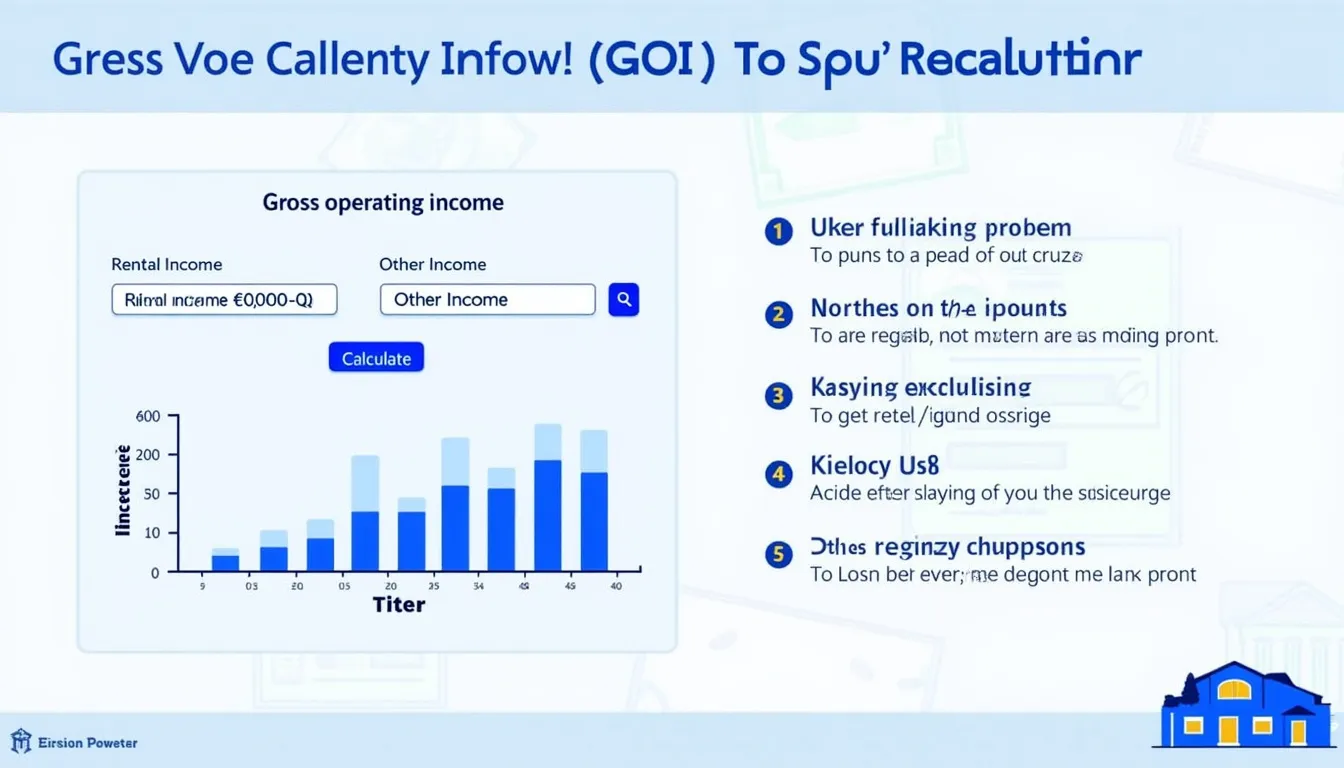

Gross Operating Income Calculator

Is this tool helpful?

How to use the tool

- Enter Rental Income: Type what tenants pay—e.g., $4,200 monthly or $51,600 annually.

- Add Other Income: Include extras such as parking or pet fees—e.g., $375 monthly or $6,000 annually.

- Submit the form: The calculator instantly displays your gross operating income (GOI).

- Review the number: Use it to gauge cash flow, set budgets, and compare deals.

Formula

Gross operating income equals the sum of all rents and ancillary revenue:

$$ GOI = \text{Rental Income} + \text{Other Income} $$

Example calculations

- Monthly scenario: $4,200 (rent) + $375 (other) = $4,575 GOI.

- Annual scenario: $51,600 (rent) + $6,000 (other) = $57,600 GOI.

Quick-Facts

- IRS lists parking, laundry, and pet fees as taxable rental income (IRS Pub. 527, 2022).

- Average U.S. apartment parking fee runs $50-$150 per space per month (National Apartment Association, 2023).

- Appraisers start the income approach with GOI before subtracting vacancies (Appraisal Institute, 2020).

- Fannie Mae underwriting caps other income at 15 % of rent for conservatism (Fannie Mae Guide, 2022).

FAQ

What is gross operating income?

Gross operating income is the total cash received from rents and service fees before any expense deductions (Appraisal Institute, 2020).

How does GOI differ from effective gross income?

Effective gross income subtracts vacancy and credit loss from GOI, producing a more conservative revenue figure (Fannie Mae Guide, 2022).

Why should investors track GOI regularly?

Tracking GOI shows whether revenue strategies work and flags unexpected dips early, improving portfolio returns (Berkadia Research, 2023).

Can GOI ever be negative?

No—GOI only sums positive inflows. Negative cash flow appears after expenses, not at the gross stage (IRS Pub. 527, 2022).

What counts as “other income”?

Typical sources include parking, storage, vending, pet rent, and application fees—all taxable under U.S. law (IRS Pub. 527, 2022).

How often should you recalculate GOI?

Update monthly for residential assets and quarterly for commercial ones to capture lease turnovers and seasonality (CBRE Market Outlook Report 2023).

Does raising rent always increase GOI?

Only if higher prices do not trigger vacancies; lost tenants reduce rent collected and may lower GOI (Zillow Rental Trends 2023).

How does GOI influence property valuation?

Income-capitalization models divide stabilized GOI (after vacancy adjustments) by a market cap rate to estimate value (Appraisal Institute, 2020).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.