Early Loan Repayment Calculator

Is this tool helpful?

How to use the tool

- 1. Loan Amount ($): Type your principal—e.g., 180 000 or 320 500.

- 2. Annual Interest Rate (%): Enter the nominal yearly rate—e.g., 3.85 or 6.20.

- 3. Loan Term (years): Add the planned duration—e.g., 15 or 35.

- 4. Early Repayment Amount ($): Insert your lump sum—e.g., 7 500 or 22 000.

- 5. Early Repayment Timing (months): Pick when you will pay—e.g., 24 or 84.

- 6. Repayment Option: Select either Shorten Loan Term or Reduce Monthly Payment, then press Calculate.

Core formulas

Monthly payment:

$$ P = rac{r \times L}{1 – (1+r)^{-n}} $$Remaining balance after m payments:

$$ B = L(1+r)^{m} – P \, rac{(1+r)^{m}-1}{r} $$New term when keeping the same payment:

$$ n’ = rac{\ln\!\left( rac{P}{P – r B’}\right)}{\ln(1+r)} $$New payment when keeping the same term:

$$ P’ = rac{r \times B’}{1 – (1+r)^{-n}} $$Example calculation

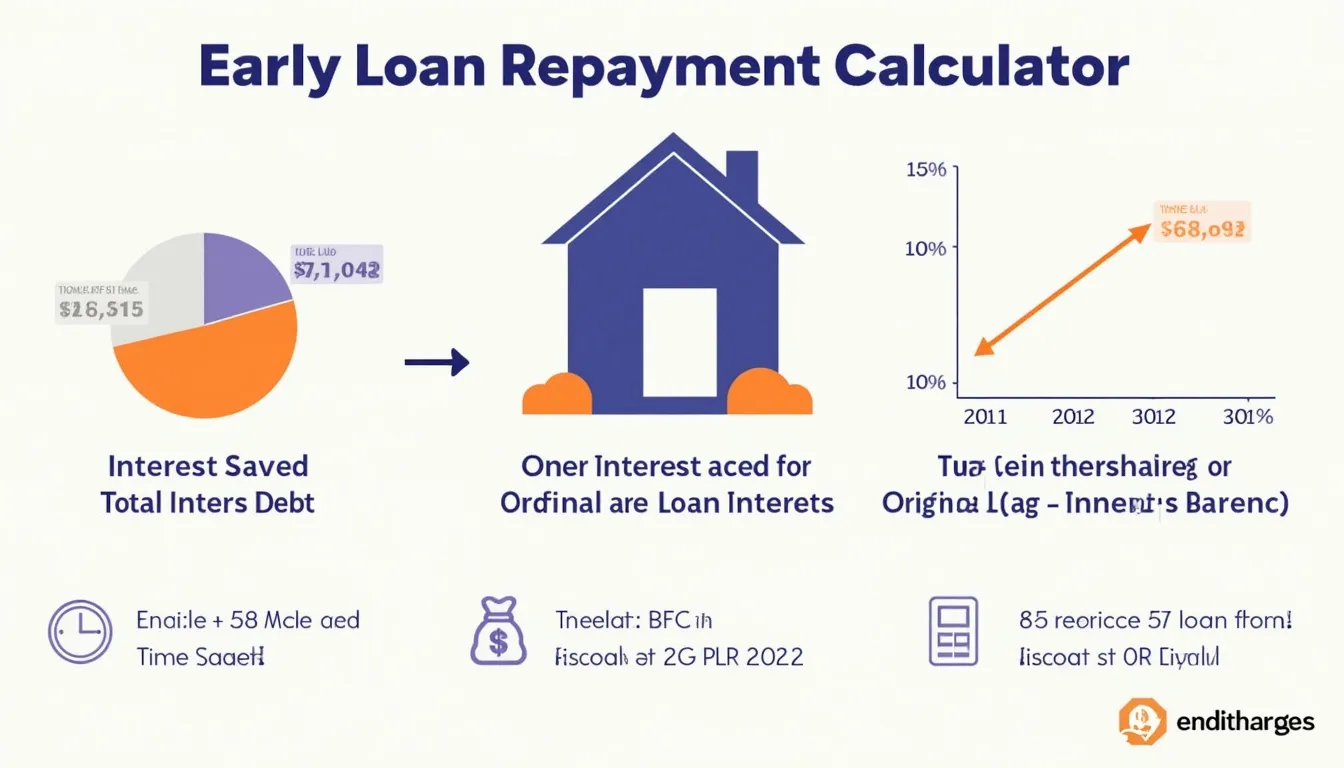

- Loan: 180 000 $, 5 % annual, 30 years (360 months).

- Monthly payment: $$P \approx 966.28$$.

- Balance after 60 months: $$B \approx 165\,251$$.

- Lump sum: 15 000 $ → new balance $$B’ = 150\,251$$.

- Shorten-term option: new term $$n’ \approx 252$$ months—48 months saved and about 31 600 $ less interest.

Quick-Facts

- U.S. mortgages issued since 2014 rarely carry prepayment penalties (CFPB, 2023).

- The average 30-year fixed rate stood at 6.79 % in May 2023 (Freddie Mac, 2023).

- Cutting a 200 k, 4 % loan by 100 $ monthly saves roughly 26 k $ in interest (Fannie Mae, 2022).

- Federal student loans charge no fees for early repayment (U.S. Dept. of Ed., 2023).

FAQ

What is early loan repayment?

Early repayment is any payment beyond your scheduled amount that directly reduces principal (CFPB, 2023).

How does the calculator project interest savings?

It creates a baseline amortization schedule, subtracts your lump sum, recalculates payments or term, then totals interest again.

Which option—shorter term or lower payment—saves more money?

Shortening the term always cuts more interest because you keep the higher payment level (Fannie Mae, 2022).

Can I use multiple lump sums?

Yes; rerun the tool for each planned lump sum and manually aggregate results for a roadmap.

Does prepaying hurt my credit?

No. Lower balances improve credit-utilization ratios, a key score factor (Experian, 2023).

Should I still build an emergency fund first?

Experts suggest three-month expenses before large prepayments to avoid liquidity issues (Vanguard, 2022).

Will my lender re-amortize automatically?

Many mortgage servicers adjust term on request; others keep payments constant—check your contract (Freddie Mac, 2023).

Is there a tax impact?

Less interest means smaller deductions for itemizing homeowners under current U.S. code (IRS Pub 936, 2022).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.