Present Value of Stock Calculator

Is this tool helpful?

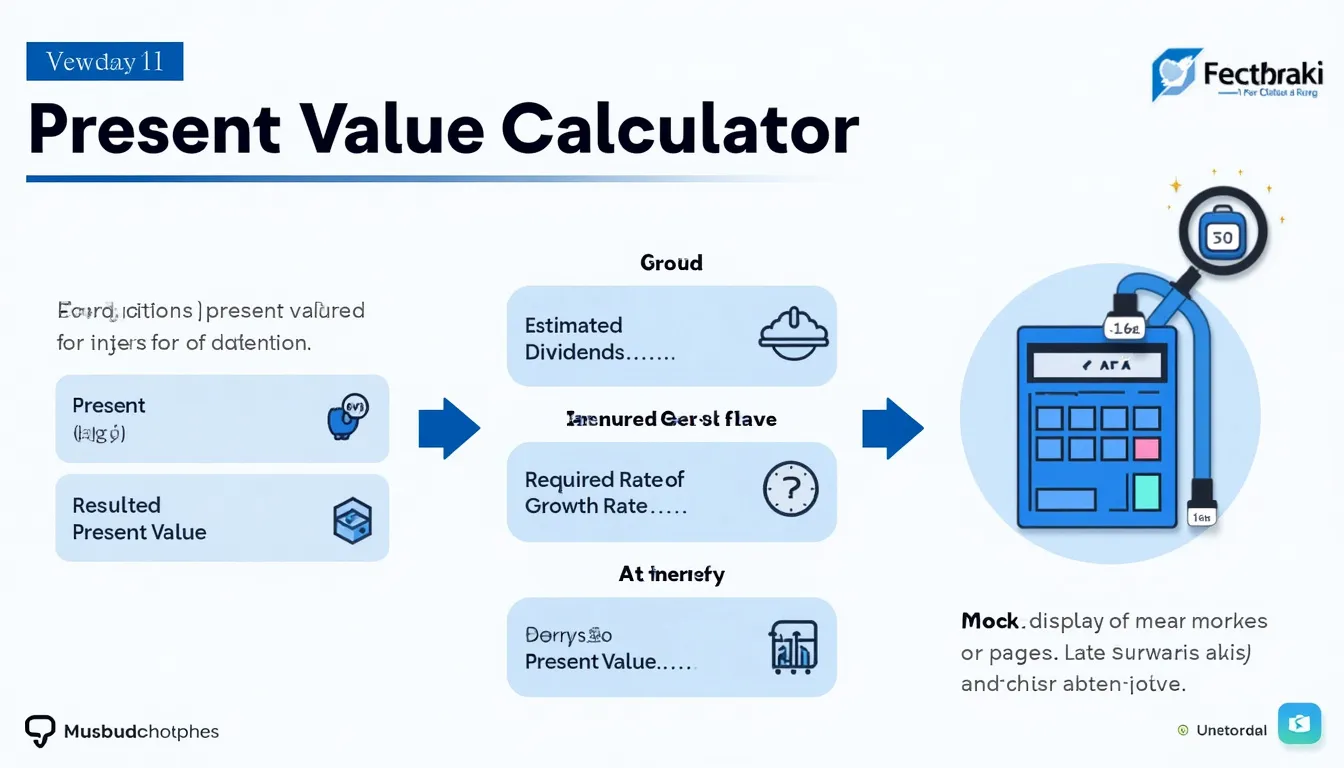

How to Use the Present Value of Stock Calculator Effectively

This Present Value of Stock Calculator with constant growth is designed to simplify stock valuation by using the Dividend Discount Model. To get accurate and meaningful results, follow these steps carefully:

- Enter the Estimated Dividends for Next Period ($): Provide the expected dividend amount the stock will pay in the upcoming period. For example, you might input 3.75 or 4.50 dollars.

- Specify the Required Rate of Return (%): Input the minimum rate of return you expect from this investment expressed as a percentage. Sample inputs could be 7.5% or 9%.

- Input the Growth Rate (%): Enter the constant dividend growth rate expected annually as a percentage. For example, use 2.8% or 4.1%.

- Click Calculate: Submit your inputs to obtain the estimated present value of the stock.

- Review the Result: The calculator displays the intrinsic stock value based on entered dividends, required return, and growth rate.

Tip: The calculator automatically saves your input values, allowing you to revisit and adjust your analysis anytime without re-entering data.

Introduction to the Present Value of Stock Calculator with Constant Growth

The Present Value of Stock Calculator leverages the constant growth dividend discount model, a vital financial tool used by investors, analysts, and students to find the intrinsic value of dividend-paying stocks. By estimating the future dividends and expected growth, you gain an informed perspective on a stock’s fair value compared to its current market price.

Using this calculator helps you:

- Accurately value stocks based on expected dividends and sustainable growth rates.

- Make informed investment decisions by comparing intrinsic value with market prices.

- Save time through automated complex calculations.

- Analyze various scenarios by adjusting growth and return rates.

- Improve financial literacy by visualizing the relationship between dividends, growth, and valuation.

Understanding the Mathematical Foundation

At the core of this calculator is the Gordon Growth Model (also known as the Dividend Discount Model), which values a stock assuming dividends grow at a constant rate forever. The formula is:

$$ P_0 = \frac{D_1}{r – g} $$Where:

- (P_0) = Present value of the stock

- (D_1) = Estimated dividend in the next period

- (r) = Required rate of return (discount rate)

- (g) = Constant dividend growth rate

Important: The formula is valid only if the required rate of return ((r)) is greater than the growth rate ((g)). Otherwise, the calculation results in unrealistic or infinite values.

Example Calculations Using the Calculator

Example 1: Valuing a Stable Dividend Stock

- Estimated Dividends for Next Period: $3.75

- Required Rate of Return: 8%

- Growth Rate: 3%

Calculation:

$$ P_0 = \frac{3.75}{0.08 – 0.03} = \frac{3.75}{0.05} = 75.00 $$Result: The estimated present value of the stock is $75.00. If the market price is lower, it might be an attractive investment opportunity.

Example 2: Comparing Two Stocks

- Stock A: Dividends = $2.20, Required Return = 9%, Growth Rate = 4%

- Stock B: Dividends = $2.80, Required Return = 10%, Growth Rate = 5%

Calculations:

$$ P_{0A} = \frac{2.20}{0.09 – 0.04} = \frac{2.20}{0.05} = 44.00 $$$$ P_{0B} = \frac{2.80}{0.10 – 0.05} = \frac{2.80}{0.05} = 56.00 $$Result: Stock B has a higher intrinsic value ($56.00) compared to Stock A ($44.00), which could guide investment choices based on current market prices.

Advantages and Key Benefits of Using This Stock Valuation Tool

- Reliable intrinsic value estimation: Provides essential insights into a stock’s true worth derived from dividend expectations and growth.

- User-friendly experience: Intuitive interface that caters to both beginners and professionals.

- Dynamic scenario testing: Modify inputs to simulate various financial environments and understand their impact on valuation.

- Assists strategic investment decisions: Enables informed buy, hold, or sell assessments by comparing calculated values against market prices.

- Quick validation for financial professionals: Supports analysts in verifying manual calculations and preparing client reports efficiently.

- Educational support: Helps learners grasp the fundamentals of dividend-based stock valuation through practical application.

Practical Applications and Use Cases

Scenario 1: Assessing Dividend Investing Potential

Investors targeting steady income streams can use this calculator to evaluate if a stock’s dividend yield and growth justify its market price. For example, assessing a utilities stock with predictable dividends helps avoid overpaying.

Scenario 2: Conducting Sensitivity Analysis

Financial analysts can explore how variations in growth rates or required returns influence stock valuation. For instance, decreasing the growth rate from 4% to 2.5% shows how valuation drops, illustrating risk considerations.

Scenario 3: Comparing Multiple Stocks Efficiently

Portfolio managers can quickly generate present values for several stocks, facilitating side-by-side comparisons to optimize portfolio selection based on intrinsic valuations.

Frequently Asked Questions (FAQs) About the Present Value of Stock Calculator

1. What types of stocks are best valued using this calculator?

This tool is ideal for mature, dividend-paying companies with stable, predictable dividend growth patterns. It’s less suited for high-growth or non-dividend-paying stocks.

2. How do I ensure my inputs lead to meaningful results?

Ensure the required rate of return is greater than the growth rate. Inputs must be positive numbers, and estimating realistic dividend projections increases accuracy.

3. Can this model handle varying dividend growth rates?

No, the constant growth model assumes a fixed growth rate. For variable growth rates, more complex models like multi-stage DDM or discounted cash flow analysis are recommended.

4. How often should I update my valuation?

Update valuations when there are material changes in dividend policy, corporate earnings outlook, or overall market conditions—typically quarterly or annually.

Conclusion: Elevate Your Investment Analysis with Constant Growth Stock Valuation

The Present Value of Stock Calculator using the constant growth model offers a streamlined, accessible way to estimate the intrinsic value of dividend-paying stocks. By understanding and applying this calculation, investors and analysts can:

- Make timely, informed decisions aligned with their financial goals.

- Perform scenario analysis to gauge investment risks and opportunities.

- Enhance knowledge of core valuation principles.

- Compare stocks on a consistent, quantitative basis.

- Save significant time on manual computations.

Explore different inputs, simulate various market conditions, and integrate this versatile calculator into your investment toolkit to gain deeper insight into stock values. Remember, for comprehensive investment analysis, always complement this method with additional research and professional advice.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.