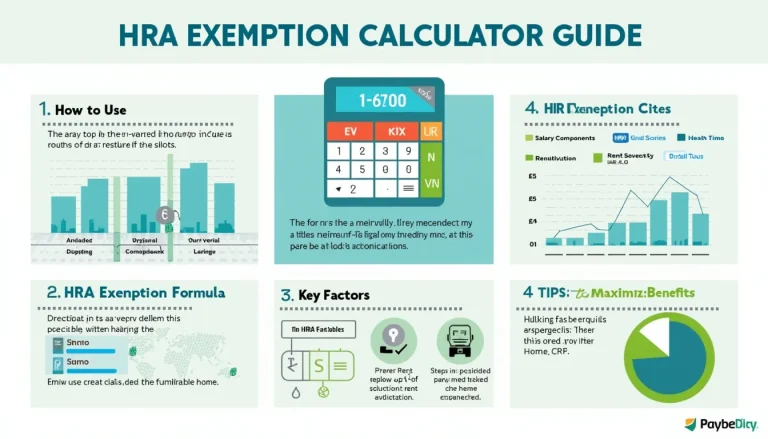

HRA Exemption Calculator: Maximize Your Tax Savings on House Rent Allowance

Use the calculator by entering your basic pay, DA, commission, actual HRA, rent, and city; it instantly shows the exempt and taxable portions of HRA. The least of (a) actual HRA, (b) excess of rent over 10 % of salary, and (c) 40 % (non-metro) or 50 % (metro) of salary is exempt—HRA can therefore shield up to half of your annual pay in the four metro cities (Income Tax Rules, 1962).