ESG Investment Screener

Is this tool helpful?

How to Use the ESG Investment Screener Effectively

To make the most of this ESG investment screening tool, follow these steps to refine your socially responsible portfolio:

- Environmental Score: Enter a value from 0 to 100 assessing a company’s environmental impact. For example, 75 for firms with moderate sustainability initiatives or 90 for companies excelling in renewable energy usage.

- Social Score: Rate social responsibility on a scale of 0 to 100. You might use 65 for companies with good community engagement or 85 for those prioritizing employee welfare and diversity.

- Governance Score: Input a score between 0 and 100 reflecting corporate governance quality. For example, 70 for firms with average board diversity or 88 for companies with transparent shareholder policies.

- Additional Investment Criteria: Provide specific investment requirements beyond ESG factors, such as sector preferences, financial metrics, or company size.

Sample Investment Criteria Inputs

Example 1:

“Target small-cap companies with market cap below $3 billion, focusing on firms in the organic agriculture and clean water sectors. Require a minimum EBITDA margin of 15% and companies with policies addressing plastic waste reduction.”

Example 2:

“Seek technology companies with over $8 billion market cap. Prioritize businesses investing at least 10% of revenue in renewable energy. Include only those with employee retention rates above 90% and transparent executive compensation reports.”

What Is the ESG Investment Screener and Why Use It?

The ESG Investment Screener helps you evaluate companies based on Environmental, Social, and Governance (ESG) factors to build a portfolio that aligns with sustainable and ethical investing principles.

This tool combines your input scores into a weighted ESG rating that guides your investment decisions and enhances your portfolio’s social responsibility. Using the screener allows you to:

- Identify companies that actively reduce environmental impact

- Support businesses with strong workplace and community practices

- Choose firms with transparent and effective governance

- Align investments with your personal or institutional values

- Improve risk management by avoiding companies with poor ESG performance

How the ESG Score Is Calculated

The tool uses this formula to calculate the combined ESG score:

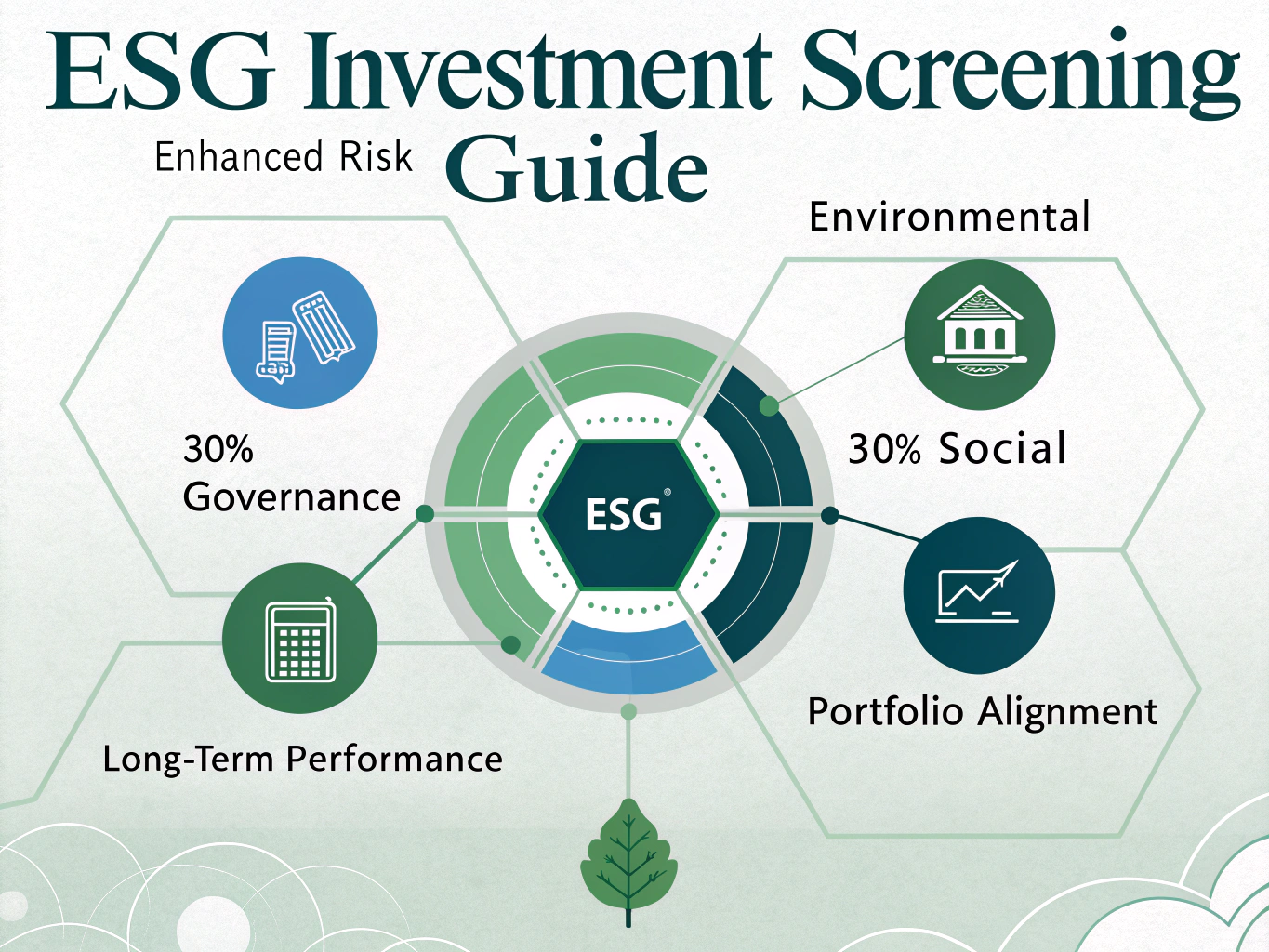

$$ \text{ESG Score} = 0.4 \times \text{Environmental Score} + 0.3 \times \text{Social Score} + 0.3 \times \text{Governance Score} $$Key ESG Components

- Environmental (40% weight): Measures carbon footprint, waste management, and resource use.

- Social (30% weight): Examines labor practices, community engagement, and employee diversity.

- Governance (30% weight): Assesses board structure, business ethics, and shareholder rights.

Practical Applications for the ESG Investment Screener

Example ESG Score Calculation

Suppose you evaluate a company and assign the following scores:

- Environmental Score: 72

- Social Score: 80

- Governance Score: 85

The total ESG score calculates as:

$$ (0.4 \times 72) + (0.3 \times 80) + (0.3 \times 85) = 28.8 + 24 + 25.5 = 78.3 $$This combined score helps you determine if the company fits your socially responsible investment goals.

How to Use This Tool in Your Investment Process

- Portfolio Construction: Allocate more capital to companies with higher ESG scores to enhance sustainability alignment.

- Sector Comparison: Compare ESG scores between companies in the same industry to identify leaders and laggards.

- Risk Screening: Identify potential ESG risks that could affect long-term financial performance.

- Monitoring: Regularly update scores based on new data to keep your portfolio aligned with ESG goals.

Real-World Examples of ESG Screening

Case Study 1: Sustainable Tech Investment

An investor wants to focus on innovative tech firms with strong ESG profiles by setting these criteria:

- Environmental score above 70

- Market cap of at least $4 billion

- High investment in renewable energy use and e-waste reduction

Case Study 2: Ethical Consumer Goods Portfolio

A socially conscious investor targets consumer goods companies with:

- Social scores over 80

- Commitment to fair labor practices and community support

- Strong and transparent governance with independent boards

Frequently Asked Questions About ESG Investment Screening

What ESG aspects does the screener focus on?

It evaluates environmental factors such as emissions and resource management, social factors like labor and human rights policies, and governance factors including board makeup and shareholder protections.

How often should I update my ESG scores and criteria?

Review your ESG factors at least once every quarter or half-year to keep pace with evolving sustainability standards and market trends.

Can I adjust the weighting of ESG factors in the screener?

The tool uses fixed weightings—40% environmental, 30% social, and 30% governance—consistent with widely accepted ESG frameworks to maintain standardized assessments.

Which industries are usually excluded in ESG screening?

Industries involved in tobacco production, weapons manufacturing, and other activities conflicting with responsible investing principles are typically excluded based on common ESG guidelines.

How does ESG screening enhance traditional financial analysis?

It adds insight into sustainability-related risks and opportunities that financial metrics alone don’t capture, enabling you to make more informed, long-term investment decisions.

What factors lead to a high ESG score?

Companies score highly by demonstrating strong environmental management, positive social impact through fair labor and community initiatives, and transparent, accountable governance practices.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.