Certificate of Deposit (CD) Calculator

Is this tool helpful?

How to use the tool

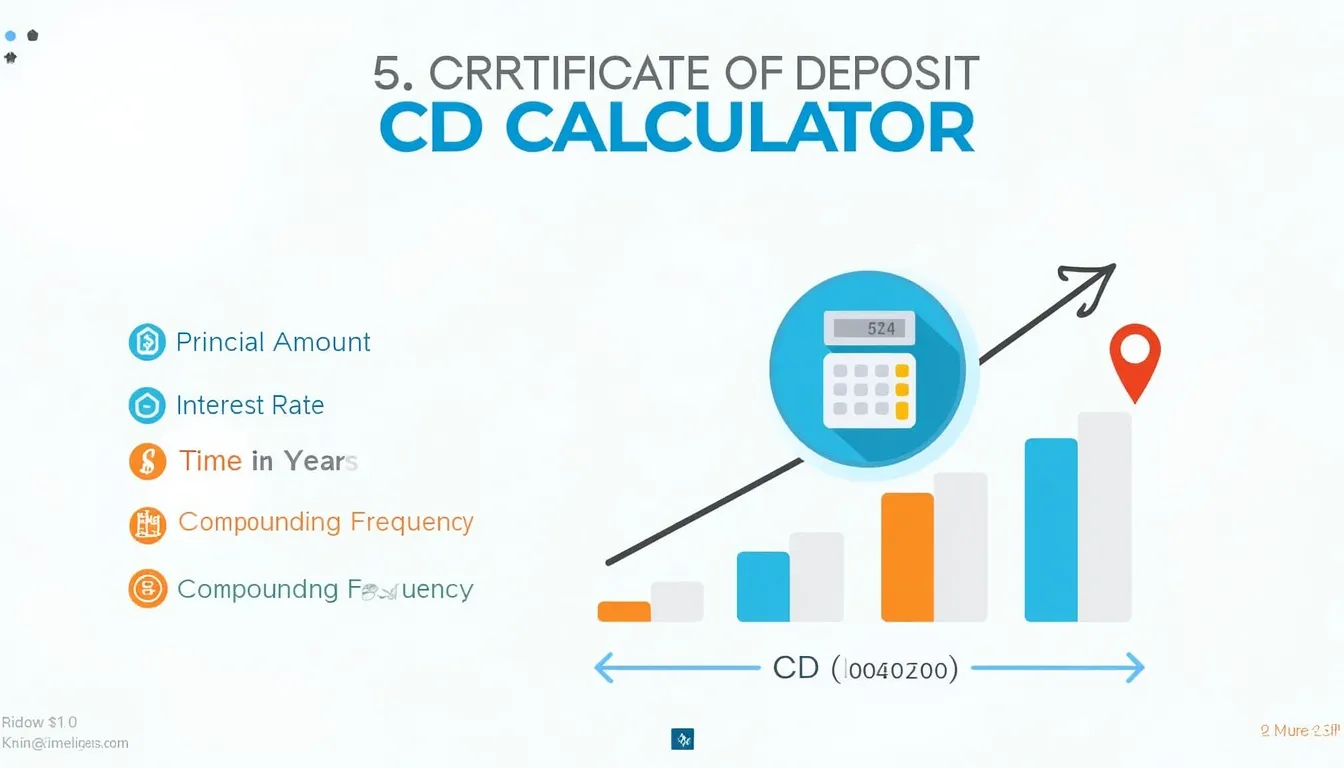

Estimate your CD’s growth in five quick steps:

- Principal Amount: Type the sum you will deposit, e.g., $20,000 or $10,500.

- Interest Rate (%): Enter the annual rate, such as 4 % or 2.6 %.

- Time in Years: Choose the term—try 5 or 3.

- Compounding Frequency: Select annual (1), quarterly (4), monthly (12) or daily (365) to match your CD.

- Calculate: Click “Calculate” to display the maturity value instantly.

Formula used

The calculator applies the compound-interest equation:

$$A=P\left(1+ rac{r}{n}\right)^{nt}$$

- P = initial deposit

- r = annual rate (decimal)

- n = compounds per year

- t = years

Worked examples

- Example 1: P = $20,000, r = 4 % (0.04), n = 4, t = 5.

A = 20,000 × (1 + 0.04⁄4)20 ≈ $24,403.79. - Example 2: P = $10,500, r = 2.6 % (0.026), n = 365, t = 3.

A = 10,500 × (1 + 0.026⁄365)1 095 ≈ $11,357.24.

Quick-Facts

- FDIC insurance covers up to $250,000 per depositor, per bank (FDIC.gov, 2024).

- The average U.S. 1-year CD yield was 1.86 % in May 2024 (FRED, 2024).

- Early withdrawal penalties often equal six months of interest on CDs ≥12 months (CFPB, 2023).

- Standard compounding intervals include annual, semi-annual, quarterly, monthly and daily (SEC Investor Bulletin, 2023).

FAQs

What is a CD?

A Certificate of Deposit is a time-deposit account that pays a fixed interest rate for a set term; withdrawing before maturity incurs a penalty (FDIC.gov, 2024).

How does compound interest boost returns?

Interest is added to your balance each compounding period, so future interest is earned on both principal and previous interest, accelerating growth (SEC Investor Bulletin, 2023).

Why does compounding frequency matter?

More frequent compounding means interest is credited sooner; daily compounding can add several dollars more per $10,000 than annual compounding over five years (FRED, 2024).

Can I pull money out early?

Yes, but “interest earned on the deposit cannot be withdrawn before maturity without penalty” (Truth in Savings Act brochure, 2023). Penalties erase some or all accrued interest (CFPB, 2023).

How do I compare CD offers?

Use the calculator to test each bank’s rate, term and compounding schedule; pick the offer with the highest maturity value after adjusting for any penalties (Bankrate, 2024).

Is my money safe?

Deposits in FDIC-insured banks are protected up to $250,000 per depositor and ownership category, even if the bank fails (FDIC.gov, 2024).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.