Receivables Turnover Ratio Calculator: Measure Your Credit Collection Efficiency

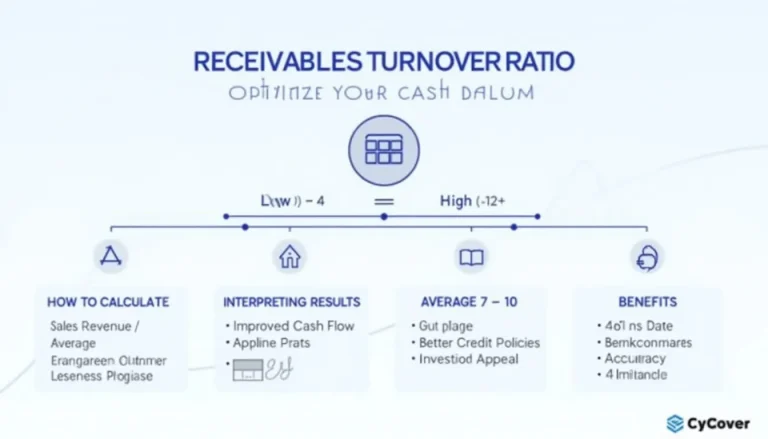

Enter your net credit sales and average accounts receivable, press “Calculate,” and the tool instantly tells you how many times you convert receivables into cash. U.S. midsize companies average 7.6 turns per year (Hackett Group Working-Capital Survey 2023).