Return On Capital Calculator: Measure Your Investment Efficiency

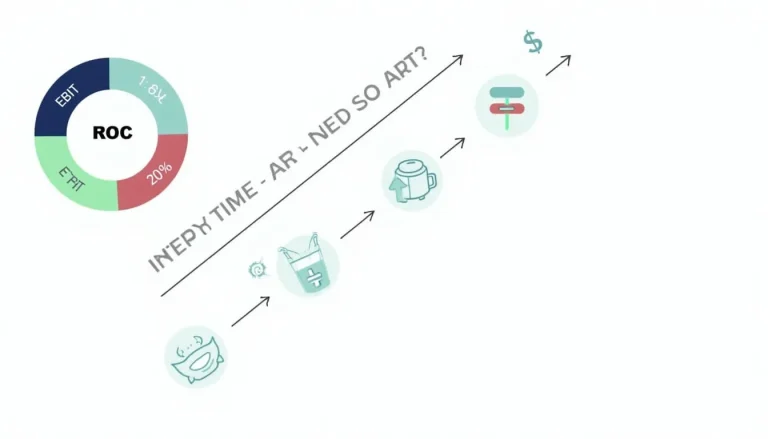

Return on Capital (ROC) tells you how efficiently each invested dollar generates operating profit after tax—anything above your cost of capital (≈8-10 % for U.S. firms) signals value creation (Damodaran dataset, 2023). Enter EBIT, tax rate and invested capital; the calculator instantly shows ROC as a percentage. Compare the result with industry norms to spot strengths or inefficiencies.