Net Profit Margin Calculator

Is this tool helpful?

How to use the tool

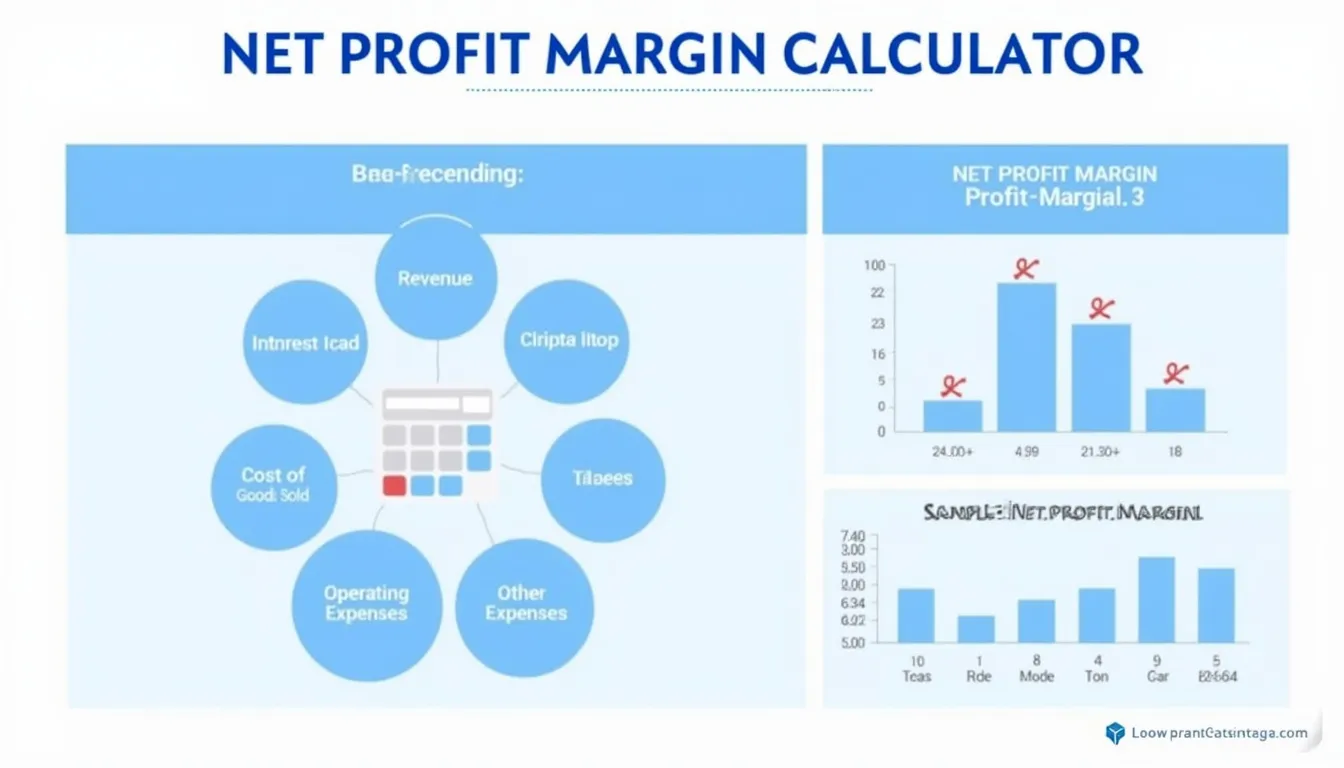

- 1. Revenue: Type your total sales. Examples: 180 000 USD or 420 000 USD.

- 2. Cost of Goods Sold (COGS): Enter direct production costs, e.g., 110 000 USD or 250 000 USD.

- 3. Operating Expenses: Add admin and selling costs, such as 30 000 USD or 90 000 USD.

- 4. Other Expenses: Record miscellaneous outlays, e.g., 6 000 USD or 12 000 USD.

- 5. Interest: Input debt service—try 2 500 USD or 4 000 USD.

- 6. Taxes: Add total tax paid—such as 4 500 USD or 15 000 USD.

- 7. Click “Calculate”. Your net profit margin appears instantly.

Formulas used

Net profit is the money left after every expense:

$$\text{Net Profit}= \text{Revenue}-\text{COGS}-\text{Operating}-\text{Other}-\text{Interest}-\text{Taxes}$$

The margin turns that number into a percentage:

$$\text{Net Profit Margin}= rac{\text{Net Profit}}{\text{Revenue}}\times100\%$$

Example A

- Revenue = 180 000

- COGS = 110 000

- Operating = 30 000

- Other = 6 000

- Interest = 2 500

- Taxes = 4 500

$$180\,000-(110\,000+30\,000+6\,000+2\,500+4\,500)=27\,000$$

$$ rac{27\,000}{180\,000}\times100\%=15\%$$

Example B

- Revenue = 420 000

- COGS = 250 000

- Operating = 90 000

- Other = 12 000

- Interest = 4 000

- Taxes = 15 000

$$420\,000-(250\,000+90\,000+12\,000+4\,000+15\,000)=49\,000$$

$$ rac{49\,000}{420\,000}\times100\%=11.67\%$$

Quick-Facts

- Average U.S. company net margin: 7.7 % (Damodaran “Margins by Sector”, 2023).

- Retail margins can run below 5 % due to thin pricing (SBA.gov “Performance Benchmarks”, 2022).

- Net margin >10 % is “healthy” for most services firms (Investopedia, 2023).

- IFRS requires deduction of finance costs and tax before declaring net profit (“IAS 1”, IFRS.org).

FAQ

What is a net profit margin?

Net profit margin shows the percentage of revenue that remains as profit after every expense (Investopedia, 2023).

Why does margin matter more than absolute profit?

Margin normalises profit by size, letting you compare performance with competitors or across periods (Harvard Business Review, 2021).

How often should you recalculate?

Quarterly is standard; monthly during rapid growth or volatile costs (SBA.gov, 2022).

Is a negative margin always alarming?

Short-term negatives occur in startups; sustained losses signal structural issues (McKinsey “Path to Profitability”, 2020).

How can you improve a weak margin?

Raise prices, cut low-value costs, renegotiate supply contracts, and automate processes (PwC “Cost Optimisation Guide”, 2023).

Does high revenue guarantee a good margin?

No. High expenses can erode profit even with strong sales, reducing margin to single digits (EY “Margin Erosion”, 2021).

What margin do investors look for?

Venture capitalists favor margins above 15 % for SaaS firms, quoting “evidence of pricing power” (Sequoia Capital, 2022).

Are taxes always included in the calculation?

Yes. International standards mandate subtracting income taxes to reflect true profitability (“IAS 12”, IFRS.org).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.