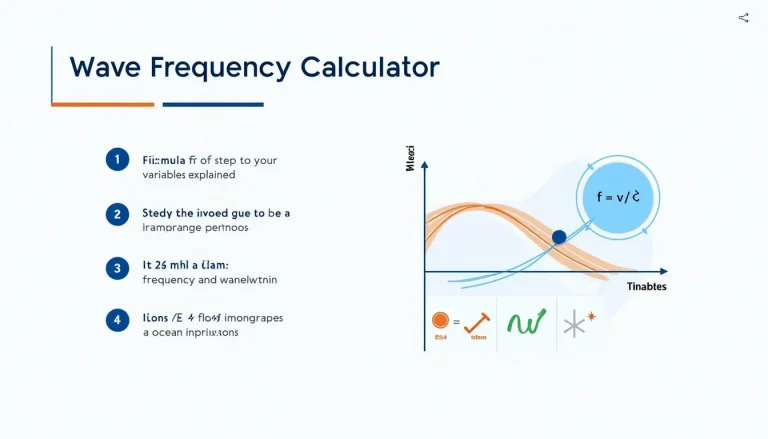

Wave Frequency Calculator: Easily Determine Oscillations per Second

Enter wave speed and wavelength, press “Calculate,” and the tool divides the two to give frequency in Hz. For instance, 340 m/s ÷ 0.68 m = 500 Hz—right in the middle of speech frequencies. Sound travels about 343 m/s at 20 °C (NASA, 2022).