Reinvestment Rate Calculator

How to use the tool

- Initial Investment – enter your starting sum, e.g. £9,300.75 or £5,480.

- Investment Period (Years) – type the whole-year length, such as 6 or 12.

- Interest Rates – provide one rate per year, for instance 2.8 %, 3.4 %, -0.5 %, etc.

- Calculate – the result shows the total value and a expandable year-by-year breakdown for quick comparisons.

Example calculation

If you invest £9,500 for 3 years at 3.2 %, 3.9 % and 4.1 %:

$$ A = 9{,}500\,(1+0.032)(1+0.039)(1+0.041)=£10{,}793.22 $$

Quick-Facts

- UK instant-access savings averaged 3.12 % in April 2024 (Bank of England, 2024).

- FTSE All-Share annualised total return: 6.9 % over 1993-2023 (Barclays Equity-Gilt Study, 2024).

- Consumer Price Index inflation averaged 2.6 % in 2014-2023 (ONS, 2024).

- ISA contribution limit: £20,000 for 2024/25 (HMRC, 2024).

- FSCS protects deposits up to £85,000 per person, per bank (FSCS, 2024).

FAQ

What is a reinvestment rate?

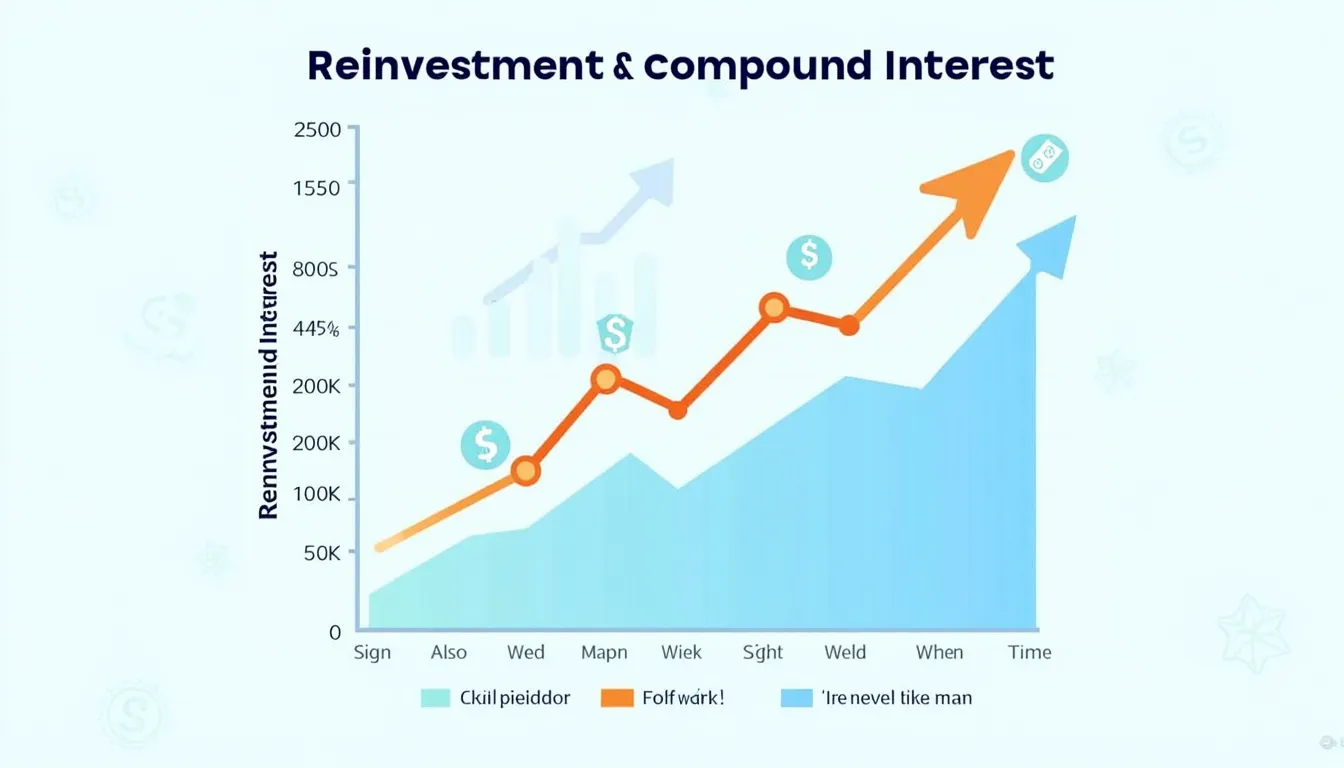

A reinvestment rate is the percentage return you roll back into the investment each year, creating compound growth (Investopedia, 2024).

How does the calculator handle negative years?

You can input negative percentages to model losses; the script subtracts those amounts before compounding the next year.

Can I skip a year’s rate?

No. Every year needs a value; blank boxes halt the calculation to avoid misleading totals.

Why do small rate changes change the outcome so much?

“Compounding amplifies even a 0.5 % difference over long periods” (Bank of England education page, 2024).

Does the tool include tax or fees?

It shows gross returns only; deduct income tax or fund fees separately using your own rate assumptions (HMRC guidance, 2024).

How precise are the figures?

The script rounds to two decimals after each year, matching UK bank statement practice (FCA Handbook, 2023).

Is compound interest the same as reinvestment?

Yes. Reinvesting interest or dividends each period compounds your capital, boosting exponential growth (Malkiel, 2022).

What happens if I invest £12,000 for 10 years at a steady 4 %?

Your pot would reach £17,760: (12,000,(1+0.04)^{10}). That’s a £5,760 gain before fees and tax.

Is this tool helpful?

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.