Customer Acquisition Cost Optimizer

Is this tool helpful?

How to Use the Customer Acquisition Cost Optimizer Effectively

This Customer Acquisition Cost (CAC) Optimizer helps you analyze your marketing efficiency and customer value. To use the tool correctly, fill in each field with accurate data reflecting your business performance. Here’s how:

- Total Sales and Marketing Cost: Enter the complete amount spent on marketing and sales over your chosen period. For example, $40,000 for a six-month campaign or $75,000 for yearly expenses.

- Number of Customers Acquired: Input how many new customers you gained during the period. For instance, 250 customers in half a year or 900 customers annually.

- Average Purchase Value: Specify how much a typical customer spends per transaction. This could be $120 for a retail store or $350 for a subscription service.

- Average Purchase Frequency (per year): Enter the average number of purchases made by a customer each year, such as 6 times for a monthly buyer or 10 times for frequent shoppers.

- Average Customer Lifespan (in years): Indicate how long customers typically stay active. For example, 4 years for a membership business or 7 years for a durable goods retailer.

- Click Calculate: Once you enter all values, hit the “Calculate” button to see your CAC, Lifetime Value (LTV), and LTV to CAC ratio.

- Review Results: Analyze the displayed results to understand your marketing efficiency and customer value.

- Consider Suggestions: The tool offers tailored recommendations based on your ratio to help enhance your customer acquisition strategy.

Understanding the Customer Acquisition Cost Optimizer: Definition, Purpose, and Benefits

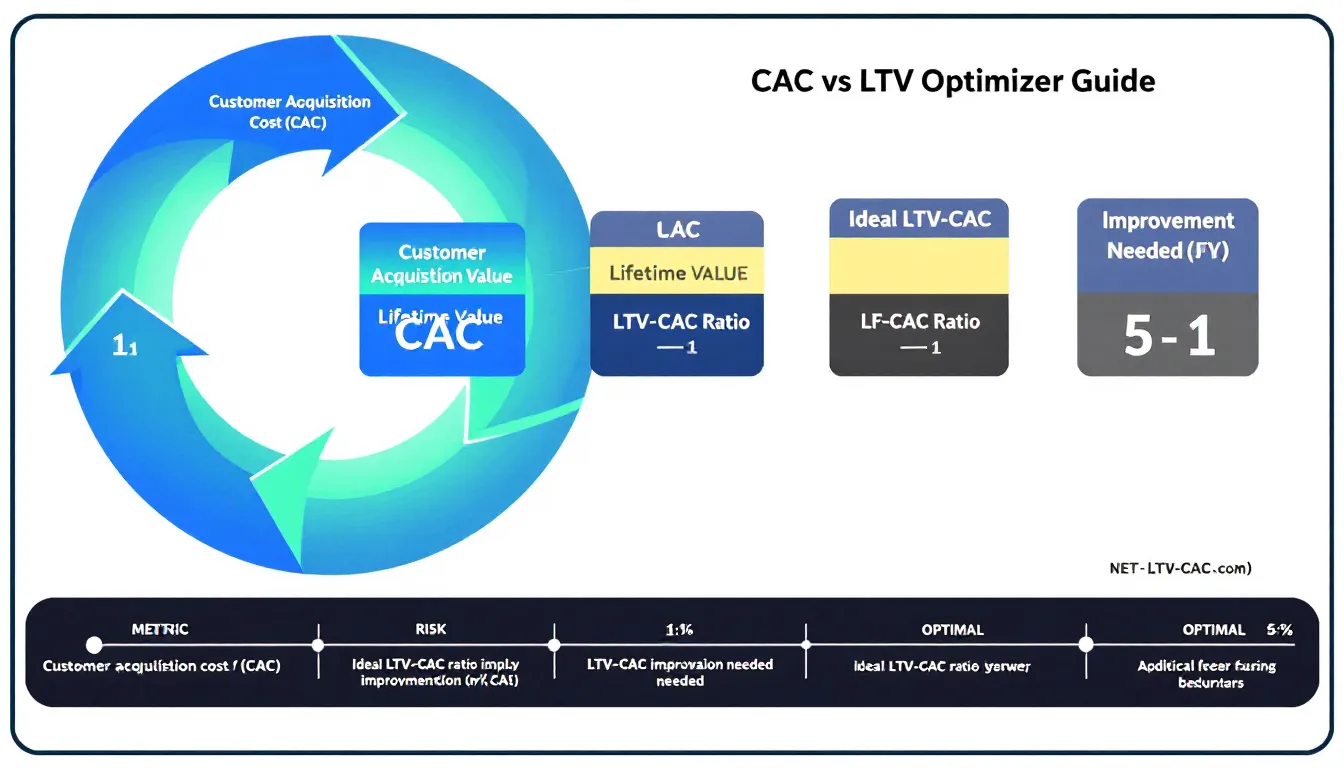

The Customer Acquisition Cost Optimizer is a practical calculator that helps you measure how much it costs to acquire a new customer and compare that to the revenue a customer generates over their lifetime. By analyzing both Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV), you gain insight into the effectiveness and profitability of your marketing strategies.

This calculator not only provides the key metrics but also delivers actionable suggestions tailored to your business’s current performance. By understanding your CAC and LTV clearly, you can make smarter decisions about how to allocate resources, optimize marketing spend, and improve customer retention.

Key Benefits of Using the Customer Acquisition Cost Optimizer

- Improves marketing efficiency: Understand your spending relative to customer gains.

- Supports data-driven decisions: Base your strategies on accurate, tailored metrics.

- Highlights long-term value: Focus on customers who generate lasting revenue.

- Offers clear actionable advice: Follow specific suggestions to boost your ratio.

- Saves time: Automates calculations, eliminating guesswork and manual errors.

How CAC and LTV Shape Your Business Growth

Customer Acquisition Cost (CAC) measures how much you spend to acquire a single customer. Keeping this cost low while maintaining quality leads is essential for sustainable growth.

Customer Lifetime Value (LTV) estimates the total revenue you earn from a customer over their entire relationship with your business.

Comparing LTV to CAC reveals whether your acquisition efforts are profitable. A strong ratio indicates you are generating more revenue per customer than what you spend to acquire them.

Core Formulas Used:

$$LTV = \text{Average Purchase Value} \times \text{Average Purchase Frequency} \times \text{Average Customer Lifespan}$$

$$\text{LTV:CAC Ratio} = \frac{LTV}{CAC}$$

Example Calculations Using the CAC Optimizer

Example 1: Retail Chain Marketing Review

- Total Sales and Marketing Cost: $60,000

- Number of Customers Acquired: 1,200

- Average Purchase Value: $90

- Average Purchase Frequency: 5 purchases per year

- Average Customer Lifespan: 3 years

Calculations:

$$LTV = 90 \times 5 \times 3 = 1350$$

$$LTV:CAC = \frac{1350}{50} = 27:1$$

This high LTV:CAC ratio means the retailer has a very efficient customer acquisition strategy and can consider increasing marketing investments to grow faster.

Example 2: Subscription Service Evaluation

- Total Sales and Marketing Cost: $120,000

- Number of Customers Acquired: 400

- Average Purchase Value: $250

- Average Purchase Frequency: 8 times per year

- Average Customer Lifespan: 2 years

Calculations:

$$LTV = 250 \times 8 \times 2 = 4000$$

$$LTV:CAC = \frac{4000}{300} = 13.33:1$$

A strong ratio like this indicates profitability but suggests keeping an eye on acquisition costs to maintain growth sustainably.

Practical Applications and Use Cases

Marketing Budget Optimization

Use the optimizer to evaluate how effectively your marketing spend translates to new customers. A high CAC to LTV ratio signals that you may be overspending or targeting the wrong audience. Adjust campaigns accordingly.

Comparing Customer Acquisition Channels

Input data from different marketing channels separately to calculate the CAC per channel. This helps identify which platforms and strategies yield the best return on investment.

Enhancing Customer Retention

Tracking average purchase frequency and customer lifespan highlights the importance of customer retention. Focus on loyalty programs and customer service to increase these metrics and improve overall LTV.

Scaling Growth with Data

Once you understand your CAC and LTV, you can confidently scale marketing efforts where the ratio is strong and adjust in areas needing improvement. The optimizer’s suggestions help guide your next steps.

Frequently Asked Questions (FAQ)

Q1: How often should I use the Customer Acquisition Cost Optimizer?

Use the tool at least quarterly to monitor changes in your CAC and LTV. Check it more often during or after major marketing campaigns or strategy changes to assess impact.

Q2: Is this optimizer suitable for B2B and B2C businesses?

Yes, the tool works well for both B2B and B2C models. The concepts of CAC and LTV apply widely, though specific values and patterns may differ.

Q3: What is a healthy LTV to CAC ratio?

A ratio of 3:1 is the standard benchmark for sustainable growth. Ratios above this indicate better profitability. Extremely high ratios may suggest the need to invest more in marketing for growth.

Q4: What are effective ways to reduce my CAC?

- Improve your marketing funnel to raise conversion rates.

- Focus on channels that bring qualified leads at a lower cost.

- Enhance targeting to attract customers more likely to purchase.

- Use referral programs to gain customers through word-of-mouth.

- Refine your product or service value to simplify sales.

Q5: How can I increase Customer Lifetime Value (LTV)?

Boost LTV by encouraging repeat purchases and extending customer relationships. Strategies include loyalty programs, personalized offers, improving customer experience, and upselling or cross-selling related products or services.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.