Corporate Structure Setup Guide

Is this tool helpful?

How to Use the Corporate Structure Guide Generator Effectively

Use this tool to receive a tailored corporate structure guide that fits your business needs. Here’s how to fill out the form for best results:

- Specify the type of corporate structure: Choose a structure that fits your goals. For example, input “Parent company with subsidiaries” or “Limited Partnership” as your business structure.

- Define your asset protection goals: Clearly explain how you want to protect your assets. Examples include “Shield family assets from commercial risks” or “Divide business liabilities across multiple entities”.

- Outline your revenue generation plans (optional): Share any ideas for earning income through this structure, such as “Monetize brand licensing” or “Operate management consulting services”.

- Enter your preferred jurisdiction: Name the location for incorporation. You might choose “British Virgin Islands (BVI)” or “New York”, depending on your strategic and regulatory preferences.

- List any compliance concerns (optional): Mention specific legal or regulatory issues, such as “Adherence to EU GDPR” or “Compliance with local environmental laws”.

Once you fill out the fields, click Generate Corporate Structure Guide to receive a customized guide that helps you optimize asset protection and revenue strategies.

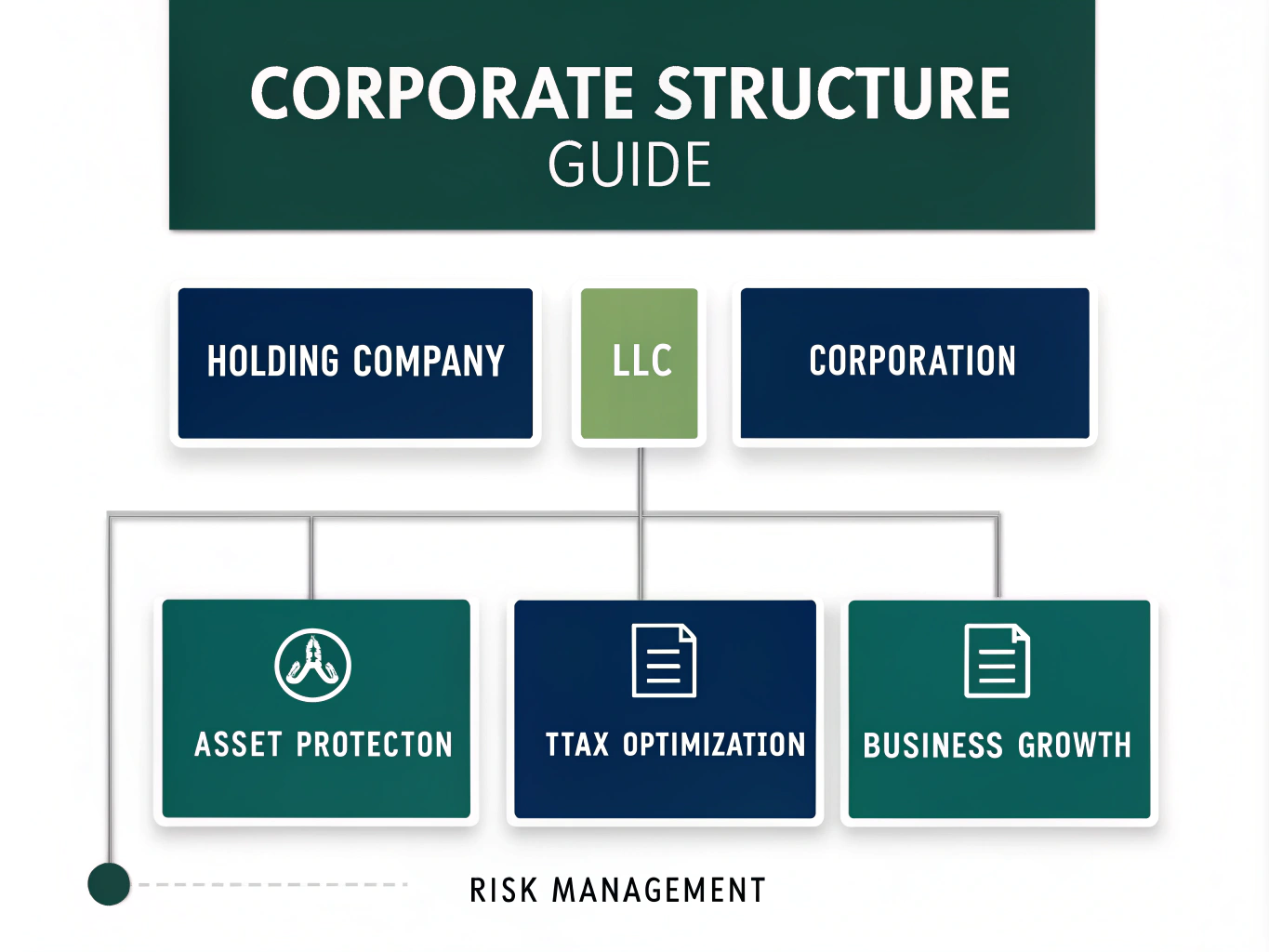

What Is the Corporate Structure Guide Generator?

This tool generates a detailed corporate structure guide tailored to your business goals. It helps you understand complex corporate frameworks and make informed decisions about asset protection, tax efficiency, and regulatory compliance. By providing your business specifics, asset protection objectives, revenue ideas, jurisdiction preferences, and compliance concerns, you get personalized insights and practical advice.

Entrepreneurs, investors, and business owners use this guide to simplify corporate setup decisions and align their structure with long-term growth plans. The generator acts as an accessible resource offering clarity around corporate options suited to your unique business context.

Practical Applications of the Corporate Structure Guide Generator

Personalized Business Planning

Use the generated guide to create a corporate structure that matches your specific goals. Whether you want to protect intellectual property, streamline tax obligations, or manage liabilities across multiple business units, the tool provides clear recommendations and strategic next steps.

Asset Protection Strategies

The guide explains how to legally separate personal and business assets using appropriate entities like LLCs, corporations, or trusts. It also covers the creation of holding companies to shield assets or structure subsidiaries to isolate risk.

Tax Efficiency and Jurisdiction Selection

Based on your revenue generation plans and preferred location, the guide highlights tax-efficient structures and jurisdictional benefits. It covers concepts such as profit allocation, double taxation avoidance, and choosing locations with favorable corporate laws.

Regulatory & Compliance Guidance

Your specific compliance concerns receive tailored advice. Whether it’s international reporting standards, anti-money laundering laws, or local regulatory requirements, the guide outlines essential steps to ensure your corporation meets all legal obligations.

Real-World Use Cases

Case Study 1: Small Business Owner Expanding Nationally

- Business Structure: Limited Liability Company (LLC)

- Asset Protection Goal: Separate business operations from personal assets

- Revenue Plan: Launch new retail locations with franchise agreements

- Jurisdiction: Texas

- Compliance Concerns: State sales tax and employment law compliance

The tool recommends structuring the LLC to isolate liabilities per franchise unit, outlines licensing requirements in Texas, and explains franchise legal obligations. It also highlights state tax issues and labor law considerations important for expansion.

Case Study 2: International Manufacturing Company

- Business Structure: Overseas Holding Company with subsidiaries

- Asset Protection Goal: Segregate international property assets

- Revenue Plan: Licensing manufacturing technology globally

- Jurisdiction: Singapore

- Compliance Concerns: Transfer pricing regulations, local import/export laws

The generated guide suggests a holding company in Singapore to benefit from tax treaties and secure intellectual property rights. It provides compliance tips for transfer pricing documentation and adherence to trade regulations in subsidiary countries.

Frequently Asked Questions About Corporate Structures

What differentiates a holding company from an operating company?

A holding company owns assets like shares or intellectual property but doesn’t conduct daily business activities. An operating company actively runs business operations, produces goods, or delivers services.

Can I modify my corporate structure after formation?

Yes, you can change your corporate structure through legal restructuring or reorganization. This process involves legal and tax considerations. Consult professionals to ensure smooth and compliant adjustments.

How is a Series LLC different from a traditional LLC?

A Series LLC creates separate divisions (“series”) under one LLC umbrella, each with distinct assets and liabilities. This setup provides added asset protection and operational flexibility compared to a traditional single-entity LLC.

What are the advantages of incorporating offshore?

- Tax efficiency in select jurisdictions

- Enhanced confidentiality and privacy

- Protection from domestic litigation

- Flexible corporate laws

- Access to international business networks

Keep in mind that offshore corporations require strict compliance with local and international regulations to avoid penalties.

How does a corporate structure help with succession planning?

- Business Continuity: Corporations persist beyond the lifespan of individual owners.

- Ownership Transfer: Shares or interests can pass smoothly to heirs.

- Management Transition: Clear policies for appointing new leadership.

- Tax Planning: Structures like family limited partnerships ease wealth transfer with tax benefits.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.