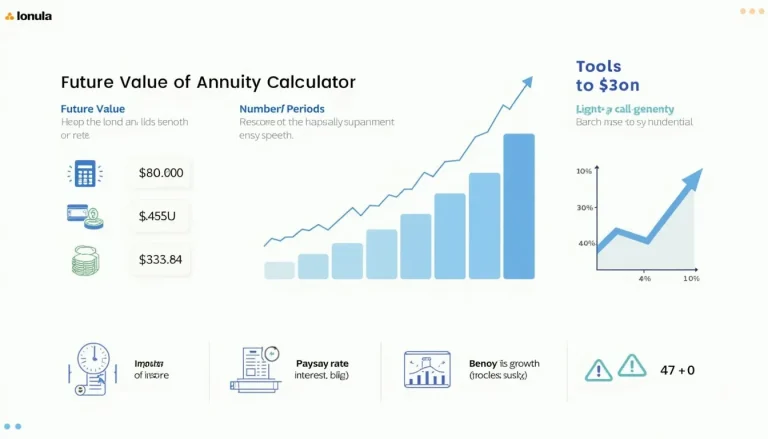

Future Value of Ordinary Annuity Calculator: Plan Your Financial Growth

This JavaScript calculator lets you project the lump sum created when you deposit the same amount at the end of each year and earn compound interest. Enter the yearly payment, a decimal rate, and years; it instantly applies $$FV = PMT times frc{(1+r)^n - 1}{r}$$ to show your future value. A $2,000 annual deposit earning 5 % for 20 years grows to $66,400—over three times the cash you put in (U.S. SEC compound-interest chart, 2023).