps John decide whether the immediate monthly savings outweigh the potential long-term costs of extending his loan term.

Example 3: Lump Sum Payment Analysis

Emily receives a $20,000 bonus and wants to understand the impact of applying it to her mortgage:

- Current Balance: $280,000

- Interest Rate: 3.75%

- Remaining Term: 28 years

Using the calculator, Emily finds that applying the $20,000 as a lump sum would:

- Reduce her loan term by 2 years and 4 months

- Save $31,524.60 in interest over the life of the loan

This analysis helps Emily weigh the benefits of using her bonus for mortgage prepayment against other potential uses or investments.

Frequently Asked Questions (FAQ)

Q1: How is the monthly payment calculated?

A1: The monthly payment for a 30-year fixed-rate mortgage is calculated using the following formula:

$$M = P \left[\frac{r(1+r)^n}{(1+r)^n-1}\right]$$Where:

- M = Monthly payment

- P = Principal loan amount

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of months in the loan term (360 for a 30-year mortgage)

Q2: Why does more of my payment go towards interest at the beginning of the loan?

A2: This is due to the amortization schedule of the loan. In the early years, the loan balance is at its highest, so a larger portion of each payment goes towards interest. As you pay down the principal over time, more of each payment goes towards reducing the balance.

Q3: How much can I save by making extra payments?

A3: The amount you can save depends on the size of your extra payments and when you start making them. Even small additional payments can lead to significant savings over time. Use our calculator’s additional payment feature to see the exact impact for your specific situation.

Q4: Should I choose a 30-year mortgage or a shorter term?

A4: This depends on your financial situation and goals. A 30-year mortgage offers lower monthly payments, which can be beneficial for cash flow management. However, shorter-term mortgages typically have lower interest rates and result in less total interest paid over the life of the loan. Use our calculator to compare different scenarios and see which aligns best with your financial objectives.

Q5: How does the interest rate affect my mortgage?

A5: The interest rate has a significant impact on your mortgage. A higher rate means more of your payment goes towards interest, increasing the total cost of the loan over time. Even a small difference in interest rate can result in thousands of dollars saved or spent over a 30-year period. Use our calculator to see how different rates affect your payments and total loan cost.

Q6: What’s the difference between interest rate and APR?

A6: The interest rate is the cost of borrowing the principal loan amount. The Annual Percentage Rate (APR) includes the interest rate plus other costs such as broker fees, discount points, and some closing costs. The APR gives you a more comprehensive view of the total cost of the loan.

Q7: How can I use this calculator to decide if I should refinance?

A7: To evaluate refinancing options, input your current loan details into the calculator, then compare the results with a new calculation using the terms of the potential refinance offer. Look at the difference in monthly payments, total interest paid, and loan payoff date to determine if refinancing aligns with your financial goals.

Q8: Does this calculator account for property taxes and insurance?

A8: No, this calculator focuses on the principal and interest portions of your mortgage payment. Property taxes, homeowners insurance, and private mortgage insurance (if applicable) are additional costs that you’ll need to factor into your overall housing budget.

Q9: How accurate are the results from this calculator?

A9: The calculator provides highly accurate results based on the information you input and standard mortgage calculation formulas. However, it’s important to remember that it’s a planning tool and should not be considered a substitute for professional financial advice.

Q10: Can I use this calculator for adjustable-rate mortgages (ARMs)?

A10: This calculator is designed for fixed-rate mortgages. ARMs have interest rates that change over time, which would require a more complex calculation. For the most accurate information on ARMs, consult with a mortgage professional.

By utilizing this 30-year mortgage calculator, you’re taking an important step towards understanding and managing one of the most significant financial commitments you’re likely to make. Whether you’re a first-time homebuyer, considering refinancing, or simply wanting to understand your current mortgage better, this tool provides valuable insights to inform your decisions and optimize your home financing strategy.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.