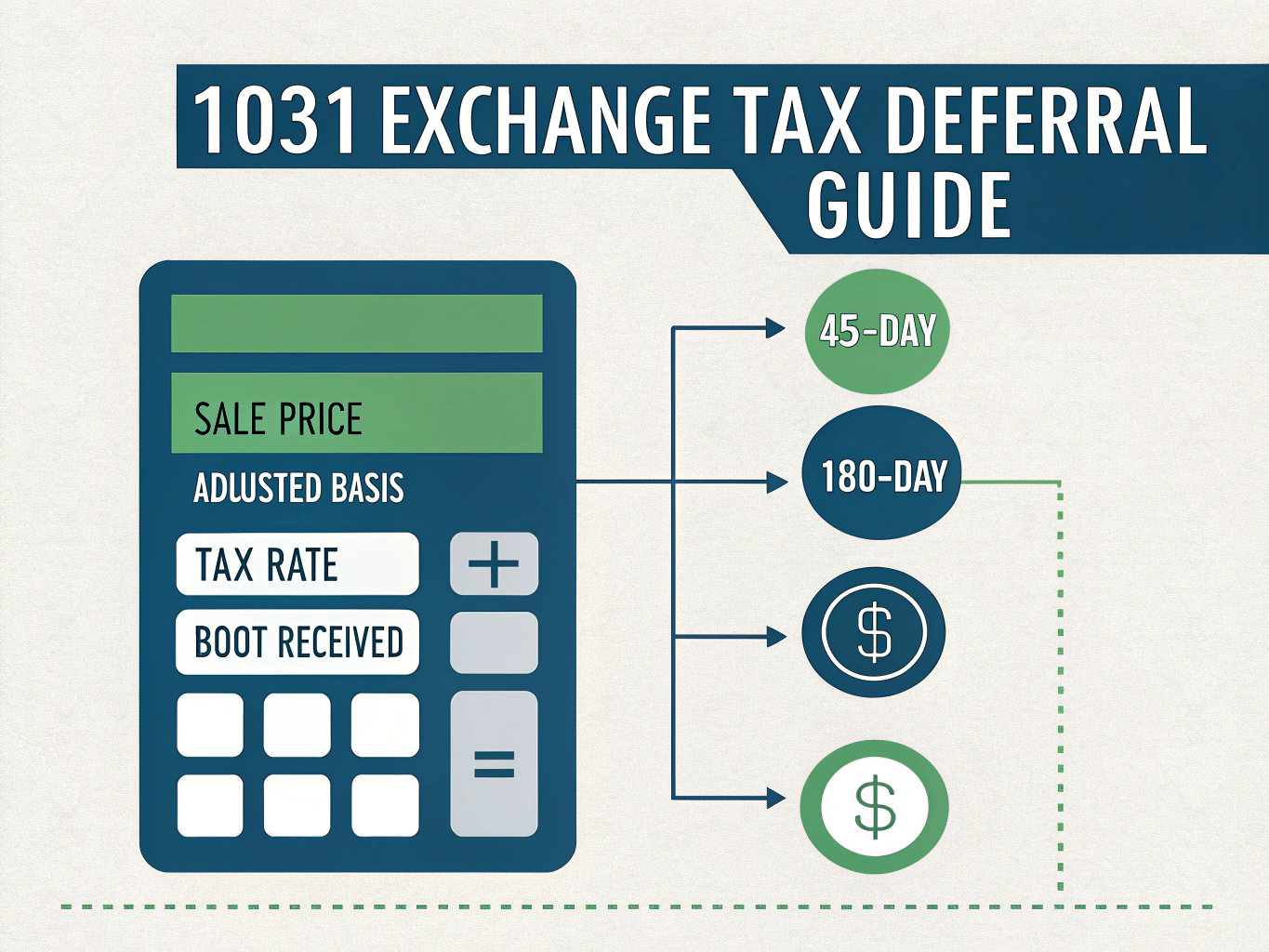

Section 1031 Exchange Calculator

Is this tool helpful?

How to Use the Section 1031 Exchange Tax Deferral Calculator Effectively

This calculator helps you estimate your potential tax deferral from a Section 1031 like-kind exchange. To get the most accurate results, carefully enter the following details:

- Sale Price (USD): Enter the total sale price of the relinquished property. For example, use $620,000 if selling a retail space or $390,000 for a residential rental.

- Adjusted Basis (USD): Input your property’s adjusted basis, which accounts for the purchase price plus capital improvements minus depreciation. For instance, enter $415,000 if you originally bought for $400,000 and added $20,000 in improvements but took $5,000 depreciation.

- Tax Rate (%): Provide your combined capital gains tax rate as a percentage. For example, use 18.5% if you pay federal and state taxes or 27% for higher state tax impact.

- Boot Received (USD) (Optional): If you receive any cash or non-like-kind property during the exchange, enter the amount here. For example, enter $12,000 if you received cash along with the replacement property.

Introduction to the Section 1031 Exchange Tax Deferral Calculator

The Section 1031 Exchange Tax Deferral Calculator is a specialized tool designed to help real estate investors quickly estimate their tax savings when executing a like-kind exchange under IRS Section 1031. By calculating your deferred tax amount, you can better plan your property exchanges to maximize financial benefits and avoid unexpected tax liabilities.

This calculator factors in the sale price, adjusted basis, tax rate, and any boot received to give you a clear picture of your deferred tax liability. Its user-friendly interface and immediate results support timely, informed decisions in complex real estate transactions.

How the Tax Deferral Calculation Works

The deferred tax is calculated using this formula:

$$ \text{Deferred Tax} = (\text{Sale Price} – \text{Adjusted Basis}) \times \frac{\text{Tax Rate}}{100} – \text{Boot Received} $$Key Variables Explained

- Sale Price: The gross amount you receive from selling your original property.

- Adjusted Basis: Your initial investment adjusted for improvements and depreciation.

- Tax Rate: The combined effective tax rate on gains, expressed as a percentage.

- Boot Received: Cash or non-like-kind property received during the exchange, which is taxable.

Example Calculation Using the Section 1031 Exchange Calculator

To illustrate, suppose you sell an investment property and enter these values:

- Sale Price: $620,000

- Adjusted Basis: $415,000

- Tax Rate: 18.5%

- Boot Received: $12,000

Applying the formula:

$$ \text{Deferred Tax} = (620{,}000 – 415{,}000) \times 0.185 – 12{,}000 = 38{,}875 – 12{,}000 = 26{,}875 $$This means you could defer approximately $26,875 in taxes by completing the like-kind exchange.

Benefits of Using the Section 1031 Exchange Tax Deferral Calculator

- Effective Tax Planning: Estimate your potential tax deferral before finalizing property transactions.

- Informed Decision-Making: Assess whether a 1031 exchange fits your financial goals.

- Scenario Analysis: Quickly compare different property sale and purchase scenarios.

- Deadline Awareness: Stay mindful of the 45-day property identification and 180-day closing deadlines required by law.

- Financial Strategy: Understand how receiving boot might impact your tax obligations.

Common Uses and Practical Applications

Real Estate Portfolio Restructuring

If you plan to exchange a commercial property for multiple residential units, you can use this tool to estimate your tax deferral and evaluate if the exchange aligns with your investment strategy.

Investment Property Upgrades

When upgrading to a larger or more valuable property, this calculator helps you forecast the tax impact and decide if the move makes financial sense.

Managing Boot in Exchanges

If you anticipate receiving boot during your exchange, calculate how it affects your taxable gains to avoid surprises during tax filing.

Frequently Asked Questions About Section 1031 Tax Deferral

General Questions

Q: What is “boot” in a Section 1031 exchange?

Boot is any cash or non-like-kind property received in an exchange and is subject to taxation on the gain realized.

Q: How do I calculate my adjusted basis?

Your adjusted basis includes your original purchase price plus capital improvements, minus accumulated depreciation. Consult your tax advisor for precise details.

Q: Which properties qualify for a 1031 exchange?

Investment properties and those used in a trade or business qualify. Personal residences and properties held primarily for resale do not qualify.

Technical and Timing Questions

Q: What are the key deadlines in a 1031 exchange?

You must identify replacement properties within 45 days of sale and complete the exchange within 180 days.

Q: Can I exchange one property for multiple replacement properties?

Yes, as long as you meet identification and closing deadlines.

Strategic Planning Questions

Q: When should I begin planning my 1031 exchange?

Start well before selling your property. Use this calculator to estimate tax impacts under different scenarios and consult with professionals.

Q: How can I maximize my tax deferral?

Maximize deferral by reinvesting all proceeds and replacing all mortgage debt, avoiding boot when possible.

Q: What other factors matter besides tax deferral?

Consider property location, type, management needs, cash flow, and long-term appreciation potential when selecting replacement properties.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.