Investment Analysis and Notification Setup

Is this tool helpful?

How to Use the Comprehensive Asset Performance Monitor (CAPM) Tool Effectively

1. Enter Stock Categories or Sectors

Start by specifying the stock categories or sectors you want the CAPM tool to analyze. This lets you focus on market areas important to you.

Sample inputs:

- Fintech, Cloud Computing, Consumer Electronics

- Utilities, Industrial Manufacturing, Biotechnology

2. Specify Digital Assets for Evaluation

Next, list types of digital assets you want to include in your analysis. This can include a variety of emerging digital investments beyond traditional stocks.

Sample inputs:

- Virtual Fashion, Blockchain Domain Names, DeFi Liquidity Pool Tokens

- Crypto Art, Decentralized Autonomous Organization (DAO) Tokens, Tokenized Commodities

3. Choose Cryptocurrencies for Monitoring

Enter specific cryptocurrencies you wish to analyze. This helps you track performance and trends for coins relevant to your portfolio.

Sample inputs:

- Stellar Lumens, Tezos, VeChain

- Binance Coin, Wrapped Bitcoin, Terra

4. Define Notification Criteria (Optional)

Set the conditions for when you want to receive alerts about your assets. This customizable feature lets you monitor market movements without constant manual checking.

Sample inputs:

- Price rises of 7% or more in 48 hours, Volume spikes exceeding 150% of weekly average, Major product launch announcements

- Market capitalization changes exceeding 25%, Regulatory updates, Moving average crossovers (e.g., 20-day crossing 50-day)

5. Specify Analysis Period (Optional)

Choose the time span for historical market analysis to tailor insights to your investment strategy.

Sample inputs:

- 6 months, 4 years, 12 quarters

- Since 2019 market peak, Previous bear market cycle, Last 5 calendar years

6. Submit Your Data and Review Results

After entering your desired fields, click the analyze button. The CAPM tool will generate a detailed analysis of the selected stocks, digital assets, and cryptocurrencies. It also provides instructions for setting up notifications based on your criteria.

Review the results carefully to gain actionable insights and configure alerts that fit your investment approach.

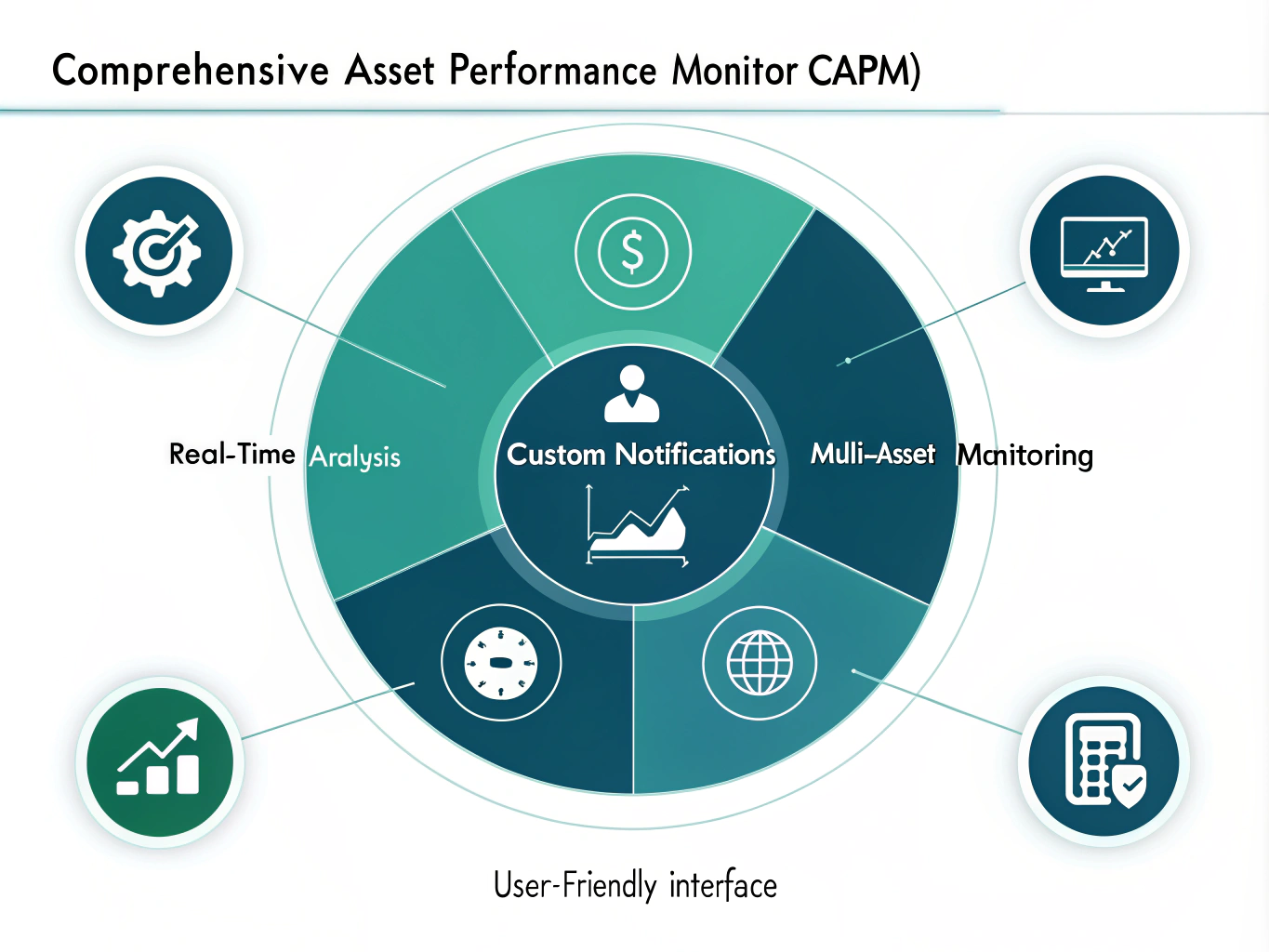

Introducing the Comprehensive Asset Performance Monitor (CAPM) Tool

The Comprehensive Asset Performance Monitor (CAPM) tool helps you analyze stocks, digital assets, and cryptocurrencies while setting up automated notifications for important market events. It offers a unified platform that simplifies tracking diverse asset classes.

Purpose and Key Benefits

- Integrated Asset Analysis: CAPM combines data from stocks, digital assets, and cryptocurrencies to give you a complete market view.

- Customizable Alerts: Set notification rules so you get updates only on the changes that matter most to your portfolio.

- Insightful Data: Analyze past performance, market volatility, and trends to make informed investment decisions.

- Risk Awareness: Identify potential risks across your holdings to manage portfolio balance effectively.

- Time Savings: Automate market monitoring and alerting to focus your attention on actionable opportunities.

Practical Usage of the CAPM Tool for Investors and Traders

You enter targeted criteria across several asset classes, and the tool processes your inputs to deliver a consolidated analysis. This helps you stay informed about market dynamics without switching between platforms.

Example Use Cases:

- You track emerging technology sectors like “Green Hydrogen” and want alerts when stocks in this category surge or drop sharply.

- You hold digital assets such as “Metaverse Avatars” and want to monitor volume spikes and news related to these assets.

- You watch cryptocurrencies like “Avalanche” and “Fantom” for volatility and set notifications for price changes exceeding 8% within a day.

Cross-Asset Correlation Insights

The CAPM tool highlights relationships between different investment types, allowing you to understand how they move together or independently.

For example, correlations between assets might look like this:

$$ \begin{aligned} Correlation_{GreenTech,AVAX} &= 0.68 \\ Correlation_{GreenTech,MetaAvatars} &= 0.32 \\ Correlation_{AVAX,MetaAvatars} &= 0.21 \end{aligned} $$

Here, a value close to 1 indicates strong positive correlation, 0 means no correlation, and -1 shows a strong negative correlation. Understanding these relationships helps balance your portfolio risk and identify unique opportunities.

Real-Time Market Monitoring Through Notifications

Set notification thresholds so the tool alerts you immediately when important changes occur. This feature reduces time spent monitoring the markets and ensures you react promptly to shifts that affect your investments.

Examples of notification triggers include:

- Price movements greater than 10% within 24 hours

- Trading volume surges beyond 250% of average

- Breaking news affecting specific stocks or cryptocurrencies

Historical Context for Smarter Decisions

CAPM lets you examine historical performance over specific periods, adding valuable perspective to current market conditions.

Sample analysis periods might include past 6 months or since significant market events. Using this data, you can identify patterns, gauge volatility, and align your investment strategy accordingly.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.