Stock Options Course Generator

Is this tool helpful?

How to Use the Stock Options Course Outline Generator Effectively

Follow these steps to create a tailored stock options course outline that fits your teaching goals and audience skill level:

-

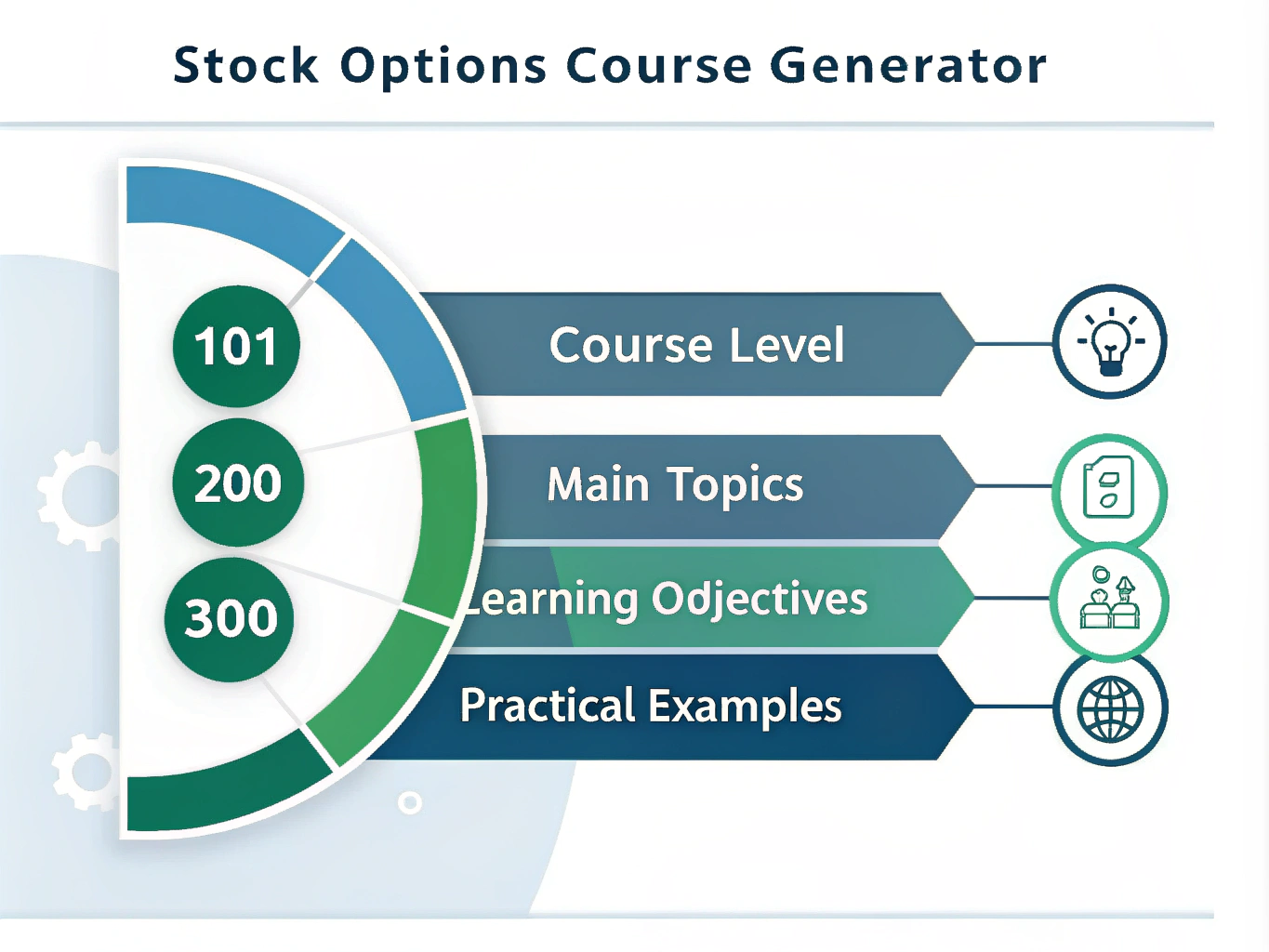

Choose the Course Level: Select the difficulty of your course from options like:

- 101 – Basics and foundational concepts

- 200 – Intermediate strategies and applications

- 300 – Advanced techniques and market analysis

Example inputs: “101” for beginners, or “300” for highly experienced traders.

-

List the Main Topics: Enter specific topics you want the course to cover, separated by commas. This guides the outline’s content focus.

For example, you might enter:

“Stock Option Basics, Time Decay Strategies, Dividend Impact on Options”

or

“Volatility Trading, Calendar Spreads, Synthetic Positions” -

Add Practical Examples: Include real-world cases or scenarios that illustrate key concepts. This is optional but improves course relevance.

Sample inputs:

“Example of protective collars during earnings season”

or

“Case study on managing risk with straddles in volatile markets” -

Define Learning Objectives: Clearly state what participants will learn and accomplish by the end of the course. Objectives should be concise and measurable.

Try phrases like:

“Master interpreting option Greeks, Apply butterfly spreads for income”

or

“Understand volatility skew, Develop hedging strategies for portfolio protection” -

Specify Platform-Specific Details: If your course targets a particular trading platform, include its name here to tailor content appropriately.

For instance:

“Thinkorswim platform’s strategy roller”

or

“Interactive Brokers’ options analytics tools” - Generate Your Outline: After completing the form, submit it to receive a customized course outline that structures your material logically and comprehensively.

About the Stock Options Course Outline Generator

What This Tool Is

The Stock Options Course Outline Generator helps educators, trainers, and finance professionals quickly create well-organized course outlines for stock options education. It streamlines curriculum development by allowing you to specify course levels, topics, objectives, and practical examples—all tailored to your teaching needs.

Why Use This Generator

- Save Planning Time: Build comprehensive course outlines in minutes instead of hours.

- Ensure Consistency: Maintain a logical flow and comprehensive coverage across all course levels.

- Customize Easily: Adapt focus areas and examples to match your audience and teaching style.

- Enhance Practical Learning: Include relevant examples and platform-specific content for applied understanding.

- Support Professional Growth: Refine your course design skills through structured outline generation.

Practical Use Cases for the Outline Generator

Academic Course Development

Professors and academic institutions can create semester-long curriculum plans, ensuring each course builds upon previous knowledge and covers essential topics thoroughly. For example, outlines can range from “Introduction to Options 101” to “Advanced Options Hedging 300.”

Professional Trading Workshops

Trainers and trading educators can design focused workshops such as “Options Income Strategies” or “Volatility and Greeks Masterclass,” featuring practical case studies and tailored learning objectives for maximum participant engagement.

Corporate Employee Training

Investment firms and hedge funds can use this tool to standardize training programs for new hires or continuing education, aligning courses with proprietary risk management frameworks and market scenarios relevant to their trading desks.

Self-Study and Group Learning Plans

Individual traders and study groups can create structured, multi-week learning schedules or deep dives into specific strategies to improve their skills systematically, using generated outlines as a roadmap for focused progress.

Sample Practical Application: Applying the Black-Scholes Model

The generator allows you to include practical examples illustrating core concepts. For instance, a course module might cover pricing European call options using the Black-Scholes equation:

$$ C = S_0 N(d_1) – K e^{-rT} N(d_2) $$Where:

$$ d_1 = \frac{\ln\left(\frac{S_0}{K}\right) + \left(r + \frac{\sigma^2}{2}\right) T}{\sigma \sqrt{T}}, \quad d_2 = d_1 – \sigma \sqrt{T} $$Here, C is the call option price, S₀ is the current stock price, K the strike price, r the risk-free rate, T the time to expiration, σ the volatility, and N(·) the cumulative distribution function of the standard normal distribution. Practical examples like this enhance understanding by linking theory to real-world markets.

Frequently Asked Questions About the Course Outline Generator

Can I customize the generated course outline?

Yes, you can edit, rearrange, and expand the outline to fit your teaching style and course duration.

How detailed are the outlines?

The outlines provide a structured framework with key topics and practical suggestions. You may want to add depth depending on your course’s length and focus.

Is it possible to create multi-level course series?

Absolutely. Generate separate outlines for beginner, intermediate, and advanced levels to build a progressive curriculum.

Can I include platform-specific training?

Yes, specify the platform to tailor content, such as features unique to trading apps like Thinkorswim or Interactive Brokers.

How do I keep the course content current?

Regularly update your outline before each course session to incorporate new strategies and market conditions.

Does the generator cover advanced options topics?

Yes, by specifying focused topics and objectives, you can generate outlines on complex subjects such as volatility skew analysis or options on futures.

Is this tool suitable for online courses?

Yes, use generated outlines as a blueprint for developing video lectures, interactive content, or self-paced modules.

Why Use This Stock Options Course Outline Tool?

Generating a customized, comprehensive course outline removes the guesswork and speeds up curriculum design. You gain a clear path from foundational concepts to complex trading strategies, enhanced by practical examples and platform-specific details. This leads to more effective teaching and improved learner engagement in the fast-evolving field of stock options trading.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.