Insurance Appeal Form

Is this tool helpful?

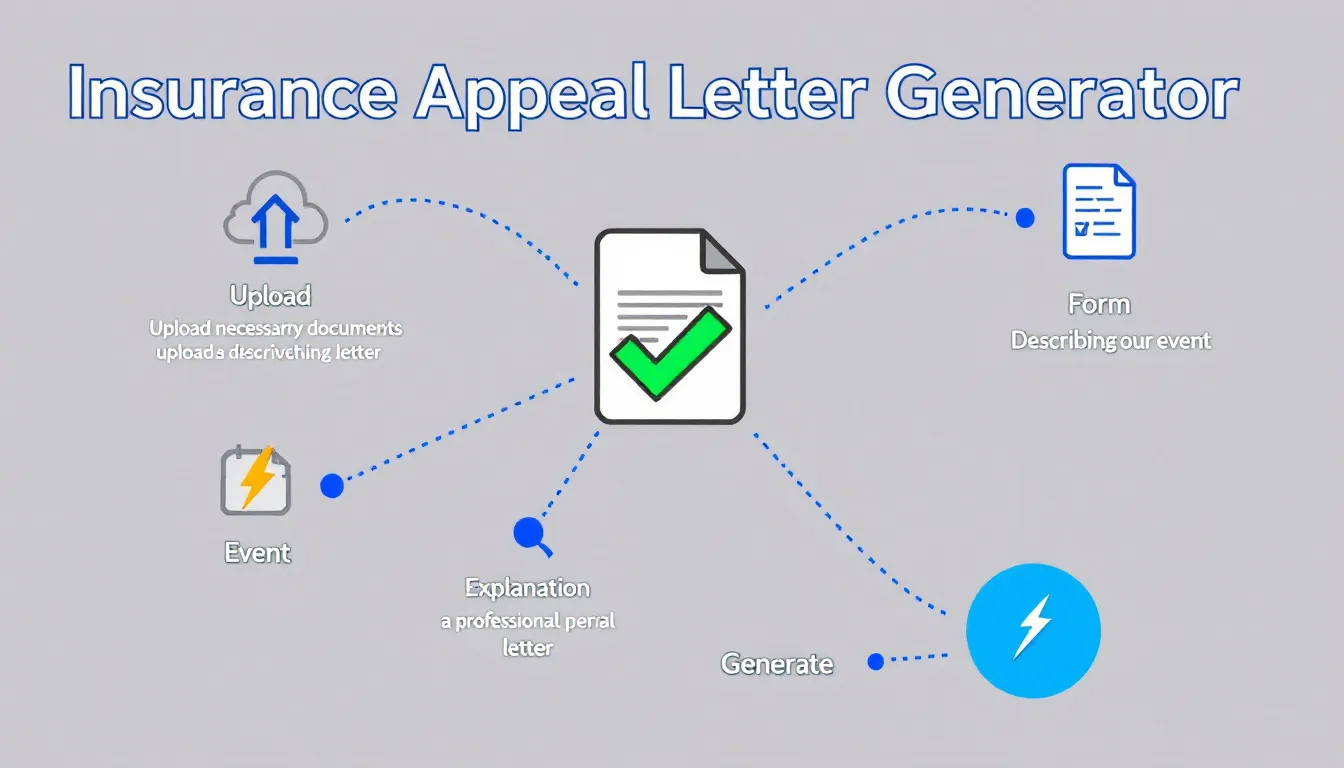

How to use the tool

- Upload the insurer’s denial: Choose a clear file such as “Denial_Notice_Apr2024.pdf” or “ClaimRefusal_Sanchez.jpg”.

- Enter your full name: For example “Ava Marie Thompson” or “David J. Lee”.

- Provide the policy number: e.g., “POL-987654321” or “TRAVEL-2024-777”.

- Select the incident date: “2024-04-22” or “2023-11-09”.

- Describe the event: “On April 22 2024, a burst pipe flooded my basement, damaging flooring and walls.”

- Explain your appeal reason: “My policy covers sudden water damage; the plumber’s report confirms the break was accidental.”

- Add contact details (optional): Emails like “[email protected]” or “[email protected]” and phones such as “404-555-6677” or “212-333-8899”.

- State your desired outcome (optional): “Reimburse $8,100 in repair costs” or “Approve full replacement value for damaged items.”

- Generate & review: Press “Generate Appeal Letter,” read the draft, adjust wording, then copy or download for submission.

Quick-Facts

- Appeal window: 180 days after health-claim denial (CMS, 2023).

- Insurer must reply within 30 days for pre-service and 60 days for post-service appeals (DOL ERISA §2560.503-1, 2023).

- First-level health appeals succeed 39 % of the time (KFF, 2022).

- Effective appeal letters run 400-600 words (Insurance Information Institute, 2023).

- Missing documentation causes 21 % of auto-claim denials (LexisNexis Risk Solutions, 2021).

FAQ

What does the generator deliver?

You receive a professionally formatted letter that cites your policy, outlines facts, and requests reconsideration, ready to print or email.

Which insurance lines can I appeal with it?

Health, auto, property, travel, and life policies all work because the tool focuses on structure—date, coverage clause, evidence—rather than product-specific jargon.

What supporting documents should I attach?

Include the denial notice, police or medical reports, receipts, photos, and expert statements—insurers cite “insufficient evidence” as a top rejection reason (LexisNexis Risk Solutions, 2021).

How quickly must the insurer respond?

“Insurers must provide a written response within 30 days for pre-service appeals” (DOL ERISA §2560.503-1, 2023). Post-service decisions take up to 60 days.

How can I improve my success rate?

State the exact policy clause supporting coverage, supply clear evidence, and keep the letter under 600 words—concise arguments reduce adjuster review time (III, 2023).

Is the generated letter legally binding?

No. It is a persuasive document, not a contract. It preserves your right to escalate but does not alter coverage terms.

Can I submit multiple appeals?

Yes. After an internal appeal, you may request external review under state or federal law when available (CMS, 2023).

Does the tool store my personal data?

The form processes inputs server-side via the process_llm_form action and deletes uploaded files after generating the letter, ensuring no long-term storage.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.