Trust Fund Distribution Planner

Is this tool helpful?

How to Use the Trust Fund Distribution Planner Effectively

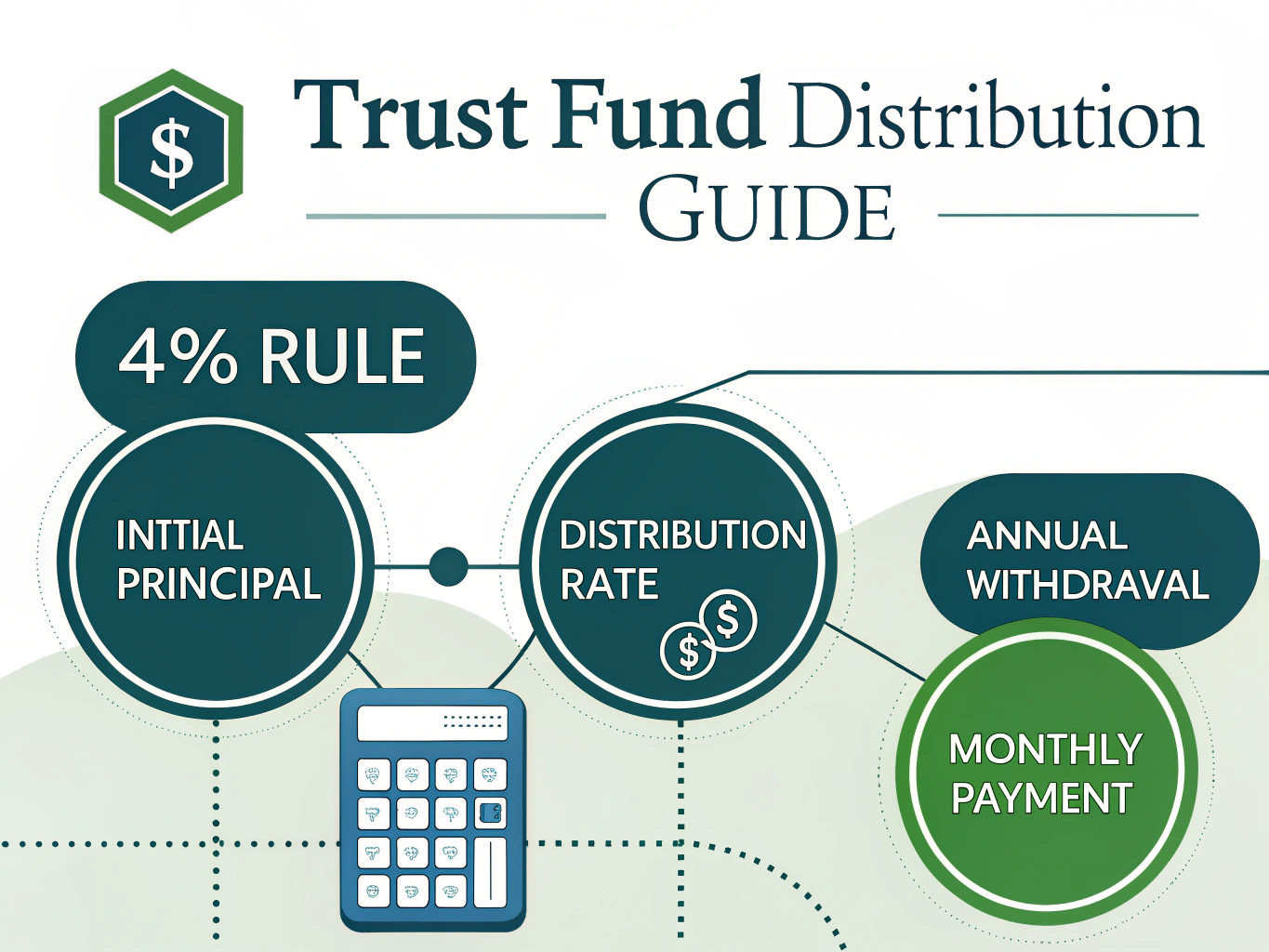

This calculator lets you estimate sustainable annual and monthly distributions from your trust fund based on the principal amount and your chosen withdrawal rate.

- Initial Principal Amount: Enter the total trust fund value you’re working with. For example, use 1,200,000 or 950,000 as sample inputs to reflect different trust sizes.

- Annual Distribution Rate: Input the yearly percentage you plan to withdraw. This is preset at 4%, but you can try other rates like 3.5% or 5% depending on your financial goals.

Once you enter these values, click the button to calculate your distribution amounts. The results will show both your annual distribution and the corresponding monthly payout.

Introduction to the Trust Fund Distribution Planner

The Trust Fund Distribution Planner helps you determine a sustainable way to distribute income from a trust fund while preserving the original principal. This financial tool targets trustees, beneficiaries, and advisors who want to balance current income needs with the fund’s long-term health.

By entering your trust’s principal and your desired withdrawal rate, you get clear figures to guide annual payments and plan future finances responsibly. This approach helps avoid depleting the trust too quickly and supports steady income transfers across years or generations.

Using this planner improves your trust fund management by providing practical and accurate distribution estimates based on widely accepted principles in wealth preservation.

Example Calculations Using the Trust Fund Distribution Planner

Let’s review how the calculator works with real examples to demonstrate trust fund distribution planning.

Example 1: Small Business Owner’s Trust

- Principal Amount: $1,200,000

- Annual Distribution Rate: 3.5%

- Calculation:

$$ \text{Annual Distribution} = 1{,}200{,}000 \times 0.035 = 42{,}000 $$

Outcome: The annual distribution is $42,000, which breaks down to $3,500 monthly payments.

Example 2: Charitable Trust Fund

- Principal Amount: $950,000

- Annual Distribution Rate: 5%

- Calculation:

$$ \text{Annual Distribution} = 950{,}000 \times 0.05 = 47{,}500 $$

Outcome: The trust can distribute $47,500 per year, or approximately $3,958.33 per month.

Understanding Trust Fund Distribution and the 4% Safe Withdrawal Rule

At the core of trust fund distribution planning is the principle of withdrawing an amount that sustains the trust over time. The formula is straightforward:

$$ \text{Annual Distribution} = \text{Principal} \times \text{Distribution Rate} $$

The standard 4% withdrawal rate, known as the “4% Rule,” is a result of extensive research on maintaining principal balance while generating income. This rate balances:

- Consistent annual income generation

- Protection against inflation’s erosion

- Preserving the trust’s value for future beneficiaries

- Long-term purchasing power across changing economic conditions

Benefits of Using the Trust Fund Distribution Planner for Sustainable Wealth Management

1. Strategic and Informed Financial Planning

- Defines clear withdrawal limits that protect your trust principal

- Supports long-term budgeting and spending decisions

- Helps quantify available income for beneficiaries yearly

2. Effective Risk Management

- Prevents overspending that could exhaust funds early

- Encourages balanced withdrawals aligning with market realities

- Maintains trust fund endurance to serve future generations

3. Clear Communication and Transparency

- Clarifies distribution plans for trustees and beneficiaries

- Facilitates informed discussions with financial advisors

- Establishes trust in decision-making processes

Strategic Guidelines for Implementing Trust Fund Distributions

Distribution Timetable Options

- Annual: Single yearly payout (e.g., $42,000 once per year)

- Semi-Annual: Divided into two payments (e.g., $21,000 every six months)

- Quarterly: Four equal distributions (e.g., $10,500 per quarter)

- Monthly: Smaller monthly amounts (e.g., $3,500 per month)

Key Considerations for Long-Term Planning

- Adjust distributions based on market performance and economic changes

- Monitor inflation to preserve purchasing power

- Manage tax implications with professional guidance

- Integrate with overall estate and trust management strategies

Frequently Asked Questions About Trust Fund Distribution Planning

Why is 4% a considered safe withdrawal rate?

The 4% rule comes from studies showing this rate typically preserves the principal while providing sustainable income over decades, even during market fluctuations.

Can I modify the distribution rate for my trust?

Yes, you can set the withdrawal rate to match specific trust needs, financial goals, or changing market conditions. The planner supports rates from just above zero up to 100%.

How often should I review distribution amounts?

Review your distribution strategy yearly or after major life or economic changes to ensure the trust’s sustainability and beneficiary needs are properly addressed.

Does the planner automatically adjust for inflation?

No, inflation adjustments require manual review. Periodically reassess and adjust withdrawal rates to maintain purchasing power over time.

Is this tool suitable for different types of trusts?

Yes, this calculator works well with family trusts, educational funds, charitable trusts, and generation-skipping trusts by providing clear distribution estimates tailored to your trust’s principal and withdrawal rate.

Best Practices for Managing Trust Fund Distributions

Maintain a Regular Review Schedule

- Assess investment performance annually

- Monitor distributions quarterly

- Evaluate beneficiary circumstances regularly

Keep Detailed Documentation

- Record all distribution calculations

- Document changes to withdrawal rates

- Maintain clear beneficiary communication logs

Collaborate with Professionals for Optimal Trust Management

While this tool provides basic distribution calculations, working with experts enhances trust fund sustainability. Professionals to engage include:

- Financial advisors with trust management experience

- Tax consultants knowledgeable about trust taxation

- Estate planning attorneys for legal compliance

- Trust administrators managing day-to-day trust operations

Additional Considerations for Trust Fund Distributions

- Understand and comply with state-specific trust laws

- Use tax-efficient withdrawal and investment strategies

- Diversify the trust’s investment portfolio to balance risk

- Establish clear communication protocols with beneficiaries

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.