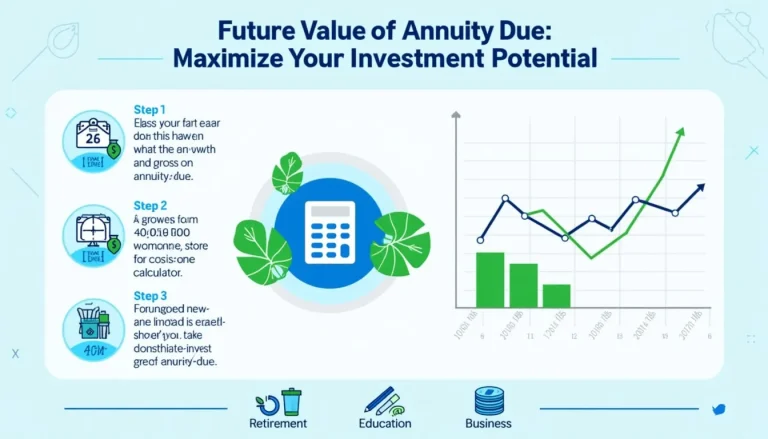

Future Value of Annuity Calculator: Plan Your Financial Growth

Unlock the power of compound interest with our Future Value of Annuity Calculator. Discover how small, regular investments can grow into substantial wealth over time. Whether you're planning for retirement, saving for education, or setting financial goals, this tool empowers you to make informed decisions. Start planning your financial future today!