Continuous Compounding Calculator

How to use the tool

Step-by-step

- 1. Type your nominal annual rate as a plain number—e.g., 3.2 or 9.4.

- 2. Enter the investment length in years; decimals handle partial years—e.g., 8.5 or 4.2.

- 3. Add the starting principal without commas—e.g., 2500 or 7500.

- 4. Press “Calculate” to see the continuously-compounded effective rate and final amount.

Field-input examples

- Example 1: Principal = 2 500, Rate = 3.2, Time = 8.5 → Final ≈ $3 174.22; Continuous rate ≈ 3.25 %.

- Example 2: Principal = 7 500, Rate = 9.4, Time = 4.2 → Final ≈ $11 683.29; Continuous rate ≈ 9.80 %.

Formula applied

The calculator uses the continuous-compounding model

$$A = P\,e^{rt}$$

where P is principal, r the nominal rate as a decimal, and t time in years (NIST Digital Library, 2020).

Quick-Facts

- Mathematical constant e ≈ 2.71828 (NIST Digital Library, 2020).

- Effective annual rate under continuous compounding equals (e^{r}−1) (Investopedia, 2023).

- “Double precision supports up to 15 decimal digits” (IEEE 754-2019).

- A 1-percentage-point rate rise over 30 years adds ≈ 30 % to the final sum (FRBNY Q2 2021).

FAQ

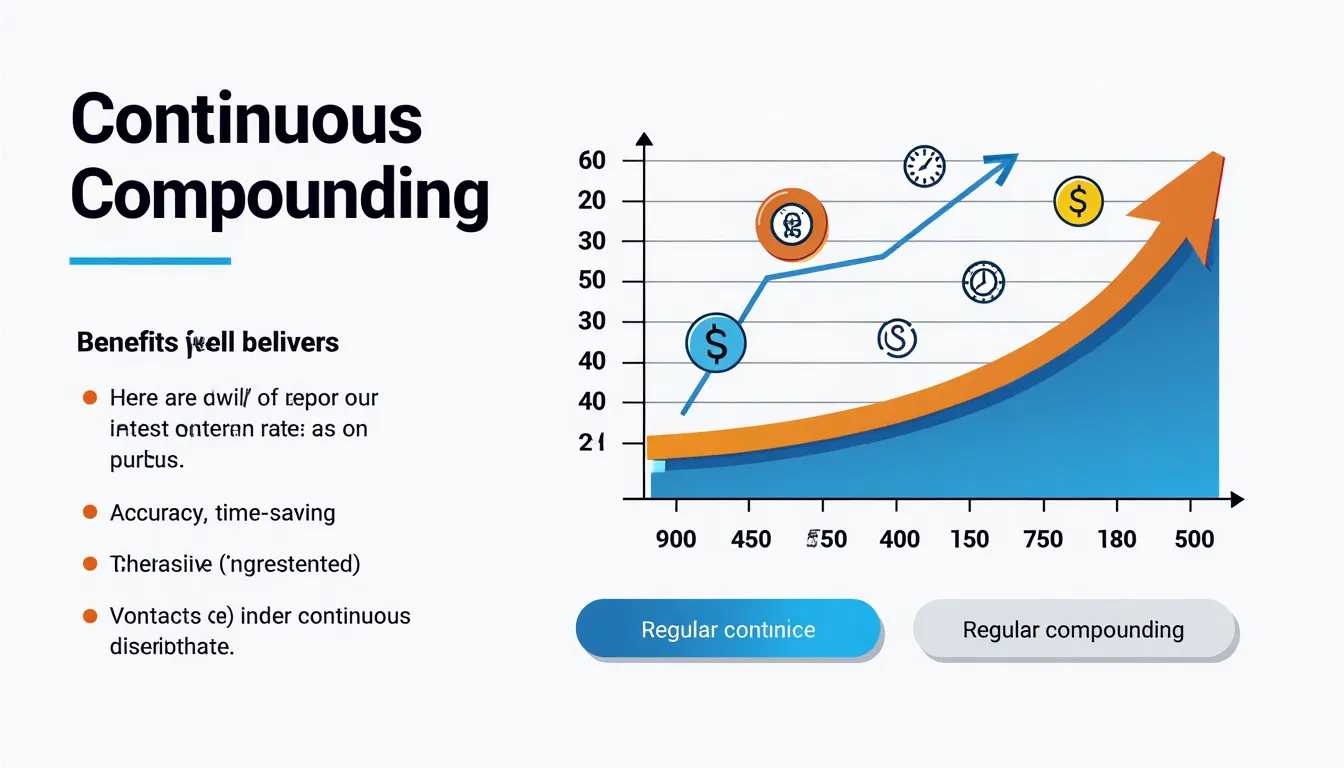

What is continuous compounding?

You earn interest every instant, so interest itself earns interest; it is the limit of faster compounding (Investopedia, 2023).

Why does it beat daily compounding?

The formula (e^{r}−1) always exceeds ((1+r/365)^{365}−1); at 10 % nominal the gap is ≈ 0.13 % (SEC Investor.gov, 2022).

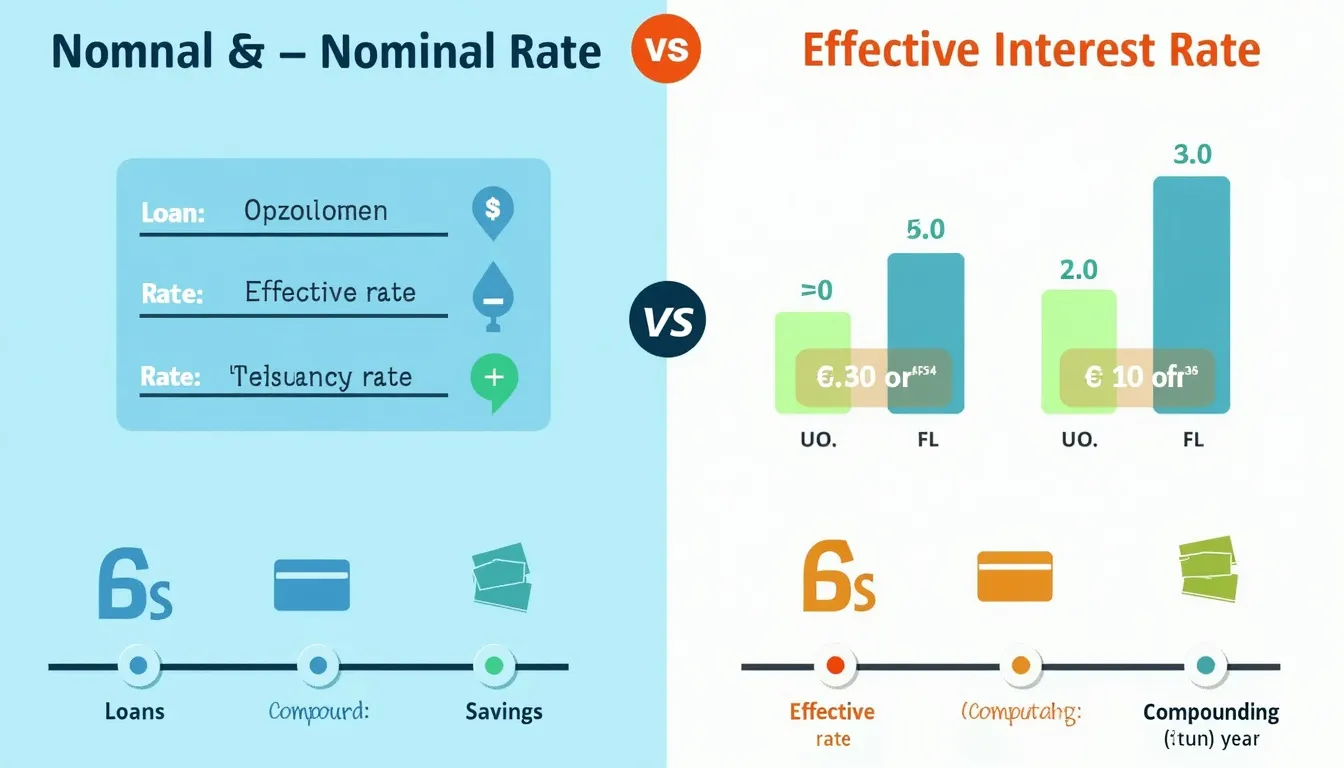

How do I convert a nominal rate to a continuous rate?

Use (r_c = ln(1+r_{nom})); 6 % nominal becomes 5.825 % continuous (NIST Digital Library, 2020).

Is the calculator reliable for long terms?

IEEE 754 double precision handles exponents up to 10308, far beyond any practical horizon (IEEE 754-2019).

Can I apply these results to loans?

Few lenders charge continuous interest; most use daily or monthly schedules, so use results as theoretical benchmarks (FDIC Consumer Guide, 2021).

How are fractional years treated?

The exponent (rt) scales linearly; entering 3.75 years computes exactly four months past the third year (NIST Digital Library, 2020).

Is this tool helpful?

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.