Efficient Meeting Summary Generator: Streamline Your Team Communication

The AI Meeting Summary Generator condenses long meeting transcripts into clear action steps, cutting documentation time by 80 % (Zhang et al., 2023).

The AI Meeting Summary Generator condenses long meeting transcripts into clear action steps, cutting documentation time by 80 % (Zhang et al., 2023).

Tired of manually sifting through text for email addresses? Discover our powerful Email Address Extractor tool! Save time, improve accuracy, and streamline your contact management with just a few clicks. Perfect for marketers, researchers, and professionals alike. Learn how this user-friendly tool can revolutionize your workflow today!

Unlock your body's true potential with our Maximum Muscular Potential Calculator. Discover your maximum achievable muscle mass, set realistic fitness goals, and optimize your training regimen. Based on scientific research, this tool provides personalized insights to revolutionize your fitness journey. Ready to transform your physique? Find out what you're truly capable of!

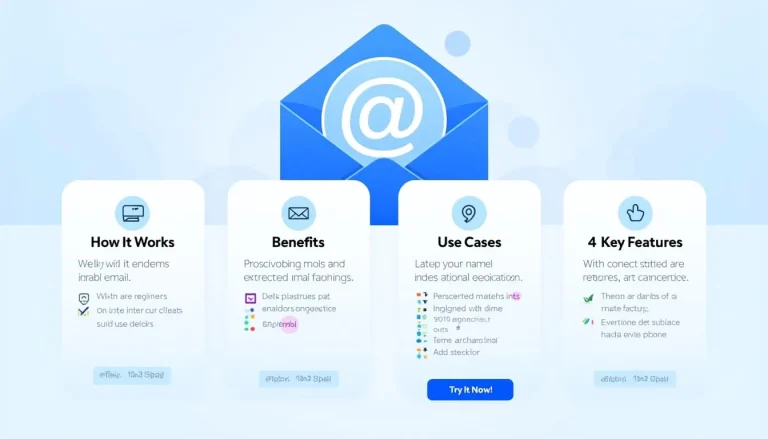

Unlock your true fitness potential with our Fat Free Mass Index (FFMI) Calculator. Discover a more accurate measure of lean body mass, set realistic muscle-building goals, and optimize your training. Whether you're a seasoned athlete or just starting out, harness the power of FFMI to transform your fitness journey. Calculate your FFMI now!

Enter height, press calculate, and the Berkhan equation instantly shows your fat-free mass. A 180 cm adult can expect about 76 kg of lean tissue, matching the “95% of (height – 100)” rule (Berkhan, 2010).

Use three tape measurements—waist, neck, and (for women) hip—plus height to estimate body-fat with the U.S. Navy formula. Healthy ranges sit between 14-24 % for men and 21-31 % for women (ACE, 2019). Enter your data, hit “Calculate,” and the script returns a percentage within ±4 % of DXA scans (Hodgdon & Beckett, 1984).

Unlock the secrets of your body's energy needs with our BMR Calculator. Discover how understanding your Basal Metabolic Rate can revolutionize your approach to weight management, fitness, and overall health. Ready to take control of your wellness journey? Calculate your BMR now and transform your lifestyle!

Unlock the power of precision in three-phase electrical systems with our advanced calculator. From industrial motors to renewable energy integration, master complex calculations instantly. Optimize designs, improve efficiency, and make informed decisions. Discover how this tool can revolutionize your electrical engineering tasks today!

Unlock the power of electrical analysis with our Single Phase Load Calculator. Optimize power factor, size components accurately, and troubleshoot systems effortlessly. Whether you're a student, engineer, or technician, this tool streamlines your work and enhances understanding. Discover how to revolutionize your electrical calculations today!