Future Value of an Ordinary Annuity Calculator

Is this tool helpful?

How to use the tool

- Payment (USD): type your regular deposit, e.g. 1 500 or 3 250.

- Interest rate (decimal): enter the annual rate like 0.045 or 0.08.

- Number of years: choose your saving horizon such as 8 or 30.

- Press Calculate; the result instantly appears below the form.

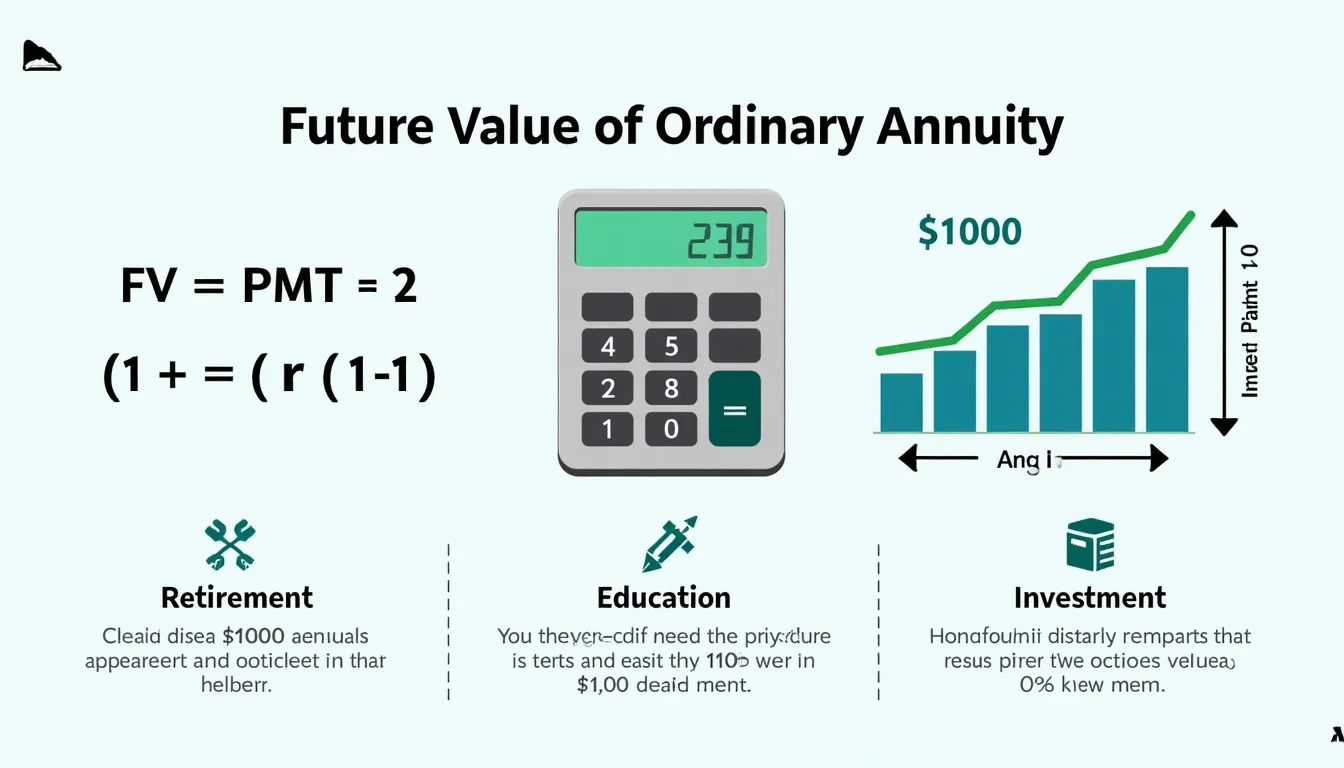

Underlying formula

The calculator applies the ordinary-annuity formula:

$$ FV = PMT \times \frc{(1+r)^n – 1}{r} $$- PMT – equal yearly payment

- r – annual interest rate (decimal)

- n – total payments (years)

Example calculations

Example A — Medium-term goal

Deposit $1 800 each year for 15 years at 6 % (0.06).

$$ FV = 1 800 \times \frc{(1+0.06)^{15}-1}{0.06}=1 800\times28.689= \$51 640 $$Example B — Long-term retirement fund

Deposit $2 000 annually for 20 years at 5 % (0.05).

$$ FV = 2 000 \times \frc{(1+0.05)^{20}-1}{0.05}=2 000\times33.066= \$66 132 $$Quick-Facts

- The formula assumes payments at the end of each period —an ordinary annuity (Corporate Finance Institute, 2023).

- Average S&P 500 annualised return ≈ 10 % since 1926 (J.P. Morgan Guide to the Markets, 2023).

- Experts suggest saving 10 – 15 % of income for retirement (Investopedia, 2024).

- Compound interest “makes your money earn money on the money it earns” (U.S. SEC, Investor.gov).

FAQ

What is an ordinary annuity?

An ordinary annuity pays or receives equal amounts at each period’s end, unlike an annuity-due that pays at the start (CFI, 2023).

Why must the rate be a decimal?

Using a decimal (0.07 instead of 7 %) lets the formula treat the rate as a multiplier directly in calculations.

Can I model monthly deposits?

Yes—divide the annual rate by 12 and multiply years by 12 to convert r and n to monthly periods (SEC, Investor.gov).

Does the calculator include taxes or fees?

No, it shows gross growth; subtract taxes, fund fees, or inflation separately for net projections.

How does interest rate affect growth?

Higher r exponentially increases FV because every payment compounds at the new, larger base (Bodie et al., “Investments” 2021).

What happens if r = 0?

With no interest you simply sum the payments: FV = PMT × n; the tool rejects r ≤ 0 to avoid division by zero.

Is my data stored?

All calculations run locally in your browser; no inputs leave your device.

Who should use this tool?

Savers, investors, students, and planners forecasting retirement, college funds, or any goal funded by steady contributions.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.