Is this tool helpful?

How to Use the Tool Effectively

You can quickly verify the validity of a VAT number and retrieve detailed company information using the VAT Validation Tool. Follow these steps to get accurate results:

Step 1: Enter the VAT Number

Type the VAT number you want to check into the VAT Number input field. This field is optional in design but must be filled to validate a VAT number. Make sure to include the country code prefix. Here are two example inputs different from those in the form:

- Sample Input 1: IT12345678901 (An Italian VAT number)

- Sample Input 2: ESX1234567X (A Spanish VAT number)

Double-check that the VAT number is correctly formatted with no extra spaces or characters.

Step 2: Click “Validate VAT Number”

After entering the VAT number, click the Validate VAT Number button. The tool connects to an online VAT validation API to check the number’s authenticity and gather related company details.

Step 3: Review the Validation Results

Once validated, the tool displays the results, including:

- Valid: Shows whether the VAT number is valid (Yes or No).

- VAT Number: Echoes the VAT number you entered.

- Company Name: Provides the registered name of the company.

- Address: Lists the company’s official address.

- Country Code: Displays the country code related to the VAT number.

If the VAT number is invalid or there is no data, the result fields will display N/A.

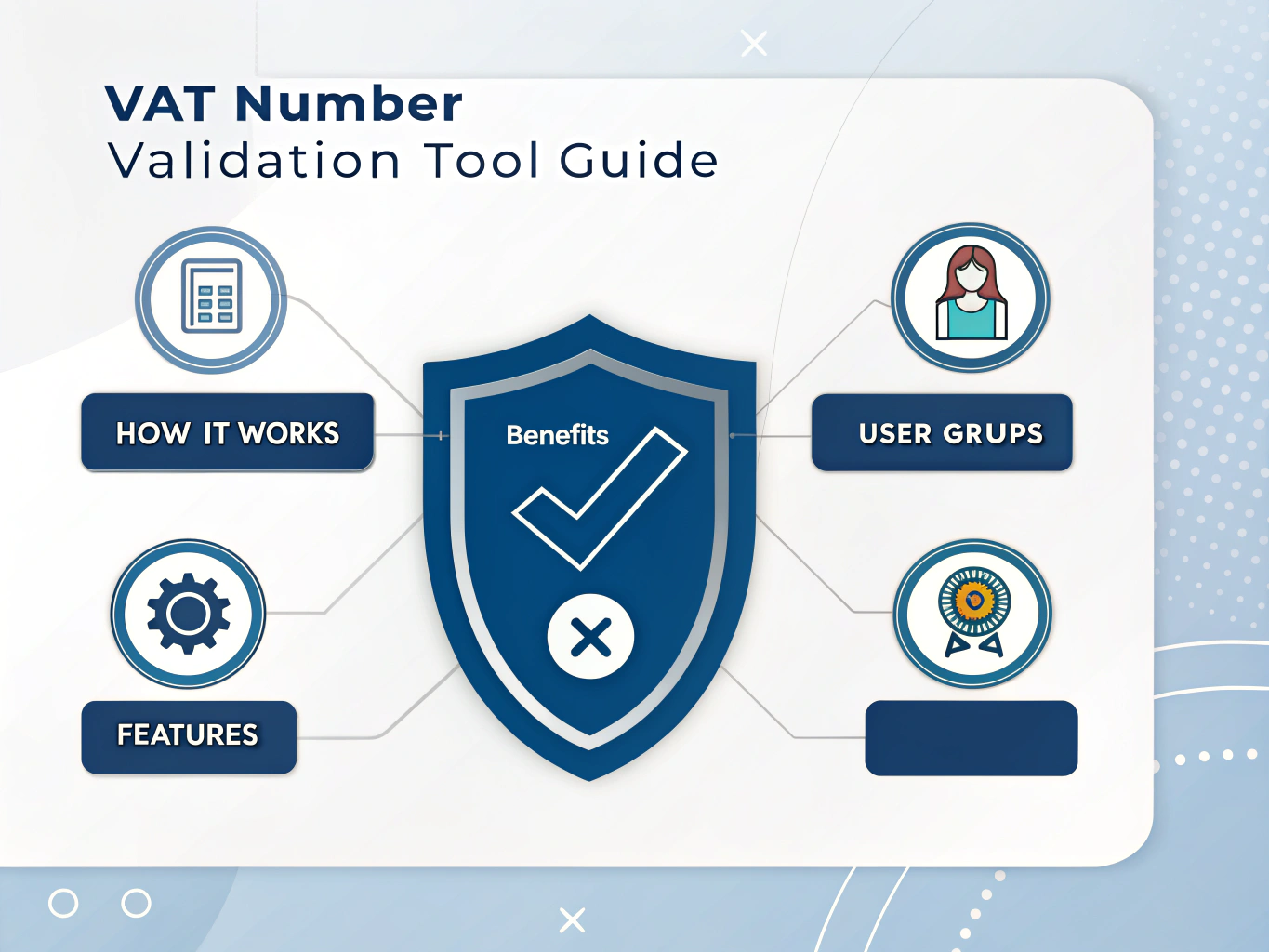

Introducing the VAT Validation Tool: Definition, Purpose, and Benefits

The VAT Validation Tool helps you confirm if a VAT (Value Added Tax) number is authentic and provides essential company details connected to that number. VAT numbers matter for businesses operating within the EU and other regions where VAT applies. This tool ensures your business stays compliant with tax laws and reduces mistakes when handling VAT numbers.

What the Tool Does

- Confirms if a VAT number is genuine and active.

- Retrieves registered company information tied to the VAT number.

- Offers quick, trustworthy validation for easier compliance and record-keeping.

Who Benefits from Using the Tool

This VAT Validation Tool is especially useful for:

- Businesses: For checking VAT numbers on invoices and contracts.

- Accountants: To validate VAT info before preparing tax documents.

- Freelancers: Handling international clients and billing.

- Developers: Adding VAT validation features to apps or websites.

Key Benefits You’ll Get

- Ensures compliance: Avoid fines by verifying VAT numbers accurately.

- Improves accuracy: Reduce errors in tax and financial records.

- Saves time: Validate numbers instantly, no manual checks needed.

- Builds trust: Show clients and partners you verify their VAT details.

- Simplifies record-keeping: Easily keep detailed company VAT info on file.

Practical Uses of the VAT Validation Tool

Here are some real-life scenarios where the VAT Validation Tool saves effort and mitigates risk:

1. Confirming Supplier VAT Numbers

Before paying an invoice, a French retailer verifies the supplier’s VAT number BE0123456789 to ensure the vendor’s legitimacy. The tool confirms the VAT number is valid and shows the supplier’s registered name and address.

2. Validating Client VAT Numbers

A software consultant working with clients across Europe uses the tool to validate client VAT numbers such as SE123456789001 before billing. This step helps keep their tax records correct.

3. Supporting Tax Audits

An accounting firm runs validation checks on all VAT numbers listed in client reports to ensure compliance ahead of a tax inspection. The tool quickly verifies the validity of each number.

Frequently Asked Questions (FAQ)

What is a VAT number?

A VAT number uniquely identifies businesses registered for Value Added Tax. It ensures companies pay the correct VAT and are traceable for tax purposes.

Can I validate VAT numbers from outside the EU?

Yes, the tool supports VAT validation for various countries, including some non-EU regions. Data availability can differ by country.

Is this VAT Validation Tool free to use?

Yes, you can validate VAT numbers without any cost simply by entering the VAT number and submitting.

What should I do if a VAT number is invalid?

Check for typing mistakes or missing characters. If the VAT number still shows as invalid, contact the business or person who provided it for clarification.

Does the tool support bulk VAT number validation?

Currently, the tool validates one VAT number at a time. For bulk checks, integrating the VAT validation API into your system is recommended.

How up-to-date is the VAT data?

The tool fetches data from a regularly updated VAT validation API to maintain accuracy and reliability.

What details are shown in the validation results?

The tool displays the validity status, VAT number, registered company name, address, and country code.

Can the tool validate VAT numbers for individuals?

Yes, it can validate VAT numbers for individuals as long as those numbers are officially registered and active.

Is the VAT Validation Tool available in other languages?

Currently, the interface is in English, but it is straightforward and easy to use for non-English speakers.

How safe is the VAT Validation Tool?

The tool uses secure HTTPS connections to protect your data during the validation process.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.