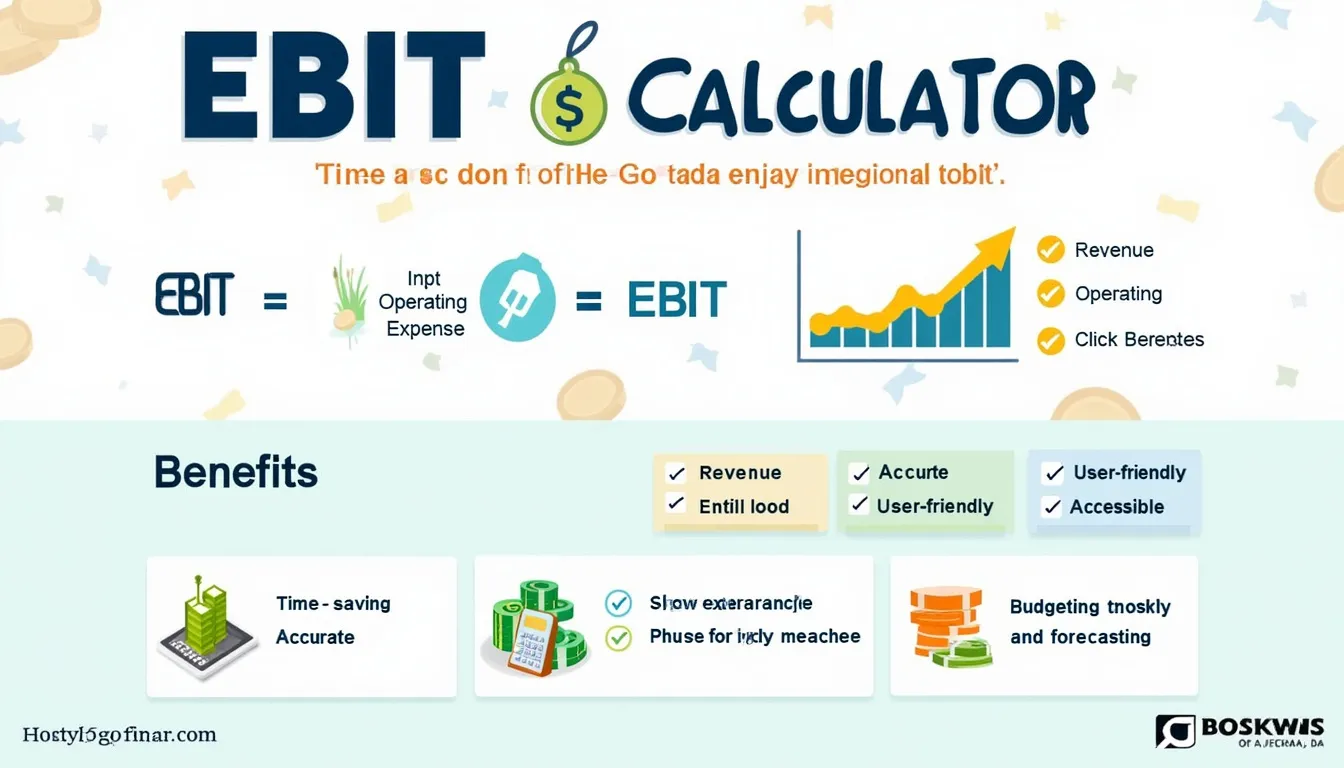

EBIT Calculator

Is this tool helpful?

How to Use the EBIT Calculator Effectively

Our easy-to-use EBIT Calculator helps you quickly determine your company’s Earnings Before Interest and Taxes with accuracy and clarity. Follow these simple steps to make the most of this financial tool:

- Enter Revenue: Provide the total revenue your company earned during the specified period. For example, input values like 150000 or 275000, which represent the income generated from sales and other operational activities.

- Input Operating Expenses: Enter the total operating expenses, covering all costs required to run your business, such as employee salaries, rent, utilities, and marketing. Try values like 90000 or 185000 for accurate calculations.

- Click “Calculate EBIT”: After entering the revenue and expense amounts, simply initiate the calculation by clicking the button to get your EBIT.

- Review Your Result: The calculator instantly shows your Earnings Before Interest and Taxes, clearly formatted with commas for better readability.

Note: Always ensure you’re entering positive numerical values to get valid and meaningful results.

What is EBIT? Definition, Purpose, and Key Benefits

Earnings Before Interest and Taxes, commonly known as EBIT, is a vital measure of a company’s core operational profitability. It excludes interest expenses and income taxes, focusing solely on how well the business performs its everyday activities.

The formula to calculate EBIT is straightforward:

Mathematical formula: $$ EBIT = Revenue – Operating \, Expenses $$

Why EBIT is Important in Financial Analysis

- Core Profitability Insight: EBIT isolates operating earnings, eliminating variables such as taxes and financing, providing a clear view of operating efficiency.

- Comparability: Enables direct comparison between businesses with different tax structures and debt levels.

- Investment Evaluation: Useful for investors and analysts to assess a company’s operational health before financing impacts.

Using our EBIT Calculator allows you to effortlessly and accurately determine this key financial metric, eliminating the need for complex spreadsheets and manual math.

Example Calculations Using the EBIT Calculator

Here are some practical examples demonstrating how the EBIT Calculator works with typical business figures:

Example 1: Small Retail Business

- Revenue: $250,000

- Operating Expenses: $175,000

- Calculated EBIT: $$ 250,000 – 175,000 = 75,000 $$

Example 2: Tech Startup

- Revenue: $1,200,000

- Operating Expenses: $1,100,000

- Calculated EBIT: $$ 1,200,000 – 1,100,000 = 100,000 $$

The calculator processes these numbers instantly, providing clear earnings data to support business decisions.

Benefits of Using Our Online EBIT Calculator

- Save Time: Get your EBIT results immediately without manually performing calculations.

- Accuracy Guaranteed: Eliminate errors common in manual formulas and spreadsheets.

- User-Friendly Interface: Designed for simplicity, accessible even if you have minimal accounting knowledge.

- Access Anytime, Anywhere: Since it’s an online calculator, you can use it on any device with an internet connection.

- Consistent Financial Reporting: Standardize EBIT calculations across teams and reports.

Practical Applications of the EBIT Calculator for Business Success

1. Investment Analysis and Due Diligence

Investors can quickly use EBIT figures to compare companies’ core profitability, filtering out financing noise. This helps to identify which business operates more efficiently regardless of capital structures.

2. Monitoring Business Performance Over Time

By tracking EBIT across monthly or quarterly periods, business owners can assess trends in operational health and identify areas needing improvement.

3. Budgeting, Forecasting, and Scenario Planning

Financial planners can model different revenue growth and expense scenarios to forecast future EBIT, aiding in setting realistic profitability targets.

Frequently Asked Questions About EBIT and the EBIT Calculator

What is the difference between EBIT and net income?

EBIT shows earnings from operations before interest and taxes, while net income represents the final profit after all expenses, including interest and taxes. EBIT focuses purely on operational profitability.

Can EBIT be negative?

Yes, a negative EBIT indicates operating losses where expenses exceed revenue.

How frequently should I calculate EBIT?

Many businesses calculate EBIT quarterly or annually, but more frequent calculations can provide timely insights for decision-making.

Is a higher EBIT always better?

Generally, a higher EBIT signals better operational efficiency, but it’s essential to consider context, like investment in future growth or one-time expenses.

How does EBIT differ from EBITDA?

EBITDA adds back depreciation and amortization to EBIT, offering a view of operational cash flow by excluding non-cash expenses.

Can the EBIT Calculator be used for any business type?

Yes, any business with revenue and operating expenses can use this calculator. However, EBIT’s interpretation may vary by industry and business model.

Conclusion: Empower Your Financial Insights with the EBIT Calculator

Our online EBIT Calculator is a must-have tool that simplifies complex calculations, helping you unlock clear insights into your company’s operational profitability. By using this calculator, you can:

- Quickly assess operational performance with pinpoint accuracy

- Make data-driven decisions that propel business growth

- Compare financial health across different companies or periods with ease

- Enhance your financial literacy and understanding of key metrics

Whether you’re an entrepreneur, investor, or financial analyst, leveraging this powerful tool streamlines your analysis and supports smarter, faster decision-making. Start using the EBIT Calculator now to maximize your business’s profitability and operational success.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.