Inheritance Tax Calculator

Is this tool helpful?

How to Use the Inheritance Tax Calculator Effectively

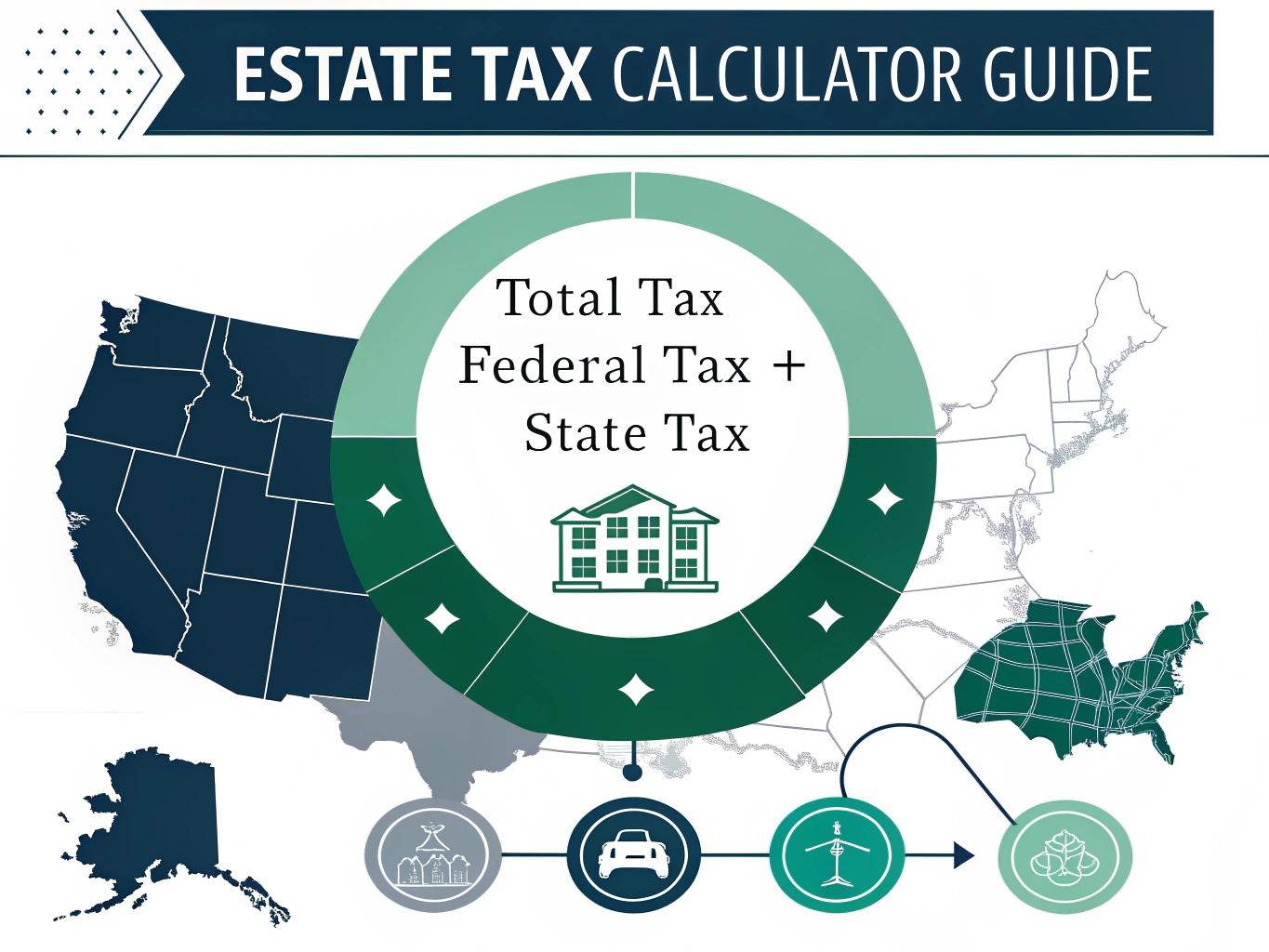

Use this inheritance tax liability estimator to quickly determine your federal and state estate tax obligations. Follow these straightforward steps:

- Enter Estate Value: Provide the total value of the estate in US dollars. For example, enter 12,300,000 or 5,450,000 as realistic estate values.

- Select State: Choose the applicable state from the dropdown. The calculator includes specific tax rates and exemptions for states like Washington, New York, Illinois, and others.

- Calculate Tax Liability: Click the “Calculate Tax Liability” button to see a detailed breakdown of your estimated federal and state taxes.

The results will display:

- Federal estate tax amount

- State estate tax amount, if applicable

- Total estimated tax liability

Understanding the Inheritance Tax Calculator: Definition, Purpose, and Benefits

This inheritance tax calculator estimates your potential estate tax liability by considering both federal and state estate taxes. It helps you understand how much tax you may owe based on current tax rates and exemptions. Using this tool simplifies complex tax calculations, so you can plan your estate effectively.

The benefits include:

- Quick and precise tax liability estimates

- Detailed federal and state-specific tax computations

- A clear breakdown of tax dues for better estate planning

- Easy-to-use online interface requiring minimal information

Example Calculations Using the JavaScript Estate Tax Calculator

Here are practical examples to illustrate how this JavaScript-powered calculator works for different estate values and states:

Example 1: Large Estate in Massachusetts

Estate Value: $14,000,000

- Federal Tax: $$ (14,000,000 – 12,920,000) \times 0.40 = 432,000 $$

- State Tax: $$ (14,000,000 – 1,000,000) \times 0.16 = 2,080,000 $$

- Total Tax Liability: $$ 432,000 + 2,080,000 = 2,512,000 $$

Example 2: Medium Estate in Illinois

Estate Value: $6,500,000

- Federal Tax: $$ 0 \quad(\text{value below federal exemption threshold}) $$

- State Tax: $$ (6,500,000 – 4,000,000) \times 0.16 = 400,000 $$

- Total Tax Liability: $$ 0 + 400,000 = 400,000 $$

How Inheritance Taxes Are Calculated

This tool calculates estate taxes by applying federal and state tax rates to amounts exceeding exemption thresholds. The core formula is:

Current Tax Rates and Exemptions

- Federal Estate Tax Rate: 40%

- Federal Estate Tax Exemption: $12,920,000

- State Estate Tax Rates: Vary from 0% to 20% depending on your state

- State Estate Tax Exemptions: Range from $1,000,000 to $9,100,000 depending on the state

State-Specific Estate Tax Considerations

States With Estate Tax

- Washington – up to 20%

- New York – up to 16%

- Illinois – up to 16%

- Massachusetts – up to 16%

- Connecticut – up to 12%

- Oregon – up to 16%

- New Jersey – up to 16%

States Without Estate Tax

- California

- Texas

- Florida

Practical Estate Tax Planning Strategies

Knowing your estimated inheritance tax liability gives you an edge in planning your estate wisely. Consider the following:

- Gift assets during your lifetime to reduce taxable estate value

- Set up trusts to manage and shield assets

- Plan residency strategically, especially if moving between states with different tax rates

- Distribute assets to minimize tax burdens across heirs

Frequently Asked Questions About Estate and Inheritance Taxes

What assets are included in the estate value?

Estate value includes all assets owned at the time of death, such as real estate, investments, business interests, personal property, life insurance proceeds, and retirement accounts.

Why do estate tax rates vary by state?

Each state sets its own estate tax rules based on factors like economic conditions, revenue needs, and local tax policies. This results in significant variation in rates and exemptions.

How often do estate tax rates change?

Federal and state estate tax rates and exemption amounts can change regularly due to new legislation. This calculator uses the most current rates available.

Can this calculator assist with gift tax planning?

While focused on estate tax, this tool helps you understand overall tax exposure and can inform your strategies for managing lifetime gifts to reduce estate tax liabilities.

Do all estates owe estate tax?

No. Only estates with a value exceeding federal or state exemptions owe estate taxes. Many estates fall below these thresholds and are exempt.

Strategies to Reduce Estate Tax Liability

- Utilize annual gift tax exclusions

- Make charitable contributions to reduce taxable estate

- Create family limited partnerships

- Establish qualified personal residence trusts

- Use irrevocable life insurance trusts to protect assets

Impact of Location on Estate Tax Planning

Your state of residence greatly influences your estate tax obligations. Take these into account:

- Review state-specific exemptions and tax rates

- Consider multiple state residences and their tax implications

- Understand state-specific deductions and credits

- Assess tax effects related to real estate and property locations

Seeking Professional Estate Tax Guidance

While this calculator offers accurate estimates, complex estates require professional expertise to optimize planning. Consider consulting with:

- Estate planning attorneys

- Tax professionals specialized in estate matters

- Financial advisors with estate planning experience

- Regular estate plan reviews to stay updated with tax law changes

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.