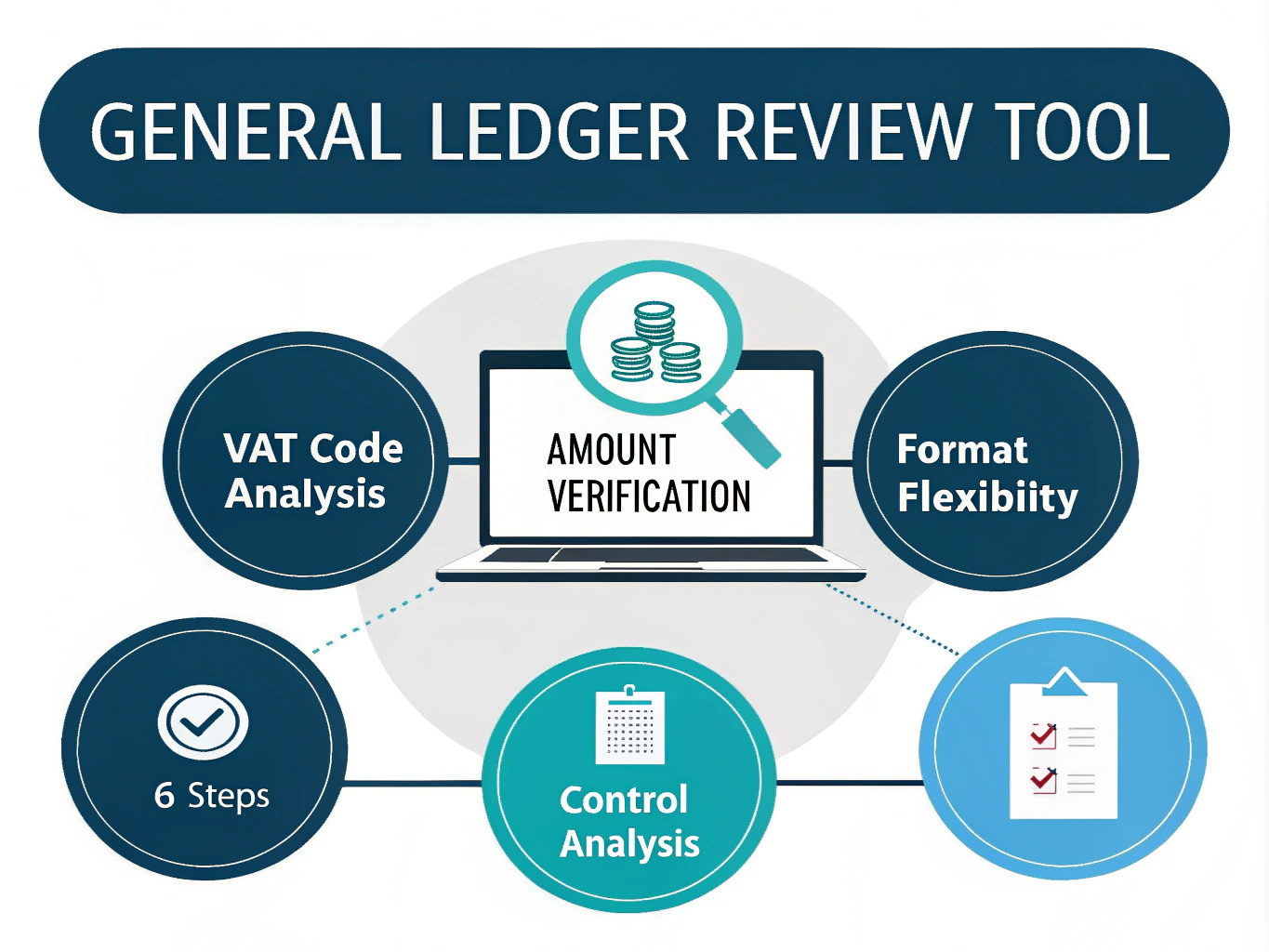

General Ledger Review

Is this tool helpful?

How to Use the General Ledger Review Tool Effectively

1. Select Your General Ledger Format

Choose the format of your general ledger file to start the review process. The tool supports two common formats:

- CSV: Use this if your ledger is exported as a comma-separated values file.

- XML: Select this if your ledger data is in XML format, common in financial reporting systems.

2. Enter Expected VAT Codes (Optional)

Provide a list of VAT codes you expect to find in your ledger. This helps the tool detect any anomalies or unexpected entries. Examples include:

- “VAT15, VAT7, VATExempt” for companies operating in European VAT regions.

- “GST12, GST0, GSTReduced” for businesses based in Canada or New Zealand.

3. Define Normal Transaction Amount Range (Optional)

Specify minimum and maximum transaction amounts considered normal for your business. This guides the tool in highlighting suspicious transactions. Sample ranges could be:

- Minimum: 250.00

- Maximum: 75,000.00

- Minimum: 1,000.00

- Maximum: 150,000.00

4. Submit Your Data for Review

Once you complete the required and optional fields, click the “Review General Ledger” button. The tool processes your input and generates an analysis highlighting VAT code consistency, anomalies in transaction amounts, and entries needing closer attention.

5. Analyze and Use the Results

Review the flagged irregularities such as unexpected VAT codes or transactions that fall outside your specified amounts. This helps you pinpoint inconsistencies, potential errors, or suspicious activities within your general ledger.

6. Copy or Share Your Review Results

If you want to save or share the findings, you can easily copy the analysis for external use, such as reporting, auditing, or internal discussions.

Introduction to the General Ledger Review Tool

Tool Overview

The General Ledger Review Tool helps you review your accounting ledger efficiently by automating checks for VAT code accuracy, transaction amount ranges, and identifying entries that need further review. It saves time and enhances the reliability of your financial data analysis.

Purpose and Key Benefits

- Streamlined Review Process: Automates the examination of VAT codes and transaction amounts to reduce manual effort.

- Improved Data Accuracy: Identifies discrepancies and unusual entries early, minimizing errors.

- Risk Detection: Flags suspicious transactions for fraud prevention and compliance checks.

- Supports Compliance: Assists in meeting tax and accounting standards by verifying VAT code use and transactions.

- Flexible Format Handling: Accepts multiple ledger file types to fit different accounting systems.

Practical Uses of the General Ledger Review Tool

Monthly Financial Close Support

Finance teams can incorporate the tool into their monthly close routine to quickly spot VAT code inconsistencies, unusual transaction amounts, and focus on high-risk entries. This improves the accuracy of month-end reports and VAT returns.

Audit Readiness

During audit preparation, this tool helps auditors and accountants analyze large ledger datasets efficiently. It highlights potential issues, enabling auditors to customize their testing and risk assessments.

Detecting Fraudulent Activity

Business owners and internal auditors use the tool to uncover transactional patterns that could indicate fraud, such as repeated transactions just below approval thresholds or unusual VAT code usage.

Key Features and Advantages

1. VAT Code Consistency Analysis

The tool compares your ledger’s VAT codes against your expected list, quickly identifying mismatched or unexpected codes. This ensures compliance with tax regulations and highlights areas needing correction or training.

2. Transaction Amount Validation

By flagging transactions outside your specified normal amount range, the tool helps identify data entry mistakes, unusually large or small transactions, or transactions warranting further investigation.

3. Prioritized Transaction Review Suggestions

The tool samples transactions that may require closer examination based on risk factors such as amounts near authorization limits, recurring payments, and round-number entries. This focus allows you to allocate review resources effectively.

4. Support for Multiple Ledger Formats

Accepting diverse file formats like Excel and PDF, the tool fits into your existing workflow without needing format conversions, streamlining ledger review regardless of source.

5. Clear, Organized Reporting

The generated report is easy to read and interpret, helping you communicate findings efficiently and keep clear audit trails.

How the Tool Addresses Common General Ledger Challenges

Inconsistent VAT Code Usage

The tool identifies and flags incorrect VAT codes by comparing your ledger data with the list you provide. For example, if your expected codes are “VAT15, VAT7, VATExempt” but the ledger shows “VAT10”, it will highlight the inconsistency for correction.

Detecting Abnormal Transaction Amounts

Transactions outside of your defined normal range, such as an unusually high purchase, are labeled for further review, helping you quickly spot errors or fraudulent activities.

Focusing Review on High-Risk Transactions

The tool samples transactions with specific characteristics—like those just below approval limits or with repeated round amounts—to help you prioritize scrutiny where it matters most.

Handling Multiple Ledger Data Formats

By supporting popular ledger formats, the tool eliminates delays caused by needing to convert files before analysis, letting you focus on reviewing data rather than preparing it.

Frequently Asked Questions (FAQ)

Q1: Can I use this tool for ledgers with multiple currencies?

It works best with a single currency. For multiple currencies, convert amounts into one main currency before uploading to ensure accurate analysis.

Q2: Does the tool handle large datasets spanning several years?

Yes, but reviewing data year by year is recommended. Adjust your normal transaction range as your business changes over time for the best results.

Q3: How does the tool decide which transactions to flag for close examination?

The tool flags transactions based on several factors including amounts near your specified limits, unusual account combinations, recurring identical transactions, round number amounts, and unexpected VAT codes.

Q4: Can I customize the criteria for identifying unusual transactions?

Currently, the tool uses standard criteria based on common accounting and risk factors. Future versions may allow customization to fit specific business needs.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.