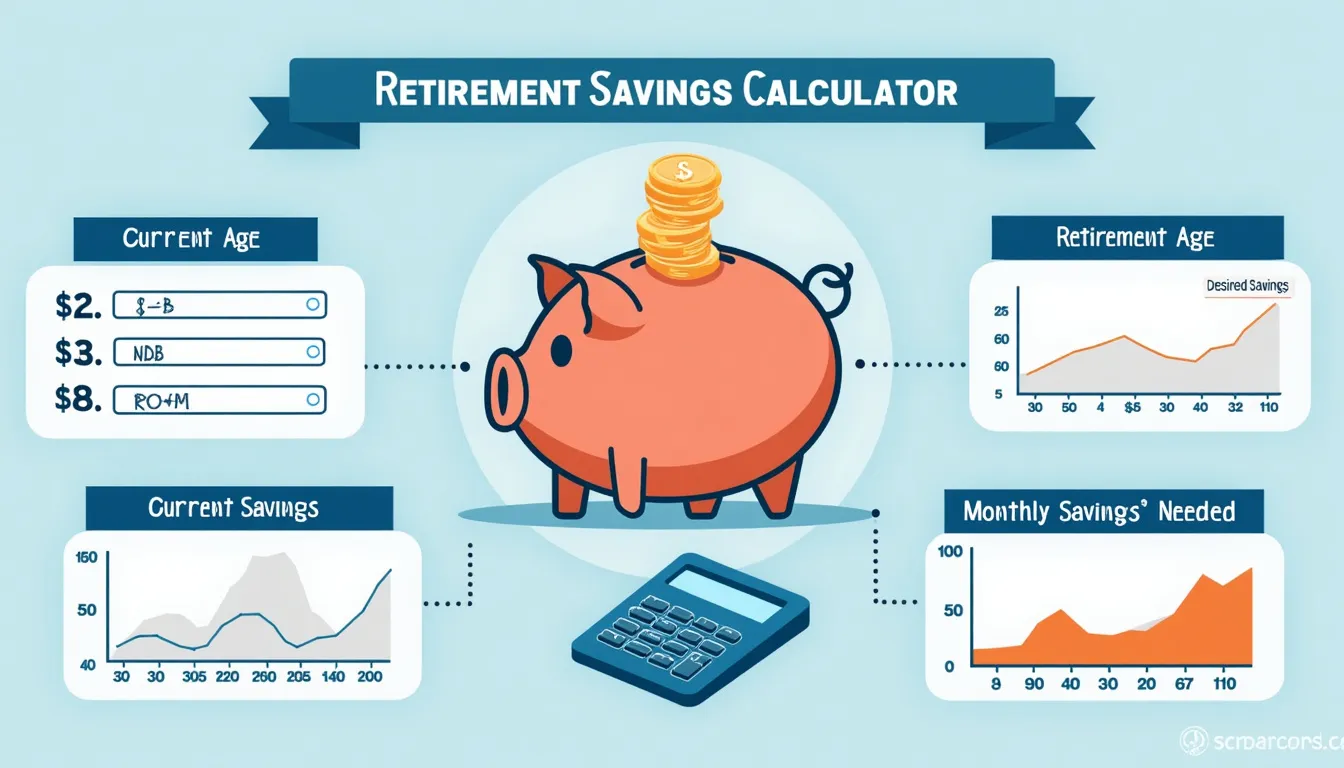

Retirement Savings Calculator

Is this tool helpful?

How to use the tool

- Current Age – type your age, e.g., 32 or 54.

- Retirement Age – choose when you want to stop working, e.g., 60 or 70.

- Current Savings (USD) – enter what you have already saved, such as $12,500 or $85,000.

- Desired Retirement Savings (USD) – set your goal, for instance $950,000 or $1,500,000.

- Annual Rate of Return % – provide an expected yearly return like 6.0 or 7.2; leave blank for the 5 % default.

- Press “Calculate” to see the fixed monthly amount you must invest.

Formula used

The calculator applies compound interest with monthly compounding:

$$ M = rac{R – P(1 + r)^n}{\frac{(1 + r)^n – 1}{r}} $$

- M – required monthly saving.

- R – target retirement fund.

- P – current savings.

- r – monthly return rac(annual return, 12).

- n – months until retirement.

Example calculations

Example A

- Current age 35

- Retirement age 65

- Current savings $40,000

- Goal $900,000

- Annual return 6 %

Result: you need to invest $688 per month.

Example B

- Current age 50

- Retirement age 70

- Current savings $150,000

- Goal $1,000,000

- Annual return 5.5 %

Result: you need to invest $1,315 per month.

Quick-Facts

- U.S. life expectancy is 79.1 years (CDC, 2022).

- The average employer 401(k) match equals 4.6 % of pay (Fidelity, 2023).

- IRS 2024 employee 401(k) limit: $23,000 (IRS, 2023).

- Historic S&P 500 annualized return ≈ 10 % (Damodaran, 2024).

- “Start saving, keep saving, and stick to your goals” (DOL, 2023).

FAQ

What formula powers the calculator?

The tool uses the future-value annuity formula shown above, assuming monthly compounding and level contributions.

Is the default 5 % return realistic?

A 5 % net return is conservative; the S&P 500 averaged ~10 % before inflation (Damodaran, 2024). Adjust the field to match your portfolio’s risk.

What if I begin saving at 40?

Starting ten years later roughly doubles the required monthly saving for the same goal because compounding time halves (DOL, 2023).

How do employer matches factor in?

Add the percentage your employer contributes; a 4.6 % average match reduces your own burden (Fidelity, 2023).

Should I inflate my goal?

Yes. Multiply the desired sum by (1 + inflation rate)^(years to retirement) to preserve purchasing power (BLS, 2023).

How often must I revisit the plan?

Review annually or after big life events to adjust for salary changes, market shifts, and updated goals (Vanguard, 2023).

What if markets underperform?

Lower returns increase M. Re-run the calculator with a smaller rate—say 3 %—to see the new required contribution.

Are contributions capped?

Yes. For 2024, employee 401(k) deferrals cannot exceed $23,000; workers 50+ may add a $7,500 catch-up (IRS, 2023).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.