Short-term Investment Calculator

How to use the tool

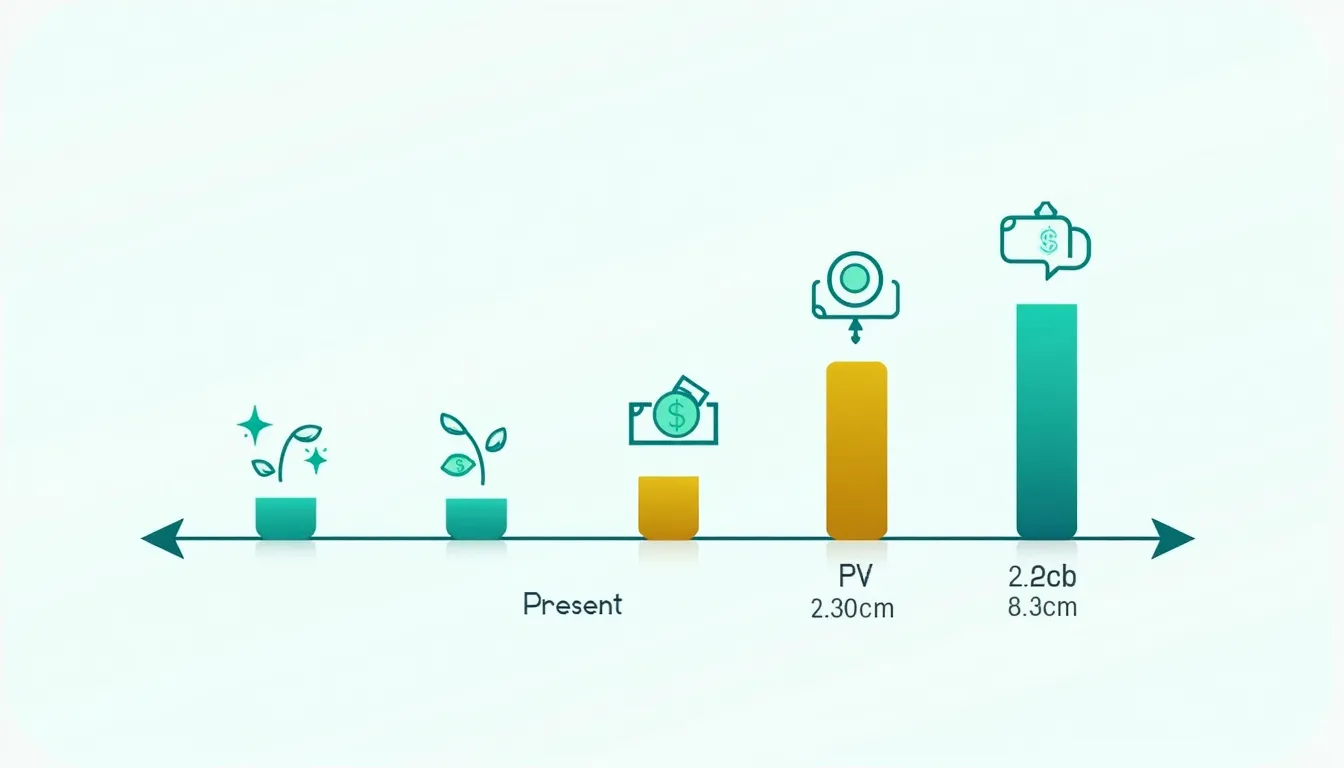

- Pick three inputs: try $3,500 Present Value, 120 days, and 5.2 % annual rate; leave Future Value blank.

- Click “Calculate FV”: the display shows $3,562.64, your balance on day 120.

- Reverse it: enter a Future Value of $2,000, 60 days, and 3.8 %; choose “Calculate PV” to see $1,987.56 today.

- Find the rate: supply $1,000 now, $1,010 later and 45 days; “Calculate Rate” returns 8.11 % p.a.

- Tweak numbers: adjust any field to compare scenarios instantly.

Formula behind the buttons

Simple interest uses one equation you can rearrange for any unknown:

$$F = P\left(1 + \frac{r}{100}\times\frac{n}{365}\right)$$

Example calculation

- Future Value: $$3{,}500 \times \left(1 + 0.052 \times \frac{120}{365}\right) = \$3{,}562.64$$

- Present Value: $$\frac{2{,}000}{1 + 0.038 \times \frac{60}{365}} = \$1{,}987.56$$

Quick-Facts

- Typical short-term horizon: 30–365 days (SEC Investor Bulletin 2023).

- Average U.S. savings account yields 0.47 % APY (FDIC Weekly National Rates 2024).

- 3-month Treasury bill recently yielded 5.2 % (U.S. Treasury Market Data 2024).

- FDIC insures up to $250,000 per depositor per bank (FDIC Consumer Guide 2024).

- Simple interest assumes no compounding within one year (Investopedia “Simple Interest” 2023).

FAQ

What does the calculator solve?

It finds Present Value, Future Value or the annual simple-interest rate when you provide the other three inputs. Results assume a 365-day year for accuracy.

Which formula does it use?

The tool applies $$F = P\left(1 + \frac{r}{100}\times\frac{n}{365}\right)$$ and algebraically rearranges it. This keeps calculations linear, perfect for terms under one year (Investopedia 2023).

When should you use simple interest?

Use it for instruments that pay interest once at maturity and run ≤ 12 months, such as Treasury bills or short-term notes (SEC Investor Bulletin 2023).

How large is the gap versus daily compounding?

On a 90-day deposit at 5 % APR, simple interest understates growth by only 0.01 %—imperceptible for most budgeting (Hull Options Futures 2022).

How do I find Present Value fast?

Divide the required Future Value by $$1+\frac{r}{100}\times\frac{n}{365}$$. The form does this automatically, saving time and errors.

Is it suitable for Treasury bills?

Yes. T-bills quote a bank-discount rate; converting that to an equivalent APR uses the same simple-interest framework (U.S. Treasury FAQ 2024).

What do money-market funds pay today?

Retail money-market funds yield roughly 4–5 % by tracking T-bill rates (ICI Money Market Report 2024).

Does FDIC insurance cover my calculated deposit?

“Each depositor is insured to at least $250,000 per insured bank” (FDIC Consumer Guide 2024). Your short-term cash stays protected within that limit.

Is this tool helpful?

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.